Chinese automakers strengthen capabilities in powertrain development

Great Wall Motor debuts a 4.0T V8 engine at the Auto Shanghai 2025. (Photo from Great Wall Motor)

The powertrain -- comprising the engine, transmission, and electric motor -- is the core of any vehicle, directly influencing power output, energy efficiency, and overall reliability.

Following decades of dedicated research and sustained investment, Chinese automakers have made substantial progress across powertrain technologies, advancing from a phase of catching up to one of leading innovation. This shift is now a driving force behind the continued growth and modernization of China's automotive industry.

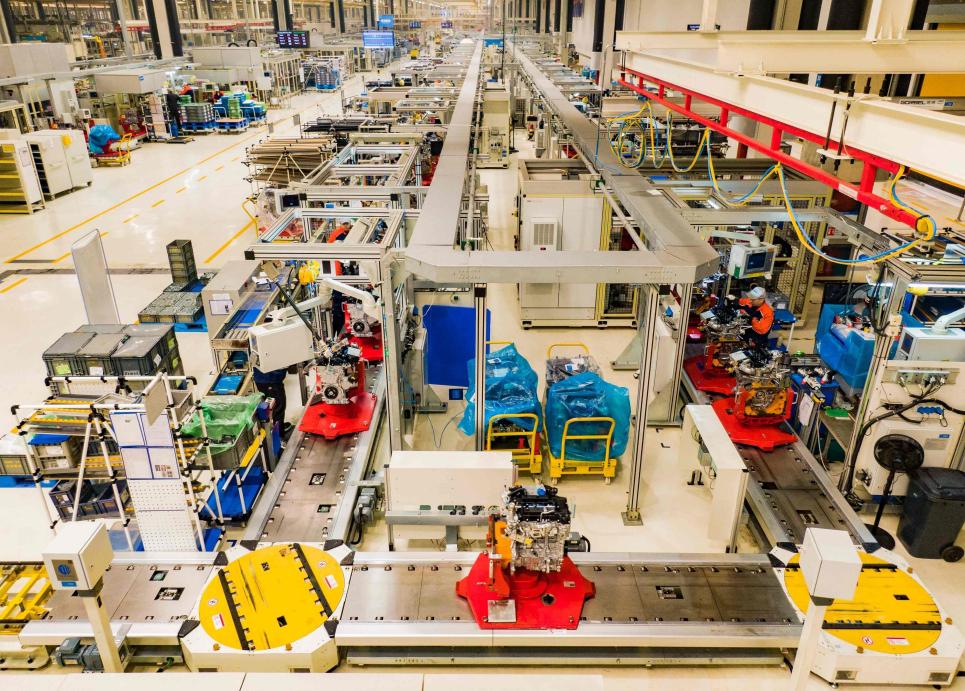

At an engine plant of Chinese carmaker Great Wall Motors (GWM) in Baoding, north China's Hebei province, robotic arms move with precision while technicians carry out final calibrations on newly assembled engines. Once considered a weak link in China's automotive sector, engines have become a focal point of domestic innovation.

In the 1980s and 1990s, Chinese automakers primarily relied on imported or reverse-engineered engine models. That began to change in 2000, when GWM established its internal combustion engine division, becoming one of the earliest Chinese companies to develop core powertrain technologies independently. By 2015, GWM had built a comprehensive portfolio of engine platforms ranging from 1.5L to 3.0T, not only powering its own models but also supplying other brands.

The development of large-displacement engines has long been regarded as a hallmark of industrial capability. At Auto Shanghai 2025, GWM debuted its 4.0T V8 engine. "Developing a V8 engine requires far more than adding cylinders. It involves major breakthroughs in hardware design, control systems, manufacturing, and key components," explained Wang Chao, deputy general manager at GWM's Research and Development Center.

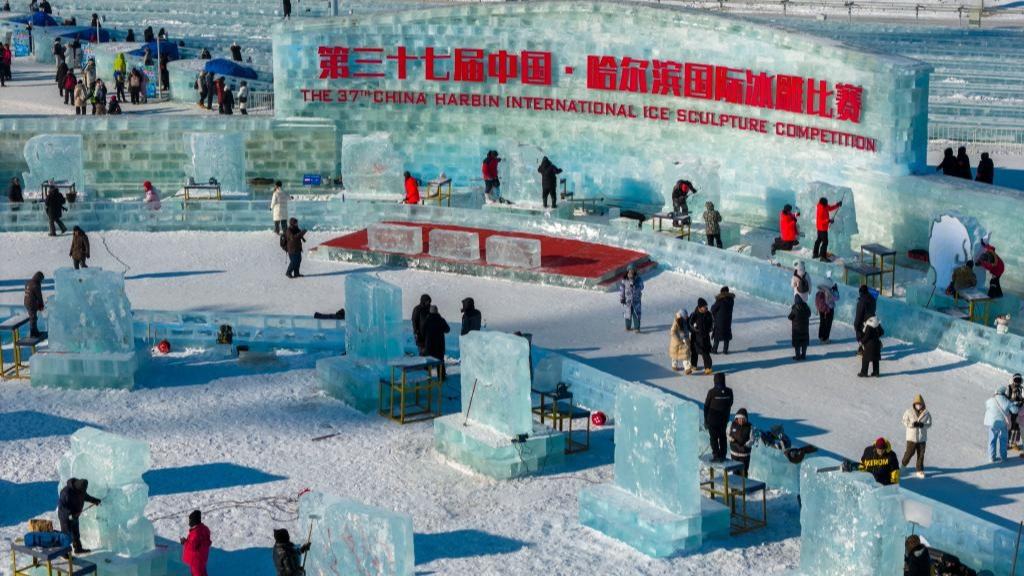

Engines for hybrid vehicles are assembled in an engine plant of Chinese carmaker Geely in Yiwu, east China's Zhejiang province. (Photo/Shi Kuanbing)

Some have questioned the relevance of investing in internal combustion engines amid the rapid growth of new energy vehicles (NEVs). Wang, however, sees hybridization as the long-term optimal solution. He argues that varying regulatory environments, infrastructure disparities, and fuel availability across global markets necessitate a diversified powertrain strategy. "A globally competitive brand must meet a wide range of user needs," he added.

Hybrid technologies, combining combustion engines with electric motors, have become a mainstream solution, offering improved efficiency, reduced emissions, and alleviating range anxiety.

According to an executive of Chinese automotive giant Geely, the Starray hybrid-dedicated engine released in 2024 incorporates advanced features such as a steeply angled 'duckbill' intake port, Mask-type airflow guidance, and airflow-profiling piston crowns. These innovations enable precise in-cylinder flow control, optimizing the coordination between battery, motor, and engine. The engine initially achieved a thermal efficiency of 46.5 percent. By 2025, with the application of Geely's full-stack AI technologies, thermal efficiency in mass production rose to 47.26 percent in 2025, placing it among the most advanced hybrid engines globally.

For new-energy vehicles, the electric motor serves as the core power component, replacing the traditional engine. "In 2010, we were already a 'hidden champion' in the global sewing machine motor market, holding around 80 percent of the market share," said Niu Mingkui, president of the new energy drive division at Zhejiang Founder Motor Co., Ltd. (FDM), a leading motor supplier based in east China's Zhejiang province.

"However, with limited growth prospects in that sector, we decided to pivot toward the rapidly expanding market for NEV motors," Niu added.

Photo shows a workshop of Zhejiang Founder Motor Co., Ltd. (Photo from Zhejiang Founder Motor Co., Ltd.)

During the early stages of its transition to the automotive sector, FDM faced a significant talent gap. "We established a research and development institute in Shanghai, where the automotive industry chain is more mature, and built a specialized research team to close the gap," Niu recalled.

Since 2020, FDM has become a supplier to major passenger-vehicle manufacturers, delivering 470,000 drive motors for NEVs that year.

Beyond battery capacity, motor efficiency is a key determinant of range in electric vehicles. "We examined every component from electromagnetic design to material applications to drive performance gains," Niu said. "We raised motor efficiency from 93 percent to 98 percent. That five-percentage-point improvement can save thousands of yuan per vehicle for automakers and deliver a noticeably better experience for consumers."

China's NEV industry continues to surge. In October 2025, NEV sales reached nearly 1.72 million units, accounting for 51.6 percent of all new car sales.

"Technology iterations are moving extremely fast, and research and development must accelerate accordingly," said Niu. "For automobiles, a major consumer product, quality must be uncompromising to earn lasting consumer trust."

Photos

Related Stories

- ‘Chinese brands’ should not be used as a pretext for protectionism by Germany

- China's auto output, sales both surpass 31 mln units in Jan-Nov

- China's Chongqing transforms into inland hub for NEV exports

- China's new-energy passenger car sales see steady growth in November

- In pics: electric buses boarding NEV carrier at Yantai Port in Shandong

- China accelerates development of charging infrastructure to support NEV growth

- China taps retired EV batteries as a strategic 'urban mine'

- Auto market rides high on NEV sales growth

- China's NEV sales surpass 50% of new car sales in Oct

- China's NEV output, sales surge in first 10 months of 2025

Copyright © 2026 People's Daily Online. All Rights Reserved.