BEIJING, July 3 -- The number of new shares hitting the stock market in early July will be reduced to 10, the China Securities Regulatory Commission (CSRC) said on Friday, following a 5.8-percent daily fall in the stock market.

China's stock market has been in the doghouse for three weeks, losing around 29 percent since a peak of 5,178.19 points on June 12. A steady drumroll of government easing policies including interest rates cuts and a reduction of securities transaction fees has failed to reverse the losing trend.

The CSRC decided in April to approve two batches of IPO applications instead of one. Forty-five new shares were listed in May and 47 in June, causing concerns of a shares glut.

Guotai Junan Securities Co., which was listed in June, became the biggest IPO in five years. More than three trillion yuan (490 billion U.S. dollars) from investors was frozen during its the IPO subscription.

The CSRC also said that it would guide more long-term funds to invest in the stock market. An official draft guideline on Monday gave pension funds the nod to invest in the stock market.

Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Hong Kong in lens

Hong Kong in lens Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Hong Kong college students feel the charm of Hanfu

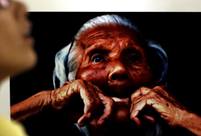

Hong Kong college students feel the charm of Hanfu Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Odd news:“carrying a rod and asking to be spanked”

Odd news:“carrying a rod and asking to be spanked” Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple College graduates shining on the red carpet in Nanjing

College graduates shining on the red carpet in Nanjing Conspiracy theories can’t explain stock falls

Conspiracy theories can’t explain stock falls Gay marriage in China: One couple's story

Gay marriage in China: One couple's story South China urged to upgrade fast

South China urged to upgrade fast CCTV's post-WWII documentary shows Berlin’s tough repentance lesson for Tokyo

CCTV's post-WWII documentary shows Berlin’s tough repentance lesson for TokyoDay|Week