For Chinese taxpayers, 2019 kicks off with a big New Year gift – a notable decrease in income tax from January 1.

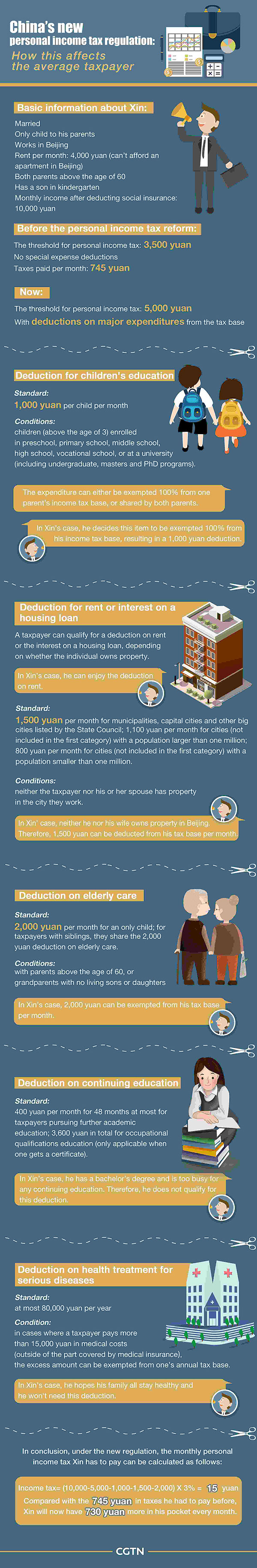

Under the new personal income law, taxpayers can claim deductions for expenses on children's education, continuing education, health treatment for serious diseases, housing loan interests, rent and elderly care. The deductible amount under each category ranges from 1,000 yuan per month to 2,000 yuan per month.

The move, following the new tax brackets that raised the minimum threshold for personal income tax from 3,500 yuan to 5,000 yuan per month starting last October 1, is the latest by Chinese authorities to relieve the household tax burden in the hope of spurring growth.

Finance Minister Liu Kun said the changes will improve the income distribution system and people's livelihoods as well as release consumption potential.

To get a clear understanding of how the new regulation works and how much of a tax cut an average taxpayer can enjoy per month, see the following infographic:

The average wage in Beijing in the first half of 2018 was 10,531 yuan, according to a report by Zhaopin.com, a leading recruitment website in China. The calculation above shows that under the new regulation, the tax burden for some could be reduced to zero.

According to a research report by CITIC Securities, one of China's major investment banks, more than 100 million Chinese people will no longer have to pay taxes from January 1.

To make it easy and convenient for taxpayers to handle their income tax deductions, Chinas' State Administration of Taxation has launched an app, through which one can complete a tax form within minutes.

An interface of the app launched by China's State Administration of Taxation for taxpayers to claim deductions for six types of expenses. /CGTN Photo

Experts said the new tax law would particularly benefit China's low-and-middle-income population, and middle-aged breadwinners who are usually burdened by the cost of renting or buying an apartment, raising children and taking care of the elderly.

"With all the deductions from the tax base, I will get about 600 yuan more every month in my pocket, which sums up to over 7,000 yuan in a year. That's a substantial increase," said Sun, a Beijing-based white collar.

"I think it's beneficial for the working class. The cost of living in Beijing is quite high, especially the rent. The tax cut, though not too much, will ease my burden. But my rent is much higher than 1,500 yuan, and I hope the deductible amount for rent could be more in the future," said Chen, who's been working in Beijing for last three years.

Tax plan for year-end bonus

After the release of the draft plan for personal income tax on December 24, many have been wondering how their year-end bonus, which usually comes after January 1, will be impacted.

On December 27, China's Ministry of Finance released a new rate schedule for taxes on individual year-end bonus, which also brings good news to the working class as it means less tax on the bonus.

Award-winning photos show poverty reduction achievements in NE China's Jilin province

Award-winning photos show poverty reduction achievements in NE China's Jilin province People dance to greet advent of New Year in Ameiqituo Town, Guizhou

People dance to greet advent of New Year in Ameiqituo Town, Guizhou Fire brigade in Shanghai holds group wedding

Fire brigade in Shanghai holds group wedding Tourists enjoy ice sculptures in Datan Town, north China

Tourists enjoy ice sculptures in Datan Town, north China Sunset scenery of Dayan Pagoda in Xi'an

Sunset scenery of Dayan Pagoda in Xi'an Tourists have fun at scenic spot in Nanlong Town, NW China

Tourists have fun at scenic spot in Nanlong Town, NW China Harbin attracts tourists by making best use of ice in winter

Harbin attracts tourists by making best use of ice in winter In pics: FIS Alpine Ski Women's World Cup Slalom

In pics: FIS Alpine Ski Women's World Cup Slalom Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa

Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa China's FAST telescope will be available to foreign scientists in April

China's FAST telescope will be available to foreign scientists in April