Chinese stocks tumbled again on Friday, with the Shanghai Composite Index falling 5.77 percent to below 3,700 points. A-share stocks have plummeted nearly 30 percent in the past three weeks. Huge losses have been inflicted on many individual investors who had recently entered the market.

The government has been sending out strong messages that it will bail out the market over the past few days. But given the ongoing free-fall, the government's power seems to be not as great as previously expected.

It only proves that no one can effectively control the stock market. Too many forces are at work in the gigantic Chinese market, which has resulted in great unpredictability.

Voices that call for government interference have been emerging over the past few days. But a market is a market, and people's emotional cries may not be able to play a decisive role in influencing the course of events.

The fundamental reason behind the market meltdown lies in the bubble caused by its unusual surge. The government may be able to calm people down through strong interventionist measures. But the speculative bubbles are unlikely to be properly digested.

Some investors have insisted that the government is the one who can least tolerate a market stumble, and therefore it will definitely take action before the market gets even worse. Such expectations are one of the reasons the market often goes out of control - its own self-adjustment capability has become sluggish.

We believe the government's management of the stock market should be based on market measures that are consistent with international practices. The government will not be able to babysit the market forever.

The fluctuations of China's stock market are not because it is overly mature, but because it is too rudimentary and unable to cope with excessive speculation. A series of problems have been exposed by the recent sharp price drops, such as some listed companies' executives collectively selling their shares, or investors' illegal use of marginal selling leverages.

Of course, if the market shows signs of getting out of control, the government will have to resolutely step in.

The current plunge has not hurt China's financial system, nor its basic economic operations. Most investors who entered the market before March are able to sustain the losses caused by the recent fluctuations. They have not lost hope, they are still biding their time.

The future of China's stock market lies in further marketization, not a "policy bull." The authorities should crack down on the manipulations that upset the market, and make the market a place for fair play.

Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Hong Kong in lens

Hong Kong in lens Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Hong Kong college students feel the charm of Hanfu

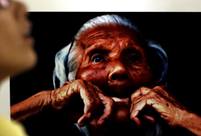

Hong Kong college students feel the charm of Hanfu Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Odd news:“carrying a rod and asking to be spanked”

Odd news:“carrying a rod and asking to be spanked” Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple College graduates shining on the red carpet in Nanjing

College graduates shining on the red carpet in Nanjing Conspiracy theories can’t explain stock falls

Conspiracy theories can’t explain stock falls Gay marriage in China: One couple's story

Gay marriage in China: One couple's story South China urged to upgrade fast

South China urged to upgrade fast CCTV's post-WWII documentary shows Berlin’s tough repentance lesson for Tokyo

CCTV's post-WWII documentary shows Berlin’s tough repentance lesson for TokyoDay|Week