China’s banks, insurance companies scale up financial support for farmers during spring ploughing season

Banks, insurance companies, and various other financial institutions are offering strong support for new types of agricultural business entities in preparation for carrying out farming activities during the spring ploughing season, which is underway across the country.

① Photo shows clerks at the China Construction Bank providing agricultural insurance services for a farmer in Raohe county, northeast China’s Heilongjiang Province. (Photo/Liu Yuliang)

② A bank manager gathers information about the loan requirements of a farmer in Zhuanghou village, Tiantai county, east China’s Zhejiang Province. (Photo/Zhang Qionglei)

Lately, Tong Zhishan and his wife have been busy fertilizing the tea-oil trees that they grow. After he received 40,000 yuan ($6,312) in loans with low interest rates from a local rural credit cooperative in Hua’an county, Zhangzhou city, southeast China’s Fujian Province, Tong said that he felt the extra financial assistance helped to relieve some of his burden and mentioned his plans to use the money to purchase more farming supplies.

Zhang Qingfang, an executive with the Fuzhou branch of the People’s Bank of China, said that in order to offer much needed financial support to farmers during the spring ploughing season, relevant efforts must be implemented in a timely manner. He added that various financial institutions in the city have tailored their products and services to bolster the demand for credit-related funding for the purchase of spring plowing materials.

Zhu Xia, a corn grower in the Sujiatun district of Shenyang, northeast China’s Liaoning Province, recently received a credit loan of 1 million yuan from HarbinBank. With the money, the woman who already grows 2,600 mu (173.33 hectares) of corn, plans to further enlarge her corn planting area.

“Along with the credit loan issued to the woman, there is also an agricultural insurance plan which ensures that if the crop yield drops due to any adverse weather events, the insurance proceeds the farmer gets will first be used as a repayment on bank loans,” explained Han Gang, head of the Sujiatun branch of Harbin Bank, who added that such a policy has motivated banks to boost their financial support for farmers while offering loans with beneficial interest rates to farmers.

In 2022, the Agricultural Bank of China (ABC) plans to offer more than 150 billion yuan in loans to support spring ploughing, while requiring its branch banks in various localities to build a “green expressway” to readily offer credit loans to farmers by prioritizing the evaluation, approval, processing and settlement of credit loans. Meanwhile, the Postal Savings Bank of China (PSBC) plans to offer 100 billion yuan in loans to support spring ploughing.

“The financial industry can play an important role in guaranteeing smooth farming activities during the spring ploughing season, including by offering support for such items as grain production, the protection of farmland, the development of the seed industry, and the production and supply of agricultural production materials,” said Zeng Gang, deputy director of the National Institution for Finance and Development.

Farm insurance has helped farmers fend off risks and cope with losses incurred due to adverse weather conditions.

At present, tea growers from a tea cooperative in Linhai, a county-level city in east China’s Zhejiang Province, have been busy planting tea trees. Due to a bout of cold weather that hit the area at the end of February 2021, the total yield of tea posted by the cooperative dropped by more than 30 percent. Thanks to a weather-based insurance scheme, however, the tea growers received more than 50,000 yuan in insurance proceeds.

This year, the cooperative expanded the area of land under tea planting to 300 mu and simultaneously chose to join the weather-based insurance program. Since the weather-based insurance program was first rolled out in 2020, tea growers in Taizhou, which administers Linhai, have received a combined amount of compensation that has nearly reached 10 million yuan.

Currently, major grain producing counties in 13 provinces throughout the country have received central financial subsidies for full-cost insurance and income insurance for the three major cereal crops. China Life Insurance Co., one of the country’s biggest insurers, has more than 2,000 agricultural insurance products that can help cover losses for farmers faced with a variety of potentially adverse circumstances.

Photos

Traditional tie-dye products of Buyi ethnic group in Guizhou popular among tourists

Traditional tie-dye products of Buyi ethnic group in Guizhou popular among tourists Girls from mountainous areas in Hainan pursue football dreams

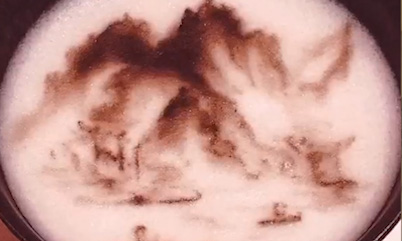

Girls from mountainous areas in Hainan pursue football dreams Chinese artist forms elaborate images using whisked tea foam in revival of Song Dynasty’s cultural splendor

Chinese artist forms elaborate images using whisked tea foam in revival of Song Dynasty’s cultural splendor Wild lilies in full bloom as snow melts in Xinjiang

Wild lilies in full bloom as snow melts in Xinjiang

Related Stories

- Smart farming program improves efficiency of agricultural production in Jiangxi

- 72-year-old 'palm leaves weaving grandpa' shows fingertip wonders

- Spring farming underway in Shaanxi with help of modern agricultural facilities and technologies

- Grain security high on agenda in China's spring farming season

- Farming activities in full swing across China

- Spring ploughing starts in SW China's Guizhou

- Farmer invests in hydroponic farming business to produce greenhouse vegetables

- Spring farming starts in China

- Farmers get rich by developing diversified farming

- Field activity teaches kids history of agriculture

Copyright © 2022 People's Daily Online. All Rights Reserved.