Convenient mobile payments bring better travel experience for foreigners

A staff member provides foreign tourists with guide materials about payment methods in north China's Tianjin Municipality on April 7, 2024. (Xinhua/Sun Fanyue)

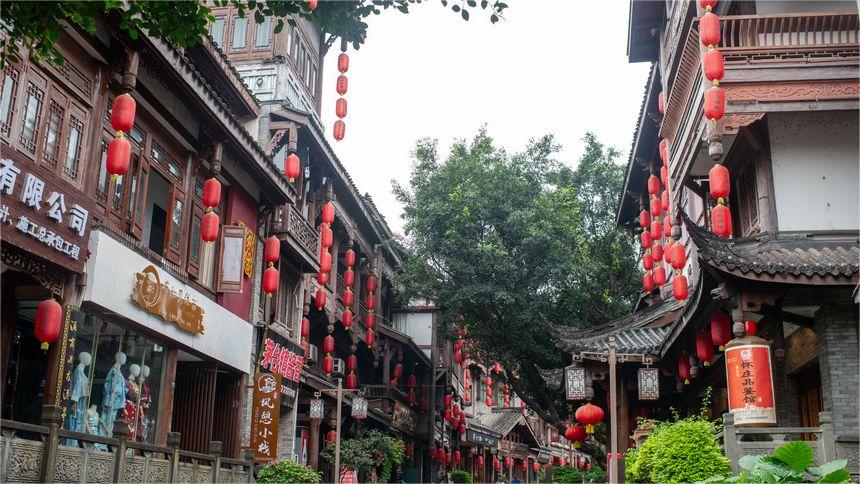

BEIJING, July 7 (Xinhua) -- For Jamie and Liliana, a couple who traveled to the southwest Chinese city of Chengdu from Australia, using Alipay for payment was an experience as unique as strolling through the historic Kuanzhai Alley.

"The payment went through so quickly. It's very convenient," said Liliana, who usually pays through cash or with credit cards when traveling.

Liliana is among many foreign visitors who have benefited from China's commitment to facilitating mobile payments for foreigners.

Years of rapid growth have made China a front-runner in mobile payment. The penetration rate for mobile payments in the country reached 86 percent, the highest in the world, by the end of 2023.

However, the widespread use of mobile payment also poses hurdles for first-time visitors to China. Foreign visitors relying on bank cards and cash may encounter difficulties during payment processes, as street vendors or small-scale service providers often prefer mobile payment to cash or international credit cards.

Taking note of this phenomenon, the Chinese government has rolled out multiple measures to help foreigners enjoy a hassle-free payment environment in China akin to that enjoyed by locals.

Thanks to simplified mobile payments for foreigners, visitors like Liliana can now easily bind overseas bank cards with Alipay or Tenpay, two major payment apps in China.

In the first half of the year, the number of foreign card transactions through mobile payment platforms increased 6.65 times from a year ago to nearly 37.4 million, and the total transaction volume increased 8.03 times to 5.42 billion yuan (about 760.29 million U.S. dollars), according to data from Chinese online payment clearing house NetsUnion Clearing Corporation.

Major payment platforms have been guided by China's central bank to raise the single transaction limit for overseas travelers using mobile payments from 1,000 dollars to 5,000 dollars and increase the annual cumulative transaction limit from 10,000 dollars to 50,000 dollars.

Today, more and more foreign visitors are relishing the experience of navigating China on a mobile phone.

A recent survey conducted by Beijing Foreign Studies University on 714 foreign tourists from 103 countries found that 86 percent of the respondents who have visited China believe that the payment experience has become more convenient. Most of them have used mobile payment.

From the commercial district near the Jiefang Monument in the "mountain city" of Chongqing to the bustling Chunxi Road in Chengdu, Isaac used his phone to pay for everything he needed, such as food, drinks, accommodation and tickets.

The university student from Singapore said he was surprised to be able to use digital wallets from Singapore to pay for tickets for high-speed trains and subways in China.

Since the beginning of the year, CHAGEE, a famous China-chic tea beverage brand, has received many more foreign customers, said Chen Xiaoming, general manager of the brand's Sichuan subsidiary. Many foreign customers are happy to learn they can use digital wallets from their home countries.

NetsUnion Clearing Corporation's data showed that more than 28.75 million transactions were made using foreign digital wallets in the first half of the year, amounting to 5.32 billion yuan.

Alipay currently accepts 12 foreign digital wallets from nine countries and regions, including Singapore, Thailand and the Republic of Korea.

Photos

Related Stories

- Lower transaction fees set to boost international bank card usage in China

- Spanish retailers introduce WeChat Pay, Alipay for Chinese tourists

- Consumer-friendly business allows foreigners to make payments easily

- China details regulations on non-bank payment institutions

- Explainer: Payment service guide for overseas visitors to China

Copyright © 2024 People's Daily Online. All Rights Reserved.