Specialists eye more stable capital flows

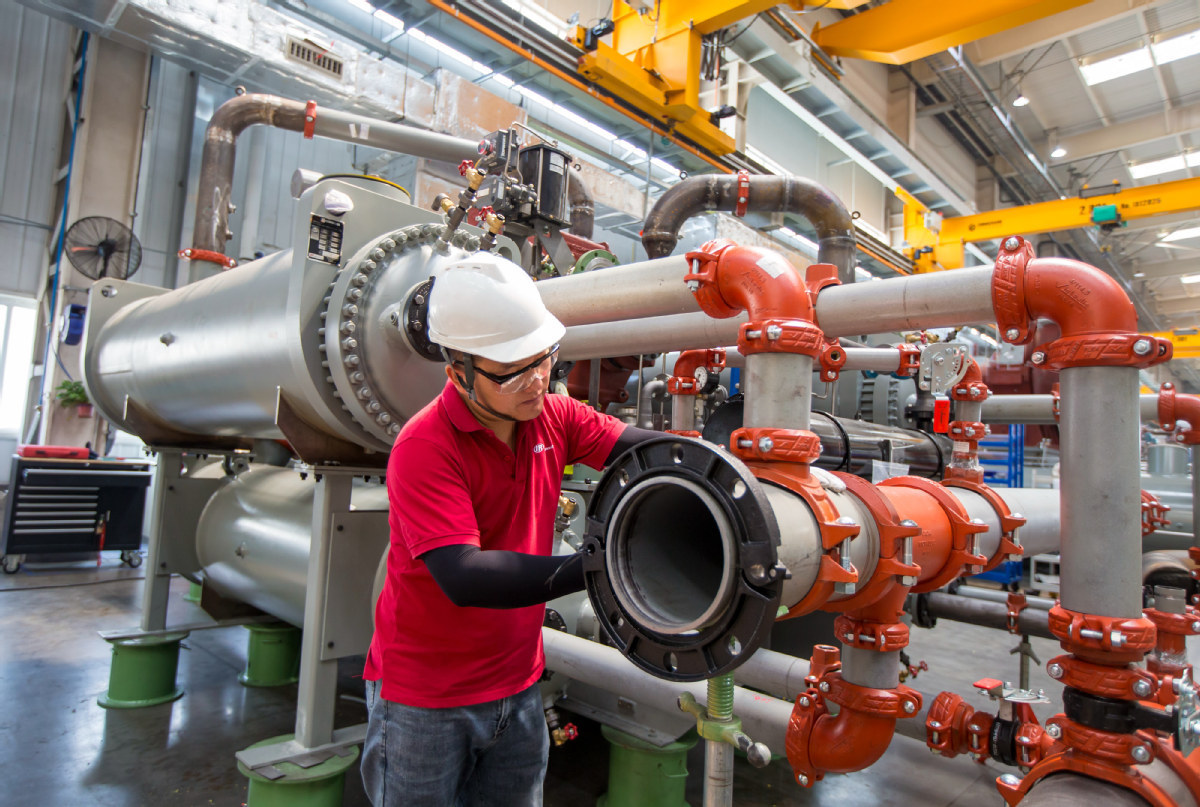

An employee works on the production line of a foreign-funded machinery manufacturer in Suzhou, Jiangsu province. [Photo by Zhai Huiyong/For China Daily]

China's cross-border capital flows are expected to become more stable this year following a "generally balanced" situation last year, officials and experts said on Wednesday.

Underpinning their forecast is a rallying Chinese economy that may drive foreign inflows into onshore securities and support the country's trade surplus and foreign direct investment, they said.

They commented after official data showed that China had registered a full-year foreign exchange settlement surplus and rising foreign holdings in Chinese securities at the end of last year, bucking the headwinds brought by global monetary tightening.

The country's foreign exchange settlement and sales by banks came in at $2.57 trillion and $2.46 trillion last year, respectively, indicating a surplus of $107.3 billion, the State Administration of Foreign Exchange said on Wednesday.

China's cross-border receipts and payments by nonbanking sectors also registered a surplus in 2022, with the amount of receipts surpassing payments by $76.3 billion, according to SAFE.

Wang Chunying, deputy head and spokeswoman of SAFE, said the figures have indicated "generally balanced "cross-border capital flows last year, which will become more stable this year as China may become the world's only major economy to see a rally in economic growth.

Specifically, the country's securities markets are expected to attract steady foreign investments as economic growth recovers, Wang said.

SAFE data showed that overseas holdings in onshore bonds increased by a net $7.3 billion in December while those in onshore stocks rose by $8.4 billion.

The recovery in foreign investments has continued in the new year, with foreign investors registering a net purchase of onshore stocks and bonds worth about $12.6 billion in the first half of January, according to the administration.

Mike Shiao, Invesco's chief investment officer of Asia excluding Japan, said the global investment management company anticipates a further upside in the Chinese economy and decent company earnings recovery this year.

"China's GDP growth will likely reach mid-single digits in 2023 due to the surge in domestic demand," Shiao said.

Wang also said China's trade in goods and FDI are likely to continue to register a surplus this year as the country's foundation of supply chain stability will become more solid upon optimized COVID response.

China's FDI, in actual use, hit $189.13 billion last year, up 8 percent year-on-year, according to the Ministry of Commerce.

SAFE data also showed that renminbi receipts and payments accounted for nearly half of the country's cross-border payments in 2022, up by more than 20 percentage points from the level seen in 2016.

Onshore foreign exchange deposits of enterprises, individuals and other market entities stood at $639.6 billion by the end of November, down by $56.2 billion compared with the end of 2021, according to the administration.

Photos

Related Stories

- Securities regulator details construction of modern capital market with Chinese characteristics

- Experts see foreign capital rising in China

- China accelerates legislation to support healthy development of capital: report

- China to support well-regulated, sound development of capital

- Influx of int'l capital underscores attractiveness of Chinese market: Bloomberg

Copyright © 2023 People's Daily Online. All Rights Reserved.