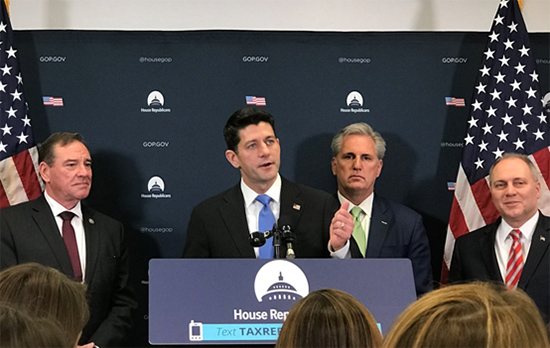

Republican House Speaker Paul Ryan (center) said he was not worried about the low public support of the tax cuts. File photo: Hu Zexi

People demonstrate against the new tax bill at the US Capitol in Washington DC.

File photo: Hu Zexi

Washington (People's Daily) - The final version of the GOP tax plan passed both the House and Senate Wednesday noon, and now awaits President Trump’s signature before it officially becomes law. Trump had been pushing for an early tax bill pass. And this latest GOP move marks the largest US tax revamp in three decades.

Beginning in December, both houses passed separate versions of the tax bill.

According to US Congress legislative procedure, GOP members of both chambers formed a conference committee to reconcile the differences between the two versions and drafted a final version.

The final version stipulates that corporate tax rates will drop from 35 percent to 21 percent.

Meanwhile, individual income tax will continue to be split into seven brackets, with rates reduced to 10-37 percent and standard deduction almost double.

Partnerships, LLC’s and S corporations, like the so-called "pass-through" businesses, will receive a 20 percent deduction for their income.

US companies transferring overseas assets back into the country will only be taxed once for cash assets and fixed assets, with a rate of 15.5 percent for cash assets and 8 percent for fixed assets.

In efforts to maintain GOP party unity, the Republican Conference Committee revised provisions during the tax plan’s final editing stages.

The final version raised the child tax credit, a move that won favor with former potential holdout Republican Senator Marco Rubio (Fla.).

Internal GOP comprises saw earlier reduced tax rates go from 20 percent to ending at one percentage point higher.

New exemptions to the bill forced GOP members to find cost-cutting solutions in accordance with legislative rules stipulating that the bill not exceed $1.5 trillion.

The new tax bill bundled provisions repealing key parts of the Obamacare and paving the way for Alaska oil drilling. The two provisions are hot-button issues in the US as millions could lose health insurance benefits, while environmentalists prepare to sound alarm bells.

Not one Congressional Democrat voted for the bill. Democrats attacked the bill of being disproportionately favorable to the rich and businesses. Meanwhile, the Democrats also questioned the GOP leaders' hasty legislation practice, emphasizing that the bill lacked public debate and bipartisan discussions. Throughout the legislating process, the GOPs kept adjusting the bill’s contents in close-door meetings, while Democrats time and again claimed their rights to "read the bill." The Democrats also believe that the GOP tax cut plan will rapidly reduce the federal government's revenue; in order to balance the deficit, the Republican Party may further promote social welfare reform next year.

Studies projected the tax reform bill will provide more benefits to businesses and high-wage earners.

According to a study released by Tax Policy Center, a non-partisan research institute, the proposed tax reform would allow US households to cut taxes expenses by roughly $1,600 for 2018, but high-income families will receive far more reductions than middle-income families.

Households earning more than $1 million a year will have a tax cut of almost $70,000 by the end of next year. which means their household net income will soar 3.3 percent. Families earning between $50,000 and $75,000 a year will have a tax cut of $ 870, marking a 1.6 percent net income increase. Analysis by the Joint Committee on Taxation demonstrated that the total $1.5 trillion tax relief would be mostly obtained by enterprises, while only about 10 percent will go to middle-income families. Moreover, the tax cut provisions for corporate is permanent, while most of the individual tax relief provisions will expire in the end of 2025.

US macro-economic conditions are hugely debated concerns by supporters and opponents.

Republicans feel the tax cuts will bring 3 percent growth to the US economy and an increase in tax sources will balance tax cut expenses. It’ s an assumption Democrats feel is unfounded.

A report from the Joint Committee on Taxation revealed the US economy will see 0.8 percent additional growth in the decade.

Overall, entire tax relief package will add $1 trillion in government debt in 10 years.

Republicans view the passage of the tax reform bill as a major political victory, believing it has finally realized the long-awaited policy objective of tax cuts and repealing Obamacare, for core Republican voters.

It’s premature to see how the bill will affect next year’s midterm elections.

CNN said on Tuesday that over half of all Americans oppose the GOP tax bill, while only 33 percent are in favor.

Some analysts believe that because of the strong opposition to the bill, Democrat supporters and independent groups have mobilized.

GOP Speaker of the House Paul Ryan said that when the public eventually finds their after-tax income has increased as a result of the bill, they will start supporting it.

Fire brigade in Shanghai holds group wedding

Fire brigade in Shanghai holds group wedding Tourists enjoy ice sculptures in Datan Town, north China

Tourists enjoy ice sculptures in Datan Town, north China Sunset scenery of Dayan Pagoda in Xi'an

Sunset scenery of Dayan Pagoda in Xi'an Tourists have fun at scenic spot in Nanlong Town, NW China

Tourists have fun at scenic spot in Nanlong Town, NW China Harbin attracts tourists by making best use of ice in winter

Harbin attracts tourists by making best use of ice in winter In pics: FIS Alpine Ski Women's World Cup Slalom

In pics: FIS Alpine Ski Women's World Cup Slalom Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa

Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa China's FAST telescope will be available to foreign scientists in April

China's FAST telescope will be available to foreign scientists in April "She power" plays indispensable role in poverty alleviation

"She power" plays indispensable role in poverty alleviation Top 10 world news events of People's Daily in 2020

Top 10 world news events of People's Daily in 2020 Top 10 China news events of People's Daily in 2020

Top 10 China news events of People's Daily in 2020 Top 10 media buzzwords of 2020

Top 10 media buzzwords of 2020 Year-ender:10 major tourism stories of 2020

Year-ender:10 major tourism stories of 2020 No interference in Venezuelan issues

No interference in Venezuelan issues

Biz prepares for trade spat

Biz prepares for trade spat

Broadcasting Continent

Broadcasting Continent Australia wins Chinese CEOs as US loses

Australia wins Chinese CEOs as US loses