GT Voice: US chip firms can’t endure more limits on China sales

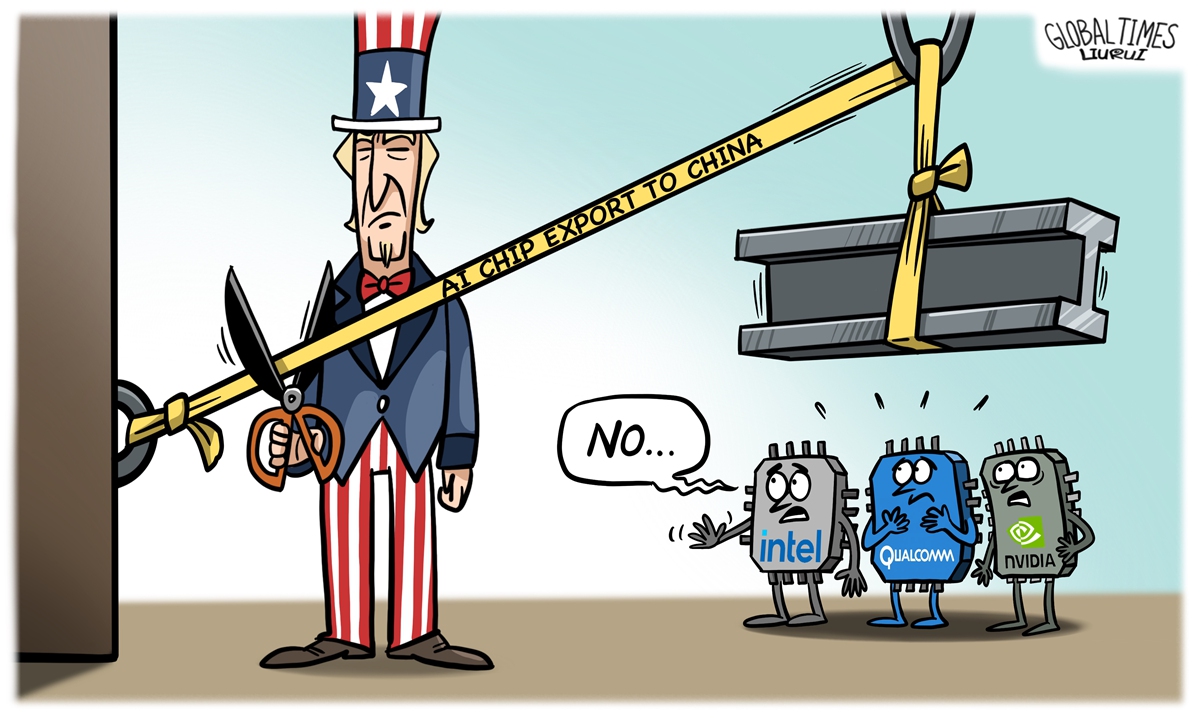

Illustration: Liu Rui/Global Times

While US politicians appear determined to continue the strategy of seeking a "decoupling" from China in the high-tech sphere, continuous layoffs by American tech giants clearly show why the export limits on chip sales to China are unsustainable and self-defeating for the US industry.

The Biden administration is likely to announce soon new controls on artificial intelligence (AI) chips and equipment that can be sold to China, US media outlet Axios reported on Saturday, citing administration officials.

This is not the first time foreign media outlets have reported that the Biden administration is likely to add curbs on AI chip sales to China. Last week, a Reuters report said that Washington is mulling ways to close a loophole that gives overseas subsidiaries of Chinese companies access to American AI chips, while the Axios article claimed that the new rules may be applied to chips that are slightly less powerful than those covered under the initial guidelines, but still have advanced capabilities.

Whatever the eventual rules are, one thing is certain: they will serve as a new blow to US chip companies that are already facing difficulties amid shrinking demand.

Just recently, Qualcomm, the world's largest maker of smartphone chips, announced a plan to cut 1,258 positions in the California cities of San Diego and Santa Clara, starting in mid-December. Chief Financial Officer Akash Palkhiwala told analysts that Qualcomm would "proactively implement additional cost actions."

The direct cause of Qualcomm's layoffs is a poor performance. According to its third-quarter earnings report, net income fell to $1.8 billion, a staggering 52 percent year-on-year drop. Intel also announced layoffs after a sharp drop in profits in the first quarter.

With global chipmakers seeing weak demand due to factors such as the sluggish economic outlook, the Chinese market is not something they can afford to lose.

In sharp contrast to continuing US efforts to cut off the American chip industry from China, US chip giants have been trying to find ways to continue doing business with China by circumventing the US chip bans. For instance, Nvidia modified its flagship A100 and H100 chips to versions that are not prohibited from being sold to China under the US rules, after US regulators banned the company from selling those chips to Chinese customers.

Also, chief executives of major US chip companies - Intel, Qualcomm and Nvidia - urged a halt to more curbs on chip exports to China when meeting with top Biden administration officials in July, according to media reports.

Their opposition and concerns are totally justified. The global semiconductor industry and supply chains are shaped by the laws of market dynamics and the choices of businesses. China is the world's largest market for chips, with imports amounting to $415.6 billion in 2022.

If politicians in Washington continue to choose the wrong way to keep their strength in technology, turning a blind eye to calls from the industry, one likely outcome is that US chip companies will face greater risks.

Not only will they lose a huge market, but they will see the rise of competitors, because the US chip war has served as a reminder of the importance of independent innovation, and it has enhanced China's resolve to pursue technological innovation and progress.

While the US chip ban may cause some difficulties for the Chinese semiconductor industry in the short term, in the long run, it will offer domestic industry players the time and market space needed for growth and thriving in the future competition.

Judging from the achievements of Chinese semiconductor companies over the past few years, especially the breakthrough by Huawei, there is already clear awareness that only with sufficient technological progress by China can the US technological war see a failure.

Photos

Related Stories

- Feature: A book threading together China, U.S.

- Shutting the door on idea of openness

- FM hopes US Congress will play a more positive role

- Chinese consulate in San Francisco slams car crash attack on visa office

- Dialogue particularly important for China, US now: Chinese vice president

- Scientists develop fully integrated memristor chip with low energy consumption

Copyright © 2023 People's Daily Online. All Rights Reserved.