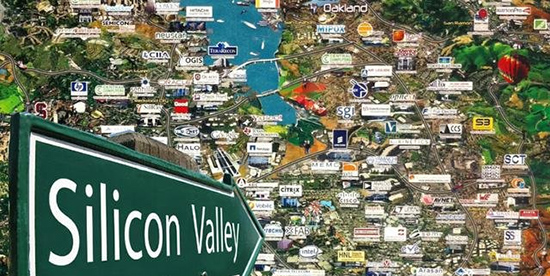

China is flooding Silicon Valley with cash, as 26 percent of U.S. unicorns are currently backed by investors from Greater China, while venture capital investment in U.S. companies is down, according to a report.

Among the 32 investors that have backed U.S. startups, Chinese internet giants like Alibaba and Tencent, as well as Chinese venture capitalists, are dominant, noted CB Insights, a New York-based investment research firm. Chinese investors have participated in over 40 American tech deals per quarter since 2014, and joined in major 2015 financing deals with the likes of Uber, Lyft and AirBnB among others, involving nearly $10 billion in U.S. tech funding for 2015 alone.

“Start-up fundraising in Silicon Valley wouldn’t function without Chinese money. It has changed the landscape,” said Chris Nicholson, the CEO of Skymind, a deep learning startup, in an interview with the Washington Post.

Meanwhile, venture capital investors in the U.S. have taken a more cautious approach as overall investment deal levels drop. What’s more, the flood of crossover investment from mutual funds and hedge funds into private technology startups in the U.S. has fallen drastically.

According to the report, the global ambitions of Chinese internet giants, the rise of wealth creation and a dearth of investment opportunities in China are the primary motivations for Chinese investors looking to the U.S.

Fire brigade in Shanghai holds group wedding

Fire brigade in Shanghai holds group wedding Tourists enjoy ice sculptures in Datan Town, north China

Tourists enjoy ice sculptures in Datan Town, north China Sunset scenery of Dayan Pagoda in Xi'an

Sunset scenery of Dayan Pagoda in Xi'an Tourists have fun at scenic spot in Nanlong Town, NW China

Tourists have fun at scenic spot in Nanlong Town, NW China Harbin attracts tourists by making best use of ice in winter

Harbin attracts tourists by making best use of ice in winter In pics: FIS Alpine Ski Women's World Cup Slalom

In pics: FIS Alpine Ski Women's World Cup Slalom Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa

Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa China's FAST telescope will be available to foreign scientists in April

China's FAST telescope will be available to foreign scientists in April "She power" plays indispensable role in poverty alleviation

"She power" plays indispensable role in poverty alleviation Top 10 world news events of People's Daily in 2020

Top 10 world news events of People's Daily in 2020 Top 10 China news events of People's Daily in 2020

Top 10 China news events of People's Daily in 2020 Top 10 media buzzwords of 2020

Top 10 media buzzwords of 2020 Year-ender:10 major tourism stories of 2020

Year-ender:10 major tourism stories of 2020 No interference in Venezuelan issues

No interference in Venezuelan issues

Biz prepares for trade spat

Biz prepares for trade spat

Broadcasting Continent

Broadcasting Continent Australia wins Chinese CEOs as US loses

Australia wins Chinese CEOs as US loses