BEIJING, July 3 -- A mockery made by investors may have best summed up China's stock market over the past week: It's neither bull nor bear, it's just a monkey market.

The wild ups and downs of the equity markets have left investors broken and regulators wary.

The benchmark Shanghai Composite Index had a volatile week: down 3.3 percent on Monday, up 5.5 percent on Tuesday, down 5.2 percent on Wednesday, down 3.5 percent on Thursday and down 5.77 percent on Friday.

In each trading session during the week, daily oscillation between the intra-day highs and lows easily exceeded 10 percent, underscoring the great volatility.

The Shanghai bourse has lost about 29 percent from its peak in mid-June. For the Shenzhen Component Index and the ChiNext, the start-up board, the plunges were even deeper.

Regulators had warned about the risks of share prices rising too rapidly and tried to talk the market down.

On June 12, the Shanghai index peaked at 5,178.19, a level that has not been reached in seven and a half years, registering a 1.5-fold rally from the bottom in April 2014.

But when the market did correct itself, as expected amid tighter margin trading requirements and profit-takings, there came a new, and unexpected, problem: the declines were too deep and too fast.

To most investors who have bet long, the past two weeks have proved disastrous.

This wave of declines has washed away half of the market value of about one-fifth of all listed firms, erasing more than 40 percent of capitalization for two-thirds of companies, and wiping out 30 percent of market value for nearly 2,000 companies, or more than 80 percent of the total listed.

Only a handful of newly-listed companies have survived, albeit with modest price rallies.

Veteran investors cannot help but be reminded of the chaotic meltdown during the financial crisis of 2007. To novices, the shocks were incomprehensible.

The market stampede, however, inspired some creative self-mockery.

In contrast to western markets, in China green charts mean falling stocks while red shows gains.

"I was thrilled to see the red light is on [when I am driving]. What's wrong with me?" reads one widely shared post on microblogging site Weibo.

Since wearing green could cause jitters among depressed investors these days, another Weibo post declares, "I am wearing a green shirt today, better not to go anywhere."

Before the crash, investors were willing to pay up to 100 times the earnings of last year to buy shares in startups or blue-chip companies that only had an average price-to-book ratio of 40 to 50.

Aggressive investors have even used leverage, or money borrowed from brokerage firms, to bet on greater increases through margin trading.

This high leverage could enable a margin trader with 1 million yuan to borrow 5 million yuan from brokers to buy stock without any collateral.

But a margin call, demanding investors put more deposits into their accounts, will be triggered if prices drop more than 20 percent, or they will face automatic sell-off orders that will see stocked pulled further into a vicious spiral.

Outstanding brokerage loans to margin traders lost more than 200 billion yuan (32.3 billion U.S. dollars) in the losing streak, falling below 2 trillion yuan.

To stabilize market sentiment, regulators have been busy trying to shore up the shaky market with a string of emergency and supportive measures.

In a rare move since the financial crisis, the People's Bank of China, or the central bank, simultaneously cut interest rates and the reserve requirement ratio over the weekend to lower borrowing costs and inject liquidity.

On Monday, an official draft guideline considered allowing pension funds to invest in the stock market.

On Wednesday night, the Shanghai and Shenzhen stock exchanges and the China Securities Depository and Clearing Company decided to slash transaction and transfer fees, while China Securities Regulatory Commission (CSRC) allowed stock brokerages to issue bonds widen funding channels.

On late Thursday, the CSRC said it will investigate suspected market manipulation to see whether it was related to the recent crash.

But the market extended its losing streak with major indexes registering further losses on Friday, evidence that investors still lack confidence despite easing measures from the government.

Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Hong Kong in lens

Hong Kong in lens Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Hong Kong college students feel the charm of Hanfu

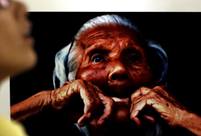

Hong Kong college students feel the charm of Hanfu Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Odd news:“carrying a rod and asking to be spanked”

Odd news:“carrying a rod and asking to be spanked” Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple College graduates shining on the red carpet in Nanjing

College graduates shining on the red carpet in Nanjing Conspiracy theories can’t explain stock falls

Conspiracy theories can’t explain stock falls Gay marriage in China: One couple's story

Gay marriage in China: One couple's story South China urged to upgrade fast

South China urged to upgrade fast CCTV's post-WWII documentary shows Berlin’s tough repentance lesson for Tokyo

CCTV's post-WWII documentary shows Berlin’s tough repentance lesson for TokyoDay|Week