What is behind Western negative opinions on China's economy?

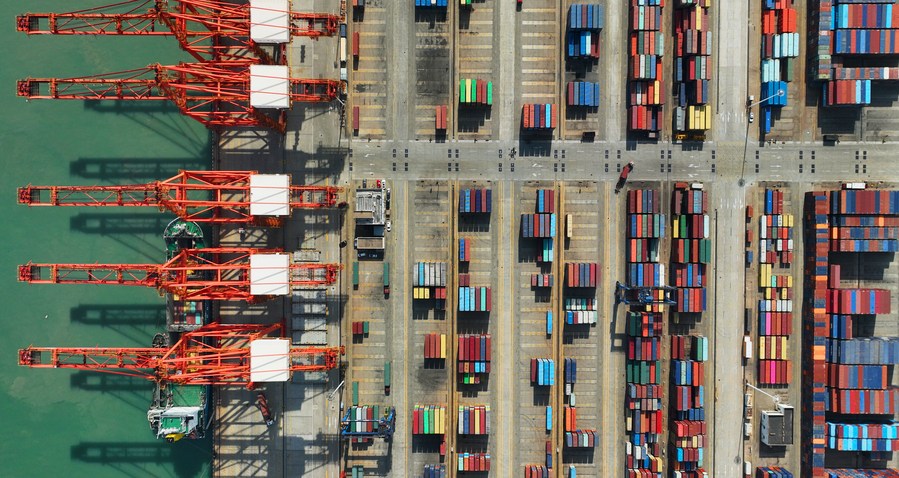

This aerial photo taken on May 9, 2023 shows the container terminal at Lianyungang Port, east China's Jiangsu Province. (Photo by Geng Yuhe/Xinhua)

Thanks to its massive market size, technological innovation, and robust development resilience, China can withstand external pressure and overcome internal difficulties. Indeed, its economy is rebounding, effectively refuting various pessimistic arguments.

BEIJING, Dec. 21 (Xinhua) -- Recently, some Western institutions have once more started to engage in pessimistic rhetoric about the Chinese economy.

They are using old tricks: First raise growth expectations, and then clamor about the figures that fell below the expectations. Their intention remains unchanged: to see the Chinese economy fail.

But they won't succeed.

Trapped in their "self-designed economic model," these institutions neglect the reasonable growth target set by China and the fundamentals of the Chinese economy. Any conclusions they make would only smear the Chinese economy while serving their own interests.

COMMON PATTERN IN THE WEST

"There is growth, but growth is not as good as expected; there are achievements, but the effect is not as good as expected..." Excessive praise first, then criticism. This has become a common pattern of U.S. and Western institutions in their attempt to manipulate the Chinese economy.

According to the economic data of the first 11 months of this year recently released by China's National Bureau of Statistics, China's economy is continuing its upward trend. Retail sales of social consumer goods increased by 10.1 percent in November year-on-year, up 2.5 percentage points from October, showing that the government's policy to expand domestic demand and promote consumption is continuing to have the desired effect.

However, some Western media organizations including the Wall Street Journal and Reuters have labeled the data as "less than expected." In a report, Reuters said the data "missed analysts' expectations of 12.5 percent."

According to their logic, China's November data needed to be at least 5 percentage points higher than October for it to be considered "qualified." The reason given for such a high expectation is the low base last year.

As early as the beginning of this year, when China optimized and adjusted its epidemic prevention and control policy, these Western media outlets created the same narrative: the Chinese consumer market would immediately go on a "vengeful" upsurge and the Chinese economy would rebound strongly. When the second-quarter data were released, they went around claiming that "China's economy is in big trouble."

Analysts believe that there is no empirical evidence to support the demand for a sharp increase in the year-on-year growth rate of China's retail sales in November.

Expecting a 12.5 percent growth is more like a premeditated act to help reach the conclusion of "less than expected," said Australian economist Guo Shengxiang. These institutions have deliberately sifted through China's unfavorable models and statistical methods, drawing conclusions first and finding arguments later, he noted.

An employee works at a company producing water treatment equipment in Huimin County of Binzhou, east China's Shandong Province, March 14, 2023. (Photo by Chu Baorui/Xinhua)

TRICKS TO SMEAR CHINESE ECONOMY

As different analysts differ in their information sources, analytic tools and interest orientations, it is natural to have different forecasts for a particular economy. What investors expect is nothing more than objective, balanced reports and diversified, rational information.

However, some Western institutions have used their discourse hegemony to block views contrary to their intentions and deliberately exaggerated pessimistic views on the Chinese economy to mislead market expectations.

In addition to the media and business organizations, the U.S. and Western politicians seem to be even better at playing these tricks.

Not long ago, the U.S. House committee on China took the usual Cold War playbook to Wall Street, presenting financial executives with a "hypothetical scenario" in which China posed a "systemic risk" to the U.S. economy.

These ideologically biased politicians have asserted that China is a "source of risk" and is no longer "suitable for investment."

Eoin Mills, a spokesman for Cummins, told the media: "If you say anything positive about the Chinese economy, you will have trouble."

This photo taken on March 15, 2023 shows excavators to be shipped at a port in Lianyungang, east China's Jiangsu Province. (Photo by Wang Chun/Xinhua)

WEB OF GRAY INTERESTS

The Western bearish narratives are not isolated -- they frequently engage with international hot capital and even Western political forces, weaving an intricate web of gray interests.

Take a look at their typical steps -- Western media and institutions take the lead in selling a bearish narrative to garner attention while international rating agencies downgrade credit ratings to attract client interest. International hot capital then follows to buy low and sell high and politicians exploit opportunities to advance their interests.

It's a narrative battle, employing psychological warfare, leveraging information asymmetry, and showcasing astute business acumen -- Western entities have masterfully employed this combination for decades, reaping substantial financial gains and strategic advantages.

Following the disintegration of the Soviet Union in 1991, Russia fell prey to such a narrative battle. Westernization and shock therapy not only failed to reverse Russia's economic decline but also triggered uncontrollable inflation, leading to a drastic rise in poverty rates, and a substantial devaluation of the nation's assets. The West and their proxies thereby seized opportunities and once gained control over Russia's economy.

In the 1990s, U.S. Financier George Soros attacked the Thai Baht by disseminating negative news and amplifying challenges faced by Thailand via so-called professional media outlets, laying the groundwork for shorting the economy.

In January, U.S. media revealed that journalists from major media outlets such as CNN, CBS, NBC, NPR, Bloomberg News, and The Washington Post had received funding from Soros, acting as his accomplices to facilitate his financial speculation.

It appears that financial speculation has burgeoned into a lucrative industry in the West. Numerous investors subscribe to the notion that to prosper in a tumultuous market, one should strategically fish in troubled waters.

Certain Western investment banks and institutions strongly criticize the Chinese economy while benefiting from information asymmetry. Some suggest so-called reform plans that overlook China's national conditions, and there are also economists profiting from speeches and books that hold a negative view of the Chinese economy.

But the Chinese economy is highly resilient. As China pursues open, high-quality development, it generates new opportunities, injecting certainty into an unstable world and boosting global development.

Thanks to its massive market size, technological innovation, and robust development resilience, China can withstand external pressure and overcome internal difficulties. Indeed, its economy is rebounding, effectively refuting various pessimistic arguments.

In a word, peddling deceitful bearish narratives about China is destined to fail.

Photos

Related Stories

- 10 sets of data decoding China's transformation in the new era

- NDRC reviews economic situation in advancing building of Chinese modernization

- Vibrant consumption fuels China's economic recovery

- China's economy shows significant signs of recovery: Spanish experts

- Economists' take on China's economic outlook in 2024

Copyright © 2023 People's Daily Online. All Rights Reserved.