Global FDI flows plunge 35 pct in 2020, set to rebound in 2021: UNCTAD

Photo taken on Jan. 7, 2020 shows China-produced sedans at Tesla's gigafactory in Shanghai, east China.(Xinhua/Ding Ting)

In its "World Investment Report 2021," the Geneva-based UN trade and development body said FDI flows fell to one trillion U.S. dollars in 2020 from 1.5 trillion U.S. dollars the previous year.

Lockdowns caused by the COVID-19 pandemic around the world slowed down existing investment projects, and the prospects of a recession led multinational enterprises to reassess new projects, the report said.

GENEVA, June 21 (Xinhua) -- The United Nations Conference on Trade and Development

said Monday that foreign direct investment (FDI) flows plunged globally by 35 percent in 2020 due to the COVID-19 pandemic, but are expected to bottom out in 2021 mainly thanks to the recovery in Asia.

In its "World Investment Report 2021," the Geneva-based UN trade and development body said FDI flows fell to one trillion U.S. dollars in 2020 from 1.5 trillion U.S. dollars the previous year.

Lockdowns caused by the COVID-19 pandemic around the world slowed down existing investment projects, and the prospects of a recession led multinational enterprises to reassess new projects, the report said.

UNCTAD said that in developing countries, the number of newly announced greenfield projects fell by 42 percent and international project finance deals, which are important for infrastructure, declined by 14 percent.

"These investment types are crucial for productive capacity and infrastructure development and thus for sustainable recovery prospects," Acting UNCTAD Secretary-General Isabelle Durant said.

The UNCTAD also said that COVID-19 caused a collapse in investment flows to sectors relevant for the Sustainable Development Goals (SDGs) in developing countries.

"The drop in foreign investment in SDG-related sectors may reverse the progress achieved in SDG investment in recent years, posing a risk to delivering the 2030 Agenda for Sustainable Development and to sustained post-pandemic recovery," Durant warned.

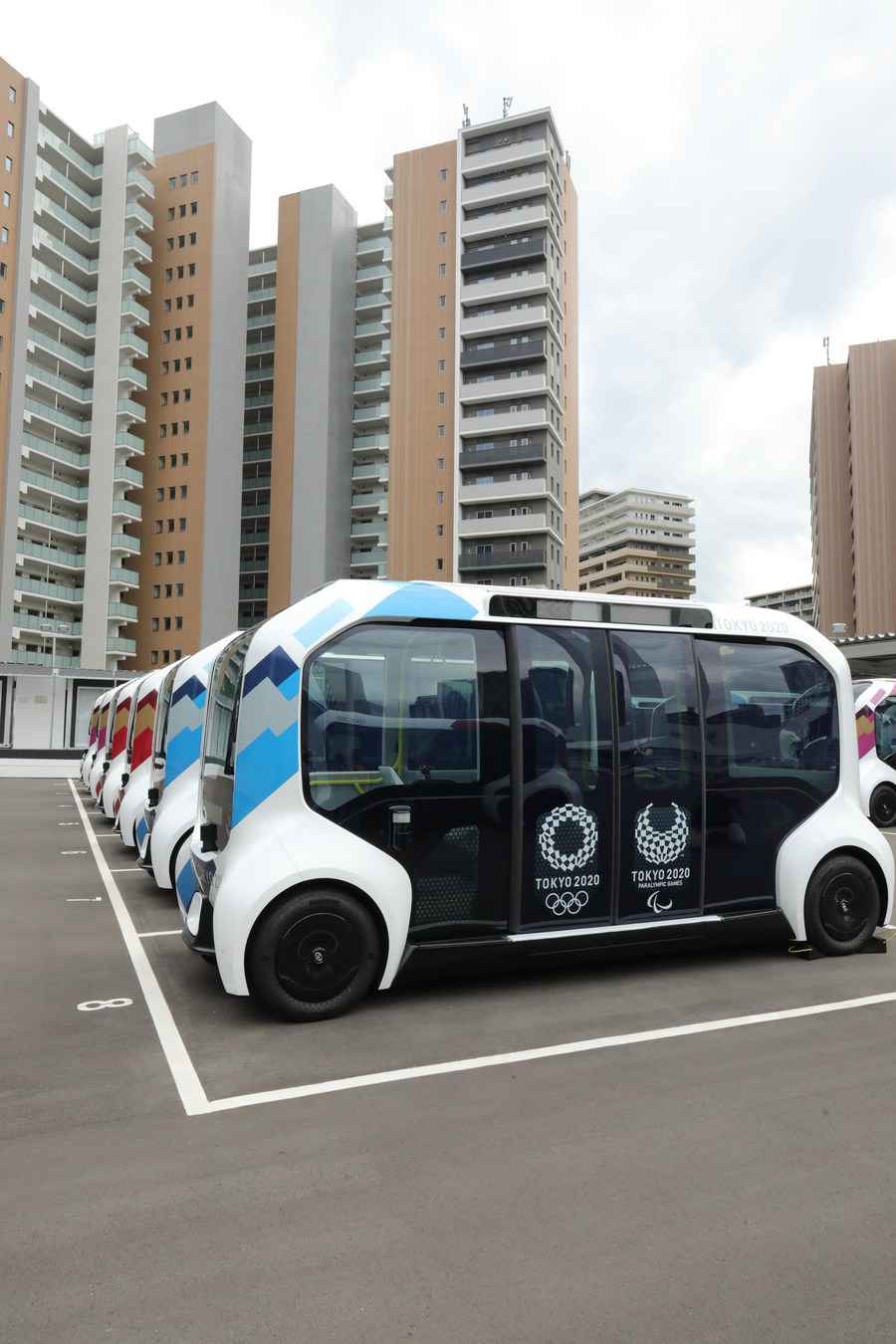

Photo taken on June 20, 2021 shows self-driving electric vehicles inside the Olympic Village for the Tokyo 2020 Olympic Games in Tokyo, Japan. (Xinhua/Wang Zijiang)

RESILIENCE IN ASIA

On the bright side, the figures showed that flows to developing countries in Asia increased by 4 percent to 535 billion U.S. dollars in 2020, reflecting resilience amid the global contraction.

"Despite the pandemic, FDI to and from the region remained resilient in 2020. Developing Asia is the only region recording FDI growth, accounting for more than half of global inward and outward FDI flows," said UNCTAD's director of investment and enterprise, James Zhan.

"FDI prospects in 2021 for Asia are more favourable than the global average, because of recovery in trade, manufacturing activities and a strong GDP growth forecast," he added.

In China, FDI growth picked up pace in 2020 and grew by 6 percent to 149 billion U.S. dollars.

UNCTAD said this was reflected by "the country's success in containing the pandemic and its rapid GDP growth recovery." Growth was driven by technology-related industries, e-commerce and research and development, it added.

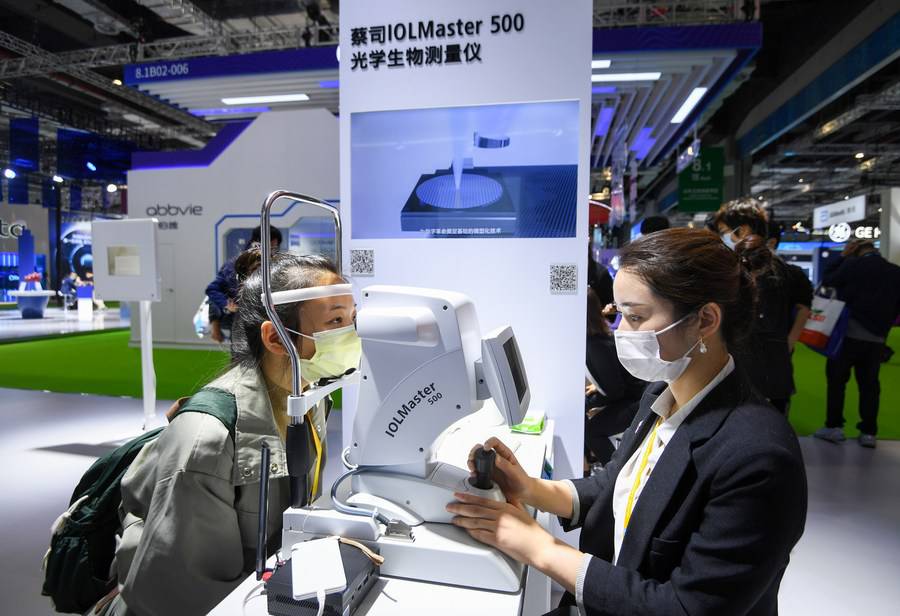

A visitor experiences an IOLMaster 500 device at the booth of German technology enterprise ZEISS during the third China International Import Expo (CIIE) in Shanghai, east China, Nov. 6, 2020.(Xinhua/Chen Yehua)

"BOTTOMING OUT LIKELY"

The UNCTAD forecast global FDI flows to bottom out in 2021 and recover some lost ground with an increase of 10 to 15 percent.

"This would still leave FDI some 25 percent below the 2019 level. Current forecasts show a further increase in 2022 which, at the upper bound of projections, bring FDI back to the 2019 level," Zhan said.

The report said that prospects are highly uncertain and will depend on the pace of economic recovery and the possibility of pandemic relapses, the potential impact of recovery spending packages on FDI, as well as policy pressures.

The relatively modest recovery also reflects the lingering uncertainty about access to vaccines, the emergence of virus mutations and the reopening of economic sectors.

"Increased expenditures on both fixed assets and intangibles will not translate directly into a rapid FDI rebound, as confirmed by the sharp contrast between rosy forecasts for capex (capital expenditures) and still-depressed greenfield project announcements," Zhan said.

Photos

Related Stories

- China witnesses boom in growth of foreign direct investment

- Actual use of FDI into Chinese mainland up 38.6 percent in first four months

- China's FDI inflow surges nearly 40 pct in Jan-April

- China's growth prospects, further opening-up in favor of attracting FDI inflows: OECD expert

- Interview: Ghana poised to be priority destination for Chinese investment: trade analyst

Copyright © 2021 People's Daily Online. All Rights Reserved.