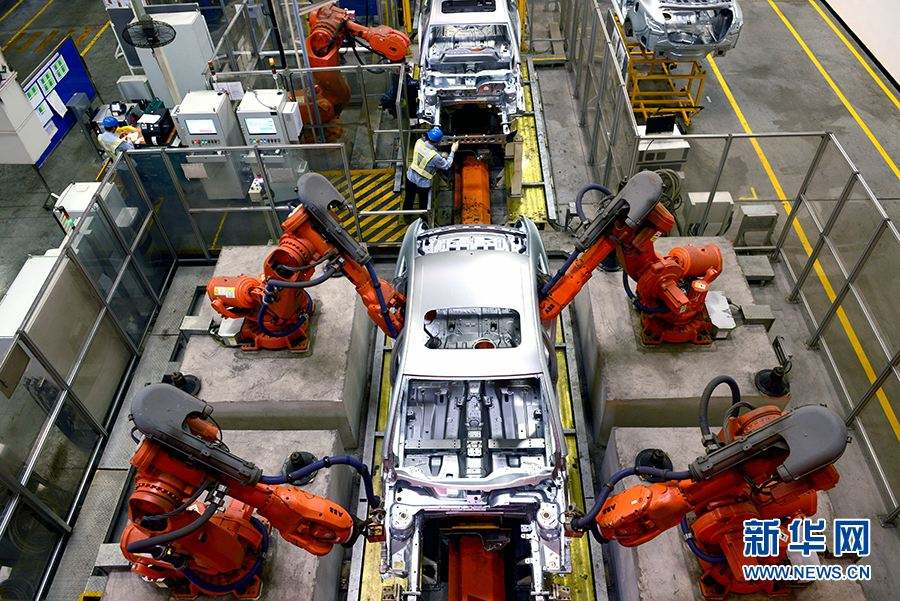

(Photo/Xinhua)

During the first five months of this year, investment in China showed stable growth, continuous optimization, and huge potential for continuously boosting economic growth.

China witnessed a year-on-year growth of 5.6 percent in fixed asset investment from January to May in 2019. This represents a stable growth, despite complex and volatile global economic environments, thanks to the Chinese government’s efforts to implement a series of measures to ensure a stable domestic investment environment from the second half of last year.

In the face of a downward trend in infrastructure investment after years of rapid growth, China accelerated issuance of special local government bonds and examination and approval of projects, which has effectively boosted the implementation of many major projects and led to a 4 percent infrastructure investment growth on a year-on-year basis from this January to May.

While maintaining stable growth, China has endeavored to highlight the weak points in infrastructure investment, targeting investments in such areas as the fight against poverty, railways, highways, water transportation, airports, water conservation, energy sources, agriculture, rural areas, ecological and environmental protection, and livelihood of the people.

“These investments may not be in as large amounts as those in the past, but they are targeted at key areas and bottlenecks, thus being able to significantly improve the overall effectiveness of the infrastructure investment,” said Xu Zhaoyuan, a senior researcher at the Development Research Center of the State Council of China.

Besides stable infrastructure investment growth, China’s investment in manufacturing has seen a sound tendency towards structure optimization. From January to May this year, investment in manufacturing grew by 2.7 percent compared with the same period last year, among which the high-tech industry saw a growth of 11.9 percent, while investment growth of research, development and design reached 27.1 percent year on year.

Structural optimization of investment in manufacturing signifies a strong impetus from the transformation and upgrading of enterprises in conventional industries and the booming development of emerging driving forces.

“Since the beginning of this year, we have seen continuous orders coming to us. Many clients purchase equipment in advance. We are fierce about the industrial robots market,” said Kong Bing, CEO of Guangdong-based industrial robot company QKM Technology, expressing that companies in the manufacturing industry are promoting intelligent manufacturing and aiming to replace manpower with machinery with increasingly greater enthusiasm.

As many enterprises in conventional industries actively seek transformation, the country’s manufacturing industry witnessed a 15 percent growth of investment in technological transformation, 12.3 percentage points higher than the overall growth of investment in manufacturing during the same period.

New technologies, new products, new forms of business and new modes of commerce have driven the birth of enormous new investment opportunities in China. From January to May 2019, investment in China’s high-tech manufacturing industry grew by 10.2 percent on a year-on-year basis.

“As the new energy vehicle (NEV) market and NEV power battery market show a continuous momentum of growth, our company’s current capacity is not able to keep up with the market pace anymore,” said an executive of Contemporary Amperex Technology Co., Ltd. (CATL), leading lithium-ion battery and energy storage system producer in China.

CATL plans to invest at least 4.6 billion yuan (approx. $667.7 million) with the aim of further perfecting the layout and competitiveness of the company, according to the company executive.

“With the continuous implementation of supply-side structural reform, companies in conventional industries invest more capital in improving quality and enhancing efficiency, which leads to rapid growth in technological transformation within the manufacturing industry. Meanwhile, emerging companies are all racing to seize opportunities and expand investments,” pointed out Wang Yuanhong, an economist at China’s State Information Center.

As the world’s most populous country, China sees appreciable investment potential from the constantly advancing consumption needs in the domestic market.

During this May, China saw a significant rise in volume of retail sales, within which cosmetics is seeing a growth of 16.7 percent year on year, while retail sales of telecommunications equipment is rising by 6.7 percent, and household electric appliances increasing by 5.8 percent, representing a respectively 10, 4.6 and 2.6 percentage points higher growth than the retail sales growth of the above areas in April this year.

In recent years, China has introduced many policies and measures on reducing taxes and fees, including cutting taxes for all small and medium-sized companies, raising the threshold of value-added tax, and lowering the value-added tax rate on the manufacturing industry from 16 percent to 13 percent.

These policies and measures have been comprehensively put into force in this year, easing the burden on enterprises whilst helping them make composed investment decisions.

Since this May, ensuring stable economic growth and investment has been an important topic at executive meetings of China’s State Council, during which a multitude of areas were determined to be key areas for the efforts to expand effective investment.

“From the previous efforts at expanding the total amount, to the present plan to highlight shortcomings, enhance momentum of growth, and benefit people’s livelihood, pertinence and effectiveness of investment will be greatly improved,” said Xu.

“We have sufficient strength to ensure a stable investment environment. We don’t need to launch a new round of incentive measures to promote infrastructure investment or comprehensive incentive measures to boost general investment, because as long as we take the right measures, we can turn investments into a key driving force for economic development,” noted Wang.

Fire brigade in Shanghai holds group wedding

Fire brigade in Shanghai holds group wedding Tourists enjoy ice sculptures in Datan Town, north China

Tourists enjoy ice sculptures in Datan Town, north China Sunset scenery of Dayan Pagoda in Xi'an

Sunset scenery of Dayan Pagoda in Xi'an Tourists have fun at scenic spot in Nanlong Town, NW China

Tourists have fun at scenic spot in Nanlong Town, NW China Harbin attracts tourists by making best use of ice in winter

Harbin attracts tourists by making best use of ice in winter In pics: FIS Alpine Ski Women's World Cup Slalom

In pics: FIS Alpine Ski Women's World Cup Slalom Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa

Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa China's FAST telescope will be available to foreign scientists in April

China's FAST telescope will be available to foreign scientists in April "She power" plays indispensable role in poverty alleviation

"She power" plays indispensable role in poverty alleviation Top 10 world news events of People's Daily in 2020

Top 10 world news events of People's Daily in 2020 Top 10 China news events of People's Daily in 2020

Top 10 China news events of People's Daily in 2020 Top 10 media buzzwords of 2020

Top 10 media buzzwords of 2020 Year-ender:10 major tourism stories of 2020

Year-ender:10 major tourism stories of 2020 No interference in Venezuelan issues

No interference in Venezuelan issues

Biz prepares for trade spat

Biz prepares for trade spat

Broadcasting Continent

Broadcasting Continent Australia wins Chinese CEOs as US loses

Australia wins Chinese CEOs as US loses