Public-private partnerships encouraged

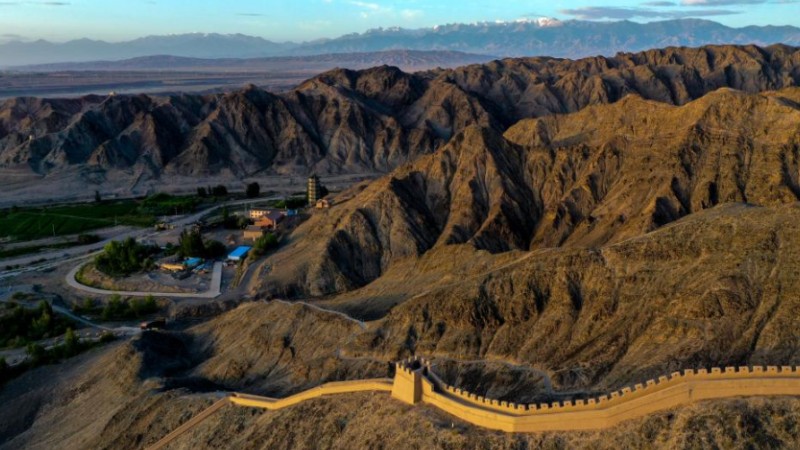

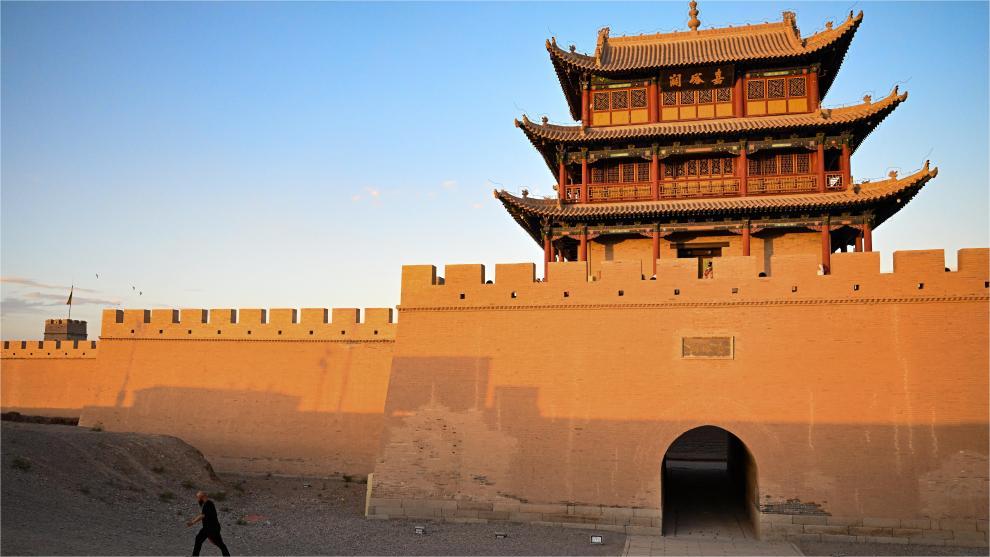

JIN DING/CHINA DAILY

Mechanism could help relieve governments' financial burdens

China has issued a guideline that includes a raft of policies that would make it easier for public and private sector entities to form partnerships as part of the country's efforts to fine-tune the cooperation mechanism between government funding and social capital, as well as deepen private sector involvement in infrastructure investments, according to analysts.

The new policies will further enhance the construction and operation of infrastructure projects and improve public services, while helping stem additional debts assumed by local governments, which is of great significance in efforts to promote the country's sustainable, high-quality socioeconomic development, they added.

The guideline, which was jointly released by the National Development and Reform Commission, the country's top economic regulator, and the Ministry of Finance, has placed greater emphasis on user-pays projects, with a preference for private enterprise participation and the adoption of franchise models.

A user-pays project is one in which a private enterprise develops infrastructure and then charges for its usage.

Public-private partnership initiatives can be broadly classified into two categories based on global experience — private financing programs centered around public funding, and franchising business models based on user-pays projects, said Chen Xinping, deputy director of the PPP Research Institute at the Chinese Academy of Fiscal Science.

Historically, PPP projects in China have primarily involved State-owned enterprises, both at the national and local levels, due to their established resources, easier access to financing and extensive experience in infrastructure development. Engagement from private enterprises, however, has remained modest, according to Chen.

According to data from Beijing-based Bridata, SOEs accounted for a remarkable 95.67 percent of the overall project value, or 2.4 trillion yuan ($336 billion), in 2022, making them a major player in China's PPP sector.

For some public-funded PPP projects, however, the government had to make up for inadequate or nonexistent revenues by guaranteeing minimum or fixed returns to private participants, thereby assuming greater accountability for future spending, Chen added.

Recognizing the immense potential of private enterprises and their capacity to contribute to infrastructure development, authorities have taken steps to advance policies and regulations to provide a more level playing field and create an environment that better enables private enterprises to participate in such projects.

The newly issued guideline, with a particular emphasis on user-pays projects, underscores the need to clarify fee channels and the way they are assessed. Revenue should be used to pay construction costs and operational expenses and should yield a return on investment. In particular, the new PPP programs should not create additional expenditures for local government finance, according to the guideline.

Projects in which users have greater capacity and willingness to pay for infrastructure services typically align with the practical needs of the public, which can foster stable cash flow expectations and indicate the potential for long-term sustainability, said Wang Yingying, assistant researcher of Center for Public-Private Partnership at Tsinghua University.

By directing attention toward user-pays projects, decision-makers can prioritize initiatives that can optimize resource allocation and enhance cost-effectiveness while avoiding the potential pitfalls of either overly premature or relatively outdated development, Wang added.

Meanwhile, the guideline highlighted the government's efforts to prevent local governments from accumulating hidden debt, which refers to debt incurred through off-balance-sheet financing, while providing necessary investment support for user-pays projects that comply with regulations and policy requirements.

The new mechanism does not eliminate government investment support, but strictly limits the conditions for government spending, said Xu Chengbin, deputy director of the China International Engineering Consulting Corporation's research center.

As the pressures of government debt continue to intensify, local governments are seeking to strike a delicate balance between debt reduction and fulfilling their development obligations. The traditional PPP mechanism, which placed a heavy burden of expenditure responsibilities on governments, needs to be improved in the current financial landscape, Xu said.

By giving out operational subsidies and refraining from subsidizing construction costs, the guideline is aimed at encouraging responsible financial management and preventing overreliance on government funding for infrastructure development, Xu said.

In a bid to maximize private sector participation in PPP projects, the government is categorizing projects based on their public attributes and marketization levels, and is introducing a project list that will be updated in line with shifting market demands, the guideline said.

Waste treatment and waste-to-energy projects, for example, have a high degree of marketization and relatively weaker public attributes that will be entirely or mostly owned by private businesses. Projects such as public utility services that have a direct impact on a nation's economy and populace should allow private companies to hold a minimum of 35 percent of their equity stake, it said.

Meanwhile, schemes such as large-scale hydroelectric projects offer significant public benefits and raise issues of national security. In these cases, related departments should create favorable conditions and encourage private businesses engagement.

By inviting enterprises that excel in technology, innovative business models, and operations, the PPP mechanism aims to harness their expertise and resources and bring fresh perspectives to the public service domain, as well as improve service quality and enhance user experience, said Chang Deliang, director of the global infrastructure research center at Deloitte China.

By promoting collaboration between local governments and private enterprises, the mechanism fosters a culture of innovation and entrepreneurship, driving local economies towards sustainable growth, Chang said, adding that by expanding the investment avenues, the new mechanism will help stimulate the growth of the private economy.

The decline in private investment in real estate development has put a great deal of pressure on China's total private investment in recent years. That said, positive changes in the structure of private investment have been observed in specific sectors, with a steady move toward the real economy, according to an official in the NDRC's fixed asset investment department.

In the first three quarters of this year, private investment in manufacturing increased by 9 percent and in infrastructure by 14.5 percent, compared to the same period last year. During the nine-month period, the growth rates were greater than those of the total investment in manufacturing and the total investment in infrastructure in 2022 by 2.8 and 8.3 percentage points, respectively, according to the NDRC.

By extending franchise periods to 40 years, the new mechanism offers increased certainty and longer-term investment prospects for private capital, said Meng Chun, a researcher at the Development Research Center of the State Council.

Moreover, for projects with substantial investment requirements and longer return cycles, the mechanism allows for additional extensions of franchise periods as appropriate, further incentivizing private capital to participate in such ventures, Meng said.

The government should actively work toward resolving issues facing private enterprises, including limited access to financing and high borrowing costs, Meng said. Meanwhile, efforts to accelerate the development of factor markets such as land, labor, and capital should be made to create a more conducive environment for them to secure the resources they need for their operations.

In addition, it is imperative to streamline regulations and promote fair competition, and foster an ecosystem that encourages private enterprises to participate in PPP projects with confidence and on equal terms with SOEs, Meng said.

Photos

Related Stories

- Measures unveiled to boost private economy

- China's private economy in H1 2023

- Chinese private companies excel in Fortune rankings, highlighting vigorous private economy

- China rolls out new regulations to enhance public well-being

- Measures to bolster private investment

- China seeks public opinion on regulation of cybersecurity incident reporting

Copyright © 2023 People's Daily Online. All Rights Reserved.