Experts: RRR cut plan to bolster biz vitality

China's stronger-than-expected plan to cut the reserve requirement ratio will boost market confidence and economic vitality, experts said on Wednesday, as it comes at a time when there is a stronger need for confidence in economic recovery.

The nation will have more room to reduce lending rates and make better use of structural monetary policy tools, in order to steadily lower financing costs for the real economy, they added.

The comments came after Pan Gongsheng, governor of the People's Bank of China, the central bank, said China will cut the RRR by 0.5 percentage point on Feb 5 to infuse liquidity of about 1 trillion yuan ($140 billion) into the market.

The PBOC will also lower the interest rates for relending and rediscount for loans to the agriculture sector and small enterprises to 1.75 percent from Thursday, down from 2 percent, Pan said at a news conference in Beijing on Wednesday.

These measures, he added, will help drive down the loan prime rate or LPR — a market-based benchmark lending rate — thereby better serving the real economy.

"We had expected an RRR cut to promote domestic demand and consolidate the economic recovery momentum, but the plan announced is slightly stronger than market expectations," said Zhou Maohua, a macroeconomic researcher at China Everbright Bank. "That has sent a strong positive signal of the authorities' determination to strengthen support for the real economy and stabilize growth."

By injecting long-term, low-cost and stable new liquidity into the economy, the PBOC's move will enhance the credit delivery capacity of financial institutions, prevent their overall liability costs from growing, and expand the space for the financial sector to better serve the real economy, Zhou said.

Lou Feipeng, a researcher at Postal Savings Bank of China, said the RRR cut will provide long-term, low-cost funding that will help stabilize the liability costs and net interest margins of commercial banks, and this will help ease the financing costs of the real economy.

"It is a substantial move to cut the RRR by as much as 50 basis points at one go, which will help maximize the policy effect," Lou said, adding that the cut also coordinates with proactive fiscal policy in boosting the economy by injecting a considerable amount of liquidity.

Experts also said China will have more room to reduce lending rates and utilize structural policy tools this year.

Gong Liutang, a professor of applied economics at Peking University's Guanghua School of Management, said the RRR cut is within expectations, and further macroeconomic policy adjustments such as a universal cut in lending rates and an increase in the fiscal deficit are still needed to bolster the current lukewarm market confidence.

"The central bank governor has stressed the need for a further fall in social financing costs, sending an important signal that interest rate reductions of a bigger scope may be in the pipeline," Gong said.

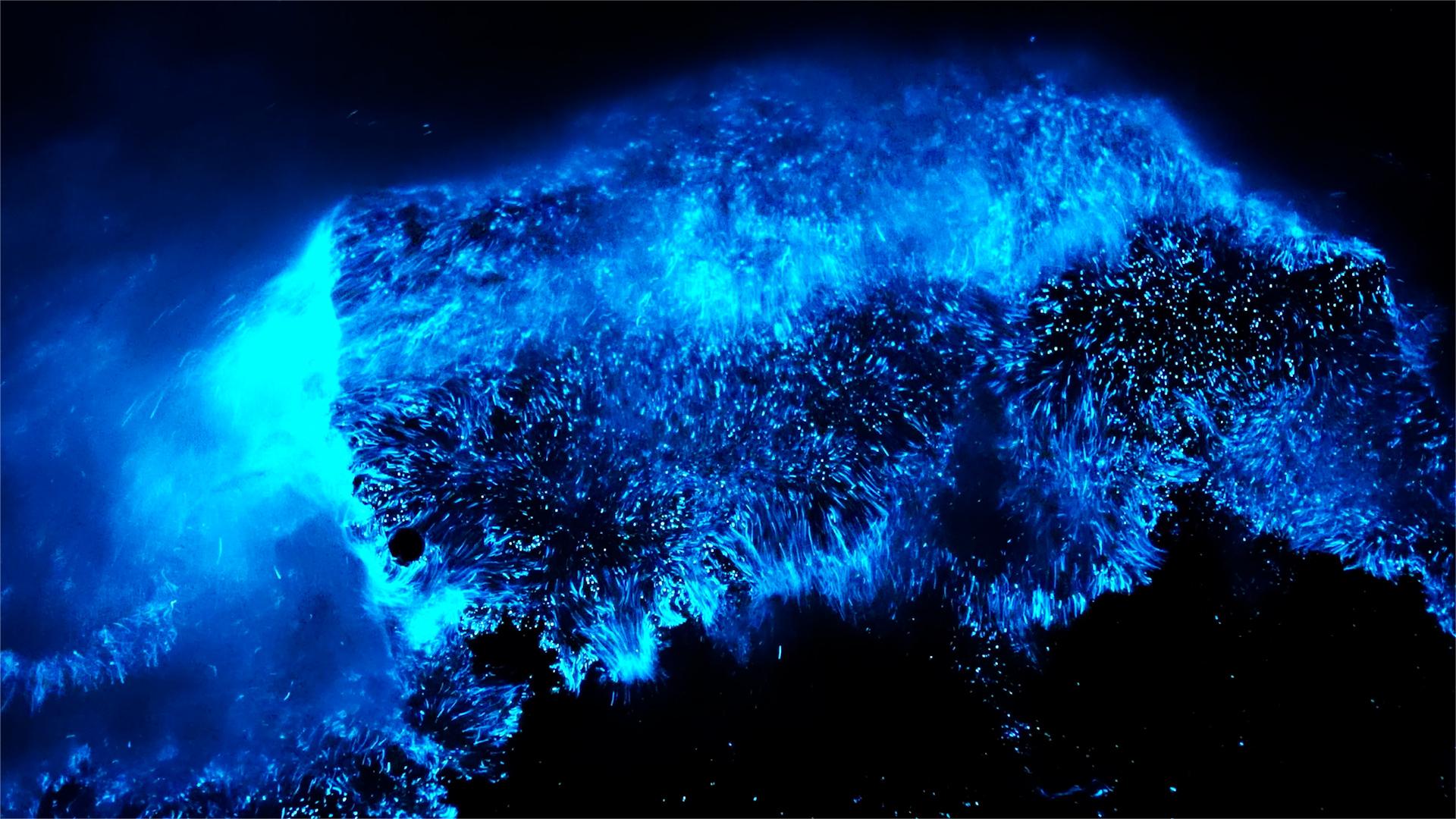

Photos

Related Stories

- Commentary: It's opportune time to "Pick China," not "Peak China"

- Pledge to open lifts confidence of foreign execs

- Growth of Chinese domestic demand provides opportunities -- economist

- Challenges abound, but can't dim 2024

- China's financial regulator pledges further opening up

- China moves to stabilize capital market, improve confidence

Copyright © 2024 People's Daily Online. All Rights Reserved.