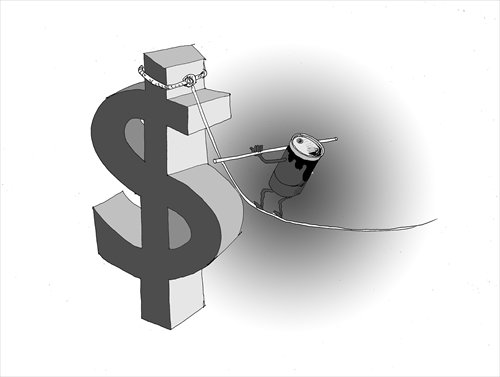

Illustration: Luo Xuan/GT

On Wednesday, the price of crude oil dipped below $30 a barrel in the New York market for the first time in 12 years. But international oil prices could yet fall even further.

The current oil price is down to the tug of war between demand and supply. There has been excess global oil supply for some time, and it happened because of four main factors. First, most global oil producing countries have been boosting their capacity, which has reduced the previous dominance of the Middle East in crude oil production. Second, the signing of the Iran nuclear deal has eased concerns about potential conflict, and allowed further liberation and acceleration of Iran's oil production. Third, Europe's economic recovery has been slow, resulting in weak energy demand. Lastly, emerging economies are also struggling with a slowdown in economic growth. The worldwide economic downturn caused by the financial crisis in 2008 still lingers, leading to sluggish demand for global energy resources.

But despite these circumstances, the major oil exporters have not taken any proactive measures to reduce production, leaving oil prices subject to market competition and hoping to defend their market share through price suppression. Saudi Arabia has played a prominent role in this regard. It used to propose reducing production to OPEC whenever international oil prices fell, but it has taken the lead in the recent price war, maintaining production levels and allowing the crude oil price to continue falling.

The current international oil price is now lower than the production costs for many oil producing countries. If it dips below $30 a barrel, even large producers like Saudi Arabia and Iran may barely make a profit. And for countries such as Russia and Venezuela, their average crude oil production cost is apparently higher than $30 a barrel. For China and some other European countries, the production cost is much higher than $30, so most of them are suffering tremendous losses.

We can therefore draw a conclusion from this situation that industry leaders like Saudi Arabia are trying to squeeze out those countries with relatively small oil production capacities. Such price wars usually have a long lifecycle, so the international oil price may continue to dip.

But what Saudi Arabia has been doing is a double-edged sword. The national budget of Saudi Arabia has fallen into deficit and if oil prices continue to tumble, the country will suffer more.

Historically speaking, oil prices have often seen big fluctuations and uncertainty. Back in the 1960s and '70s, the price even fell to $1 to $3 per barrel. It later rose to $25 per barrel, but by the end of the last century, the price was only around $10 per barrel. As the world economy recovered and China's economy boomed, oil demand increased and the price shot up to $140 per barrel, before falling back to $40 after the 2008 financial crisis. Chinese demand helped it recover to $100 per barrel, and it lingered at that level for five to six years, before sliding again last year.

Given that international oil prices may fall further, China should carefully consider its specific conditions and balance two factors when initiating oil-related policies. First, China lags behind in terms of natural oil reserves, which means that costs of production and processing are higher than the international average. Second, China is facing tremendous pressure to improve environmental protection. If the oil price is too low, it will be harder to deal with pollution.

The new cap and floor pricing mechanism (with an upper limit of $130 per barrel and a lower limit of $40 per barrel) introduced by the National Development and Reform Commission on Wednesday is a sensible strategy that fits into China's current situation.

The Chinese government may also consider gradually opening up its oil market and changing its tax management. It may curb automobile-related consumption through consumer tax, allowing the oil industry to manage and adjust itself autonomously. Some thorough thinking on this is warranted, so that the industry can avoid suffering too heavily.

PLA holds joint air-ground military drill

PLA holds joint air-ground military drill Charming female soldiers on Xisha Islands

Charming female soldiers on Xisha Islands Beautiful skiers wear shorts in snow

Beautiful skiers wear shorts in snow Getting close to the crew on China's aircraft carrier

Getting close to the crew on China's aircraft carrier A beauty's dancing youth

A beauty's dancing youth Chinese stewardess celebrate test flight at Nansha Islands

Chinese stewardess celebrate test flight at Nansha Islands World's first 'underwater skyscraper'

World's first 'underwater skyscraper'  "Rent me as your girlfriend!"

"Rent me as your girlfriend!" Top 10 weapons in the world in 2015

Top 10 weapons in the world in 2015 Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and Roads Visa trap

Visa trap Same-sex, same abuse

Same-sex, same abuse Chinese netizens rank Japan as least-wanted neighbor

Chinese netizens rank Japan as least-wanted neighbor ‘Detective Chinatown’ pays homage to the mystery genre

‘Detective Chinatown’ pays homage to the mystery genreDay|Week