Financial digitalization gets e-CNY trust

[MA XUEJING/ZHOU LANXU/CHINA DAILY/WANG XIAOYING/ZHENG YIJIA/FOR CHINA DAILY]

Use of China's digital currency grows rapidly as wide-ranging application scenarios emerge

As the fall semester started in September, Liu Xiaojing, 35, a product manager in Beijing, enrolled her 7-year-old son into an after-school English-language program. That was a sort of an encore. The child had completed a similar program that coincided with the spring semester. The only difference this time round was that Liu paid 3,168 yuan ($437) toward the program in digital yuan, or e-CNY.

That shows the rapid rise in user acceptance levels of China's central bank digital currency. Industry observers said digital payments using apps such as Alipay, WeChat Pay or Apple Pay could soon have competition as e-CNY is increasingly seen as much more than just a new payment method.

For Liu, e-CNY payment brought an extra benefit — it ensured that each fen, or penny, of the tuition fee she paid is strictly owned by her until her child took the lessons. And that meant a whole new level of security and comfort for the young mother.

"In the past, I used to feel a bit uneasy upon paying tuition fees upfront," Liu said. "With e-CNY, I feel no such concern as I know there is a government-backed platform. Even if the English course gets disrupted for whatever reason, I can rest assured and don't have to spend extra time trying to secure a refund. That's a big relief indeed."

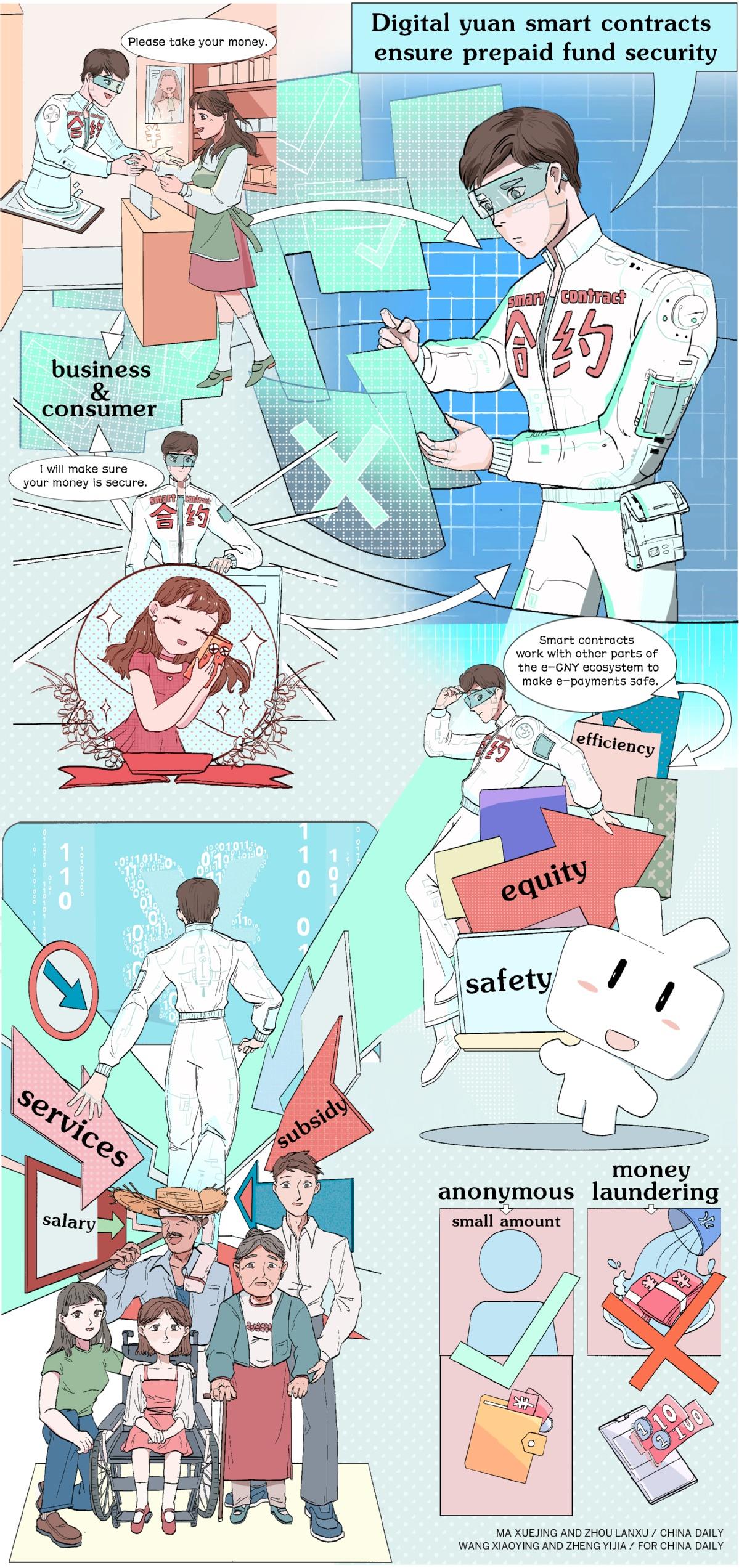

Liu used Secured Pay to make the e-CNY payment. Secured Pay is a digital yuan prepaid fund management system. When a consumer makes an advance payment to a business, the system parks the money in an e-CNY wallet that runs a digital yuan smart contract — or a set of computer programs that automatically execute e-CNY payments according to preset conditions.

In other words, the smart contract examines whether the preset event of payment has taken place and decides accordingly whether or not to transfer prepaid funds in the digital wallet to the business.

The recipient cannot access the money in the wallet immediately and has to wait for the smart contract to transfer the money. Such transfer would take place only after preset conditions are met, like provision of goods, services, technologies or content. Until the transfer, the prepaid money in the wallet is owned by the consumer.

Secured Pay's system, unveiled by the Digital Currency Institute of the People's Bank of China in September, is already in use at Beijing Chaoyang District Houhai Training School.

So far, the system has proceeded nearly 1 million yuan worth of payments to the school, accounting for about one-fifth of the institution's transaction value during the same period, said Zhao Lei, a corporate business expert at Bank of Communications, which serves as the Secured Pay system operator for the school.

"Consumers showed stronger-than-expected willingness to try the new prepaid fund solution," Zhao said. Secured Pay, he said, would ensure hassle-free refund of prepaid money in case the educational institution goes bust or shuts down for whatever reason.

Huang Yafeng, director of the general office of the school, said the adoption of Secured Pay has boosted parents' trust in the institution and helped it gain more patrons. The institution plans to put more courses on the Secured Pay system.

Experts said the prepaid fund management system demonstrates the great potential of digital yuan applications — especially those based on smart contracts — to reduce transaction costs, protect consumer rights and boost the efficiency of economic activities.

The nation has made positive progress in applying digital yuan smart contracts in such areas as consumption coupons and government subsidies and will further boost their role in developing the digital economy and improving the business environment, Fan Yifei, deputy governor of the PBOC, China's central bank, said at a forum last month.

With the next five years holding great significance for the country's modernization drive, experts said e-CNY is expected to play a growing role in powering China's digitalization and inclusive development, with more applications unfolding in business-oriented scenarios and public services.

The report to the 20th National Congress of the Communist Party of China, delivered on Oct 16, has underscored achieving common prosperity for all as one of the essential requirements of Chinese modernization, while calling for efforts to move faster to boost China's strength in digital development.

Song Ke, deputy director of the International Monetary Institute of the Renmin University of China, said the digital yuan is expected to boost the development of China's digital economy by facilitating digital and smart payments and reducing transaction costs.

E-CNY can also help enhance financial inclusion as it has developed hardware wallets such as gloves and badges and accommodated offline transactions, satisfying the payment preferences of different users, Song said.

Supportive of financial inclusion, China will leverage e-CNY to facilitate smaller businesses' fund management and salary payment while making the digital yuan system more friendly to the elderly and people with disabilities, according to a PBOC article this month.

Moreover, the digital yuan system will be integrated with traditional electronic payment tools so that consumers can access all payment methods by scanning one QR code, the article said, adding that China will also advance digital yuan applications in public finance, taxation and government services.

However, experts noted the development of e-CNY still needs to overcome multiple challenges. Although awareness of e-CNY is rising fast, many people prefer the familiar or the known, like the popular digital payment apps in vogue, which offer a sort of comfort zone.

Yang Tao, deputy director-general of the National Institution for Finance &Development, said while the digital yuan can help boost financial digitalization, its influence should not be exaggerated given that it is still nascent.

Yang said more efforts are necessary to make the digital yuan system more commercially sustainable and optimize its data governance framework.

Zhao at BOCOM said the lender has been working to incentivize more businesses to use the prepaid fund solution Secured Pay, as part of its ramped-up efforts to ensure the system is commercially sustainable.

For instance, although e-CNY itself does not carry interest, a possible way is being explored to enable businesses receive the interest generated by the prepaid money, Zhao said.

According to him, the bank will work to introduce more educational institutions to the Secured Pay system — especially in Beijing's Chaoyang district where relevant infrastructure is ready — and then explore more application scenarios in other sectors such as medical care.

"The coming years are expected to see a rapid development of digital yuan smart contracts," Zhao added.

By slashing the possibility of human manipulation, digital yuan smart contracts can enhance mutual trust between buyers and sellers, he said, adding that the bank is developing digital yuan smart contract products for targeted salary payment and fiscal fund distribution.

Having been piloted in parts of 15 provinces and cities since late 2019, e-CNY has formed a variety of application scenarios covering wholesale, retail, catering, travel, education, medical care and public services.

As of Aug 31, 360 million transactions had been carried out via e-CNY in pilot areas, with the cumulative transaction value hitting 100.04 billion yuan, according to the PBOC.

Photos

Related Stories

Copyright © 2022 People's Daily Online. All Rights Reserved.