Explainer: Payment service guide for overseas visitors to China

BEIJING, April 11 (Xinhua) -- In its latest efforts to facilitate ease of payments for overseas travellers, Chinese authorities earlier this week introduced measures to make payments more accessible for foreigners visiting the country's major tourist attractions.

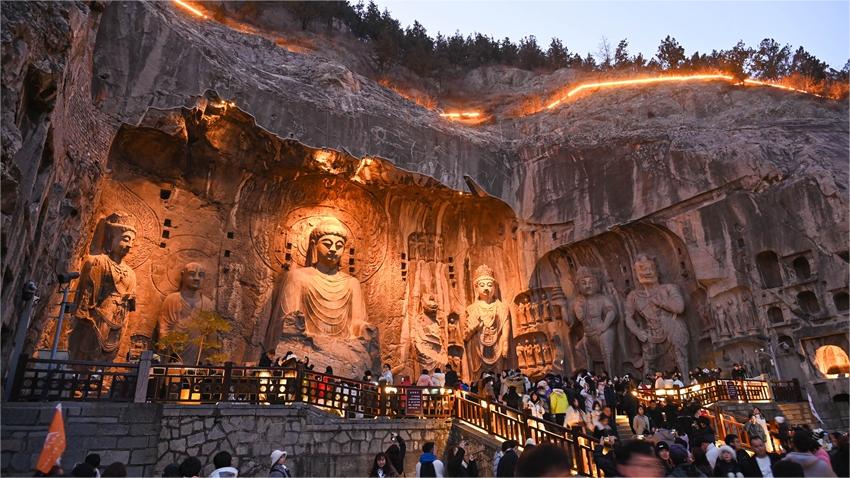

A circular, jointly issued by several government organs including the People's Bank of China (PBOC), stipulates that domestic and overseas bank cards should be accepted in all three-star and above tourist hotels, 5A-level and 4A-level national tourist attractions, national and provincial tourist resorts, as well as national tourism and leisure districts.

Major cultural and tourism attractions should retain ticket booths and ticketing staff, and actively set up foreign currency exchange outlets in venues with a large number of foreign tourists, the circular said.

The move represents part of China's push to facilitate payments for foreigners. In early March, the country's State Council released a guideline aimed at continuing to optimize payment services of bank cards, promoting cash use and facilitating mobile payment.

Over the past month, Chinese authorities have taken intensive steps to smooth payments for foreign travellers. Major payment service providers, including Alipay and WeChat Pay, have also enhanced payment operations and introduced foreigner-friendly functions.

What are the payment options available for foreign visitors? How to make digital payments? The following are some policy highlights and payment tips.

TIPS FOR CONVENIENT PAYMENTS

-- Overseas visitors to China have several payment options, ranging from mobile payments to bank cards and cash.

-- Mobile payment services are available in Alipay, WeChat Pay and UnionPay. In Alipay and WeChat Pay, foreign users can link their international credit cards, including Visa and Mastercard, to these platforms.

In addition, Alipay has also allowed foreigners to use their familiar home e-wallets by scanning Alipay QR codes.

-- Some international e-wallets, including TrueMoney and Changi Pay, can also be accepted by merchants in China. Foreign visitors who have these e-wallets can pay without downloading other apps, according to the PBOC.

-- No ID information is required for transactions under a certain amount when foreigners use mobile payments such as Alipay and WeChat Pay, the PBOC said.

-- The single transaction limit for overseas visitors using mobile payments on payment platforms has now been raised from 1,000 U.S. dollars to 5,000 dollars. The annual cumulative transaction cap has been increased from 10,000 dollars to 50,000 dollars.

-- More user languages are available on payment apps. For instance, Alipay has expanded its service languages from two, Chinese and English, to a total of 16. The translation services can be applied to various services within the app, such as taxi hailing, hotel booking, purchasing tickets for scenic spots, public transportation, and checking exchange rates.

-- Bank cards can be accepted if logos of the payment organizations are displayed at the checkout counter. Unionpay cards can be accepted by all merchants point of sales (POS) terminals.

-- China has also been working to expand cash acceptance in transportation, shopping, dining, entertainment, and other businesses, while ensuring sufficient cash reserves for business owners.

Foreign visitors can directly conduct exchange at bank outlets with currency exchange signs, outlets of qualified financial institutions, or self-service kiosks. RMB cash can be withdrawn with bank cards at ATMs with logos of corresponding bank card organizations.

Photos

Related Stories

- Payment service center for international travelers opens at Kunming airport in SW China

- A Serbian fashion designer's day with mobile payment in China

- Visitors to benefit from payments revamp

- China specifies steps to improve payment services in tourist attractions

- China strives to make payment environment more convenient, efficient

Copyright © 2024 People's Daily Online. All Rights Reserved.