New energy vehicles reshape the industrial ecosystem

New energy vehicles (NEVs) are shifting from being a “new force” to a “new trend”. Statistics reveal that in the first half of April this year, the wholesale and retail penetration rates of passenger NEVs exceeded 50 percent, achieving the planned targets 11 years ahead of time.

China has become the world’s largest consumer market for NEVs and has established a highly efficient and collaborative industrial system.

R&D: 100,000 workers strong

BYD is one of China’s largest NEV manufacturers and battery makers. On its quest to enhance competitiveness through innovation, the company employs over 100,000 workers committed to just R&D, along with 11 research institutes.

Photo shows a production line for blade batteries at BYD, one of China’s largest NEV manufacturers and power battery makers. (Photo courtesy of the interviewee)

Its investment has paid off with the introduction of the blade battery in March 2020.

For a long time, the automotive industry struggled to achieve both battery safety and a long travel range. The blade battery was BYD’s solution as it maintained the safety qualities of traditional lithium iron phosphate batteries while allowing for a longer driving range thanks to higher density and space utilization.

“Compared to traditional lithium iron phosphate batteries, blade batteries increase space utilization rate by around 40 percent,” explained Lian Yubo, chief scientist, chief automotive engineer, and director of the Automotive Engineering Research Institute at BYD. Lian added that the blade battery can be installed directly onto the car chassis, further improving space utilization and system safety.

The blade battery has become a flagship product for BYD, and along with other innovations produced by the company, has been proven to be a “driving force” for its success.

This focus on technology and R&D has paid off for the NEV industry as a whole. According to data from the China Association of Automobile Manufacturers, the market share of China’s domestic brands overseas continues to rise. In the first half of the year, the export of domestically produced new energy vehicles reached 605,000 units, marking a 13.2 percent year-on-year increase.

Testing: 1,172 scenarios and counting

Dou Jian, 37 years old, is deputy chief engineer of software quality at Chinese automaker Changan.

Dou Jian, deputy chief engineer of software quality at Chinese automaker Changan, tests a vehicle. (People’s Daily Online/Hu Hong)

Dou, who has accumulated over 120,000 kilometers testing different vehicle types, said that a new vehicle model goes through a testing phase lasting 8 to 10 months before being introduced to the public.

Due to the rising demand for NEVs and evolving consumer needs, Dou’s testing responsibilities have increased. The number of testing projects has expanded from a few initial tests to 28 primary tests and 145 secondary tests.

The testing scenarios have also grown from 322 to 1,172, encompassing a wide range of scenarios including external discharge, camping in the car with air conditioning, vehicle-to-vehicle charging, wireless fast charging for mobile phones, and in-car karaoke.

“These new scenarios are what NEV automakers compete over,” Dou says with a laugh.

“The problems should only be fed back to the company, not left for the user.” This is the guiding principle that drives Dou and his team forward.

On August 2, Changan Nevo under Changan, announced its latest delivery data. The company delivered 12,445 vehicles in July and a total of 85,413 vehicles from January to July.

By 2030, Changan will invest a total of 200 billion yuan (about $27.85 billion) and add over 10,000 new employees to its technology innovation team in areas such as intelligence, new energy, and forward-looking technologies.

Ecosystem: Over 90 percent localization rate

Currently, China’s NEV industry is accelerating the clustering of “chains”. Both upstream and downstream small and medium-sized companies are taking advantage of this opportunity, joining the NEV ecosystem for growth while supporting the industrial chain.

Data reveals that thanks to a complete industrial chain, major NEV manufacturers in China have achieved a component localization rate of over 90 percent, with some even surpassing 95 percent.

At a factory of NEV manufacturer Lynk & Co located in Yuyao city, a county-level city administered by Ningbo, east China’s Zhejiang Province, a new energy vehicle rolls off the production line every 72 seconds, while car seats from a branch of Magna, a global developer and manufacturer of complete seating systems, are directly delivered to the assembly workshop of Lynk & Co in several hours.

The establishment of the NEV project of Lynk & Co in the China-Italy (Ningbo) Ecological Park in Yuyao has attracted 17 automotive supporting companies.

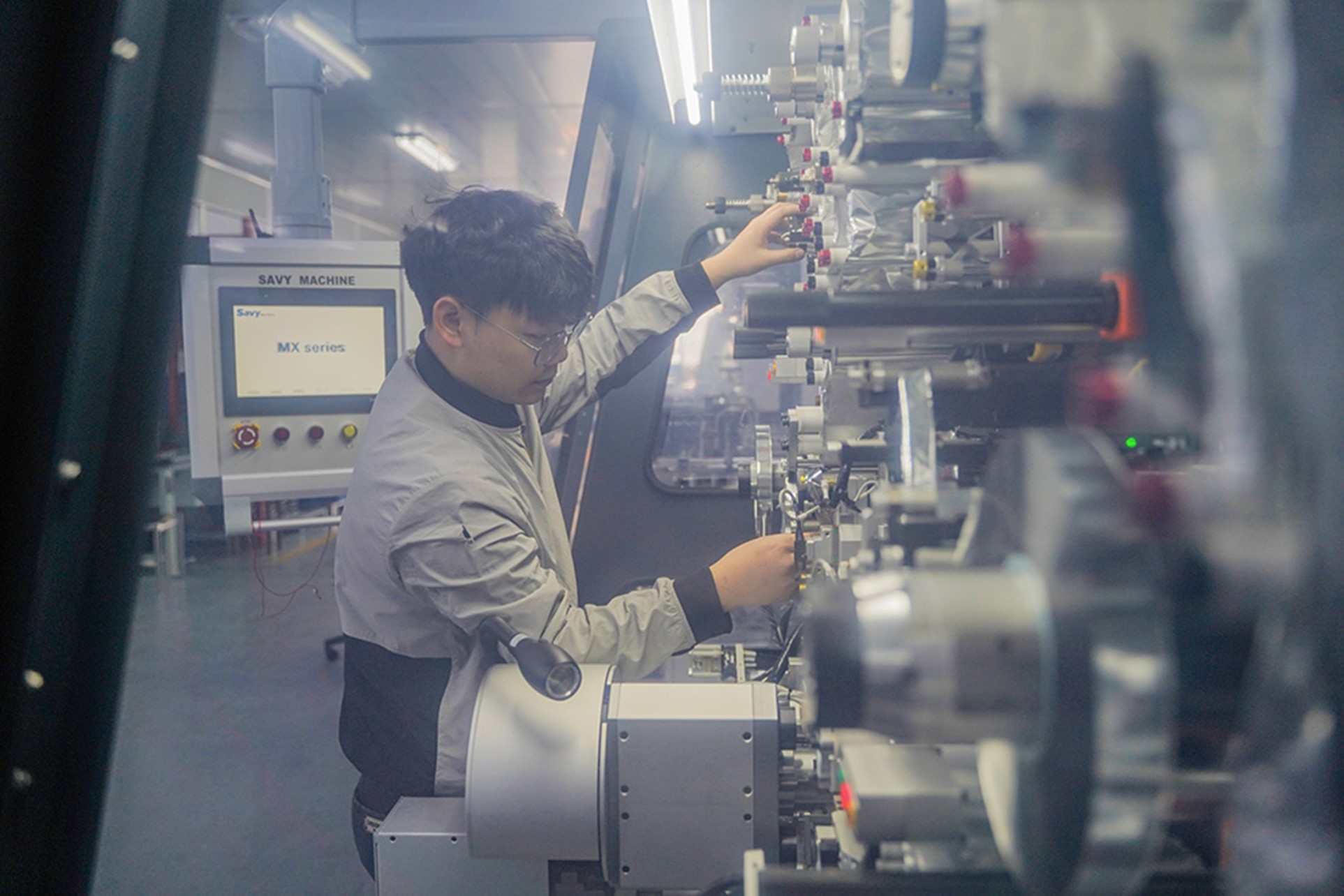

A staff member operates a film capacitor winding machine at Savy Machine, located in Xinbei district, Changzhou city, east China’s Jiangsu Province. (People’s Daily Online/Gao Chao)

Magna, which had just over 100 staff members in 2018 when it first settled in the ecological park, has doubled its workforce and increased monthly seat production from around 4,000 to nearly 10,000 units, according to Huang Fei, deputy general manager of the company’s factory.

Currently, Yuyao has formed an industrial foundation that includes whole vehicles, lightweight automotive components, battery systems, and in-car optical devices, with upstream and downstream companies rapidly gathering.

Across the country, “little giants” are thriving thanks to the NEV industrial ecosystem.

“From January to June this year, the sales of LS series capacitor winding machines surged to 1.5 times the figure of the same period last year,” said Yu Shengwu, general manager of Savy Machine, located in Xinbei district, Changzhou city, east China’s Jiangsu Province.

The capacitor winding machine plays a crucial role in the production of power batteries for NEVs. In this market, Savy Machine already ranks third globally in terms of market share.

Photos

Related Stories

Copyright © 2024 People's Daily Online. All Rights Reserved.