The value of Chinese stocks has risen above $10 trillion for the first time, the latest milestone for the nation's world-beating rally.

Companies with a primary listing in China are valued at $10.05 trillion, an increase of $6.7 trillion in 12 months, according to data compiled by Bloomberg. The gain alone is more than the $5 trillion size of Japan's entire stock market. The US stock market at almost $25 trillion is the largest globally.

No other stock market has grown as much in dollar terms in a 12-month period, as Chinese individuals piled into the nation's equities using borrowed funds to bet gains will continue.

Valuations are now the highest in five years and margin debt has climbed to a record, despite the economy being mired in its weakest expansion since 1990.

Investors outside China don't have the same enthusiasm for the nation's equities. Funds pulled a net $6.8 billion out of Chinese stock funds in the seven days through Wednesday, Barclays said in a research note, citing EPFR Global data. Dual-listed Chinese shares cost more than twice as much on average on Chinese mainland exchanges than they do in Hong Kong.

MSCI's decision against including Chinese mainland equities in its benchmark gauge on Tuesday had little effect on the Shanghai Composite Index, which climbed 2.9 percent last week to its highest level since January 2008. Foreigners are limited by quotas when buying shares in Shanghai via an exchange link with Hong Kong, while similar access to Shenzhen-traded stocks will likely start this year, according to the Hong Kong bourse.

The Shanghai gauge has rallied 152 percent in the past 12 months, the most among global benchmark indexes tracked by Bloomberg, and trades at about 26 times reported earnings. Less than a year ago, the gauge was valued at about 9.6 times, the lowest since at least 1998.

The Shenzhen Composite Index, tracking stocks on the smaller of the Chinese mainland's two exchanges, trades at 77 times profits after surging 194 percent.

Gains have been fueled by speculation the government will take more steps to boost growth. HSBC Holdings predicts a 50-basis-point cut in lenders' required reserves in the "coming weeks", while Societe Generale said one more is needed before the end of June. That would be the third reduction this year.

While the latest data showed the economy stabilizing, indicators from retail sales to industrial output are still growing near the slowest pace in years and trade remains weak. Exports slumped in May and imports declined for a seventh month.

Profits in the Chinese gauge trailed analyst estimates by the most in six years in 2014 as economic growth slowed to 7.4 percent, the slowest pace in more than two decades.

Fervor for stocks by investors on the Chinese mainland remains undaunted, with a record 4.4 million trading accounts opened in the final week of May, and margin debt on the Shanghai exchange rising to a record 1.44 trillion yuan ($232 billion) on Thursday.

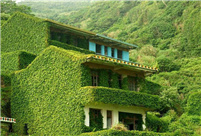

Abandoned village swallowed by nature

Abandoned village swallowed by nature Graduation: the time to show beauty in strength

Graduation: the time to show beauty in strength School life of students in a military college

School life of students in a military college Top 16 Chinese cities with the best air quality in 2014

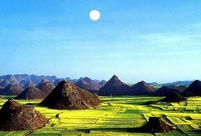

Top 16 Chinese cities with the best air quality in 2014 Mysterious “sky road” in Mount Dawagengzha

Mysterious “sky road” in Mount Dawagengzha Students with Weifang Medical University take graduation photos

Students with Weifang Medical University take graduation photos PLA soldiers conduct 10-kilometer long range raid

PLA soldiers conduct 10-kilometer long range raid Stars who aced national exams

Stars who aced national exams

PLA helicopters travel 2,000 kilometers in maneuver drill

PLA helicopters travel 2,000 kilometers in maneuver drill Investment slows to 15-year low

Investment slows to 15-year low China, Myanmar focus on win-win ties

China, Myanmar focus on win-win ties Dangerous stigma

Dangerous stigma Smashing drug addiction

Smashing drug addictionDay|Week