By piling pain on global, Chinese chip chains, what is US gaining?

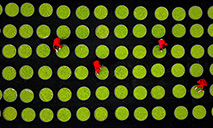

Employees work at a chip production facility in Huaian, Jiangsu province, in March. ZHAO QIRUI/FOR CHINA DAILY

As the world is still grappling with a prolonged chip supply crunch, a report from South Korean media exacerbated concerns that a geopolitically motivated chip alliance will further split the global semiconductor industry chain, harming the interests of thousands of enterprises.

South Korean online news publisher Business Korea recently reported that the US government proposed setting up a semiconductor industry alliance with its allies, including South Korea and Japan, to keep the Chinese mainland's fledgling semiconductor industry at bay.

The report, though not verified yet by concerned parties, did not strike industry insiders as a surprise. The US government has long been trying to leverage its semiconductor technological prowess to contain tech companies based in the Chinese mainland and to build a Washington-led semiconductor supply chain alliance excluding the Chinese mainland.

But the latest political attempt to corral Japan and South Korea will not likely produce the results it intends. The report from Business Korea cited an anonymous industry source as saying the proposal was not "fully acceptable" to Seoul because South Korean chip giants Samsung Electronics and SK Hynix have invested billions of dollars in key manufacturing facilities on the Chinese mainland.

As the world's largest chip market, the Chinese mainland is an indispensable part of the global semiconductor industrial chain. It consumes more than 50 percent of all semiconductors in the world, which are then assembled into tech products to be re-exported or sold in the domestic market for final consumption, according to market research company Daxue Consulting.

The logic is simple and clear: The Chinese mainland is too big a market for any chip company to ignore, not just South Korean companies but US companies. The Chinese mainland imports more than $300 billion of semiconductors annually, and most, though not all, major US semiconductor companies pull in at least 25 percent of their sales from the Chinese mainland market, according to an article published on the Brookings Institution's official website.

"Access to this massive market is essential to the success of any globally competitive chip firm today and in the future," said the Semiconductor Industry Association, a Washington-based group that represents the US semiconductor industry.

Meanwhile, the Chinese mainland is also playing an increasingly important role in the global chip manufacturing layout. It accounted for 11 percent of worldwide semiconductor fabrication capacity in 2019, and the number is forecast to reach 18 percent in 2025 and nearly 19 percent in 2030, according to the Semiconductor Industry Association.

In such a context, it does not make any sense for the US to build a chain alliance that excludes the Chinese mainland. The price will be too big to bear.

Moreover, rather than cementing US semiconductor dominance, such moves will further deteriorate global protracted chip supply woes, which eventually will bite back on US companies.

Experience has already proved that. When the US government wielded its semiconductor hegemony to crack down on Chinese tech companies including Huawei Technologies and Semiconductor Manufacturing International Corp in the past, such moves triggered a wave of panic hoarding of chips which fueled a chip shortage and harmed the interests of dozens of US chip companies such as Qualcomm Inc and Intel Corp.

Such concerns are worthy of special attention as the latest research from Susquehanna Financial Group showed that global chip supply problems seemed to have worsened recently. The wait times for semiconductor deliveries reached a new high in March, with lead times, or the lag between when a chip is ordered and delivered, increasing by two days to 26.6 weeks last month.

Splitting the global semiconductor sector to stifle Chinese mainland's chip development will only worsen such a chip supply crunch and Washington should not turn a blind eye to the collateral damage that could be forced upon its economy, as has already been shown in its automotive industry.

In a recent letter to US Secretary of Commerce Gina Raimondo, the US Chamber of Commerce said the semiconductor industry is global and reliant on open markets and supply chains that span the world. That is a fact no one can change and politicians should take it into full consideration when drafting any semiconductor policies.

Photos

Related Stories

Copyright © 2022 People's Daily Online. All Rights Reserved.