|

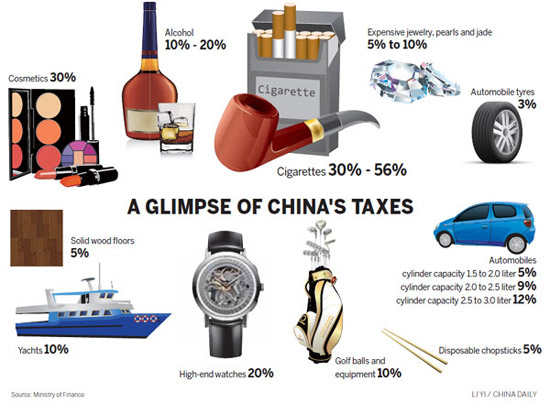

| (Photo/China Daily) |

China is considering levying a consumption tax on some products that make heavy use of resources and cause pollution, in a major effort to promote resource and environmental protection awareness, according to a report.

The plan was mentioned in a document compiled by the Ministry of Finance and the Budget Committee of the Standing Committee of the National People's Congress, the country's top legislature, Economic Information, a newspaper affiliated with Xinhua News Agency, reported on Friday.

The committee is studying the inclusion of products with high resource consumption, those causing environmental pollution, and some high-end consumer goods in items subject to consumption tax, the document states.

It also says it is considering adjusting the tax rate on some consumer products that are "incompatible with the country's consumption level".

Fourteen items are currently subject to consumption tax, including cigarettes, alcohol, cosmetics, expensive jewelry, pearls and jade, firecrackers, motorcycles and automobiles.

The finance ministry did not respond to media inquiries on Friday. The document did not detail any timetable. Ni Hongri, a research fellow with the Development Research Center under the State Council, said under the current "structural tax reform", the "adjustment" should include both an increase and a decrease.

For example, cosmetics are subject to a 30 percent consumption tax. But as people's living standards have improved, many cosmetics products have become more widely available, so should be subject to a lower tax, Ni said.

Several experts suggested raising the consumption tax on cigarettes, as this levy in China is much lower than the international average.

Liu Shangxi, researcher at the Research Institute for Fiscal Science under the Ministry of Finance, said some emerging luxuries such as motorboats, sailboats, light aircraft and luxury bags should be subject to consumption tax.

Yuan Qingdan, vice-director of the Policy Research Center for Environment and Economy under the Ministry of Environmental Protection, suggested that disposable plastic bags and lead-acid batteries should be subject to consumption tax.

A 5 percent consumption tax is currently levied on disposable chopsticks and solid-wood floors.

Yuan said fertilizers and pesticides, whose prices fall as their use increases, should be subject to consumption tax.

Ni said whether a rise in tax leads to price increases depends on "elasticity" in product prices.

"For example, cigarettes are a daily necessity for smokers. So a tax increase means smokers will pay more for cigarettes if they don't quit, and this is good.

"And if a tax increase on high-end watches raises their price, fewer people might buy them. This is good for reducing extravagance."

Now you can use mobile phone to 'call' the dead

Now you can use mobile phone to 'call' the dead

![]()