Asian economies are slowing down a bit amidst increasing uncertainty. On one hand, growth in Japan and the US is weak now but expected to get stronger, eventually buoying exports for developing Asia. On the other hand, the prospect of a US interest rate rise and the ongoing turmoil in the eurozone have put governments and investors on edge. Slower growth and recent market volatility in some of Asia’s leading economies, including the People’s Republic of China, have raised the question whether Asia will remain the engine of global growth.

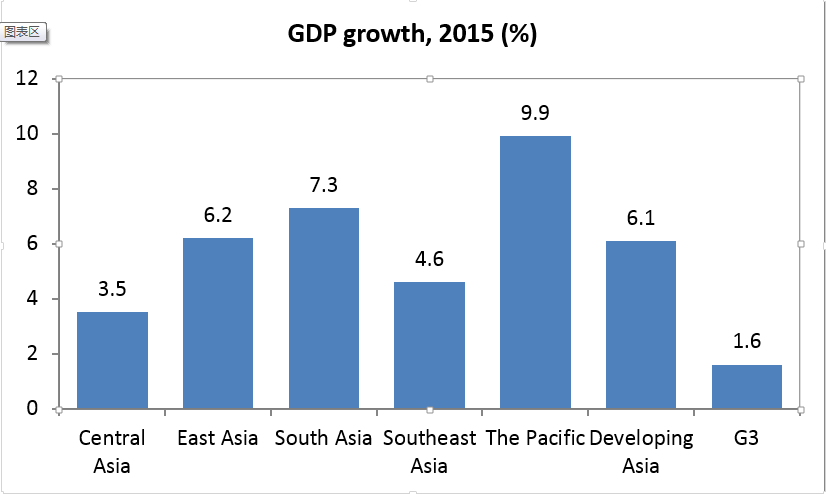

Before raising the alarm bells, some perspective is in order. In a supplement to the Asian Development Outlook released this month, we project developing Asia’s growth will moderate slightly. Growth in 2015 will be 6.1%, a downward adjustment by 0.2 percentage points from our projection in March.

Source: Asian Development Bank. 2015. Asian Development Outlook 2015 Supplement (July 2015). Manila.

The revision takes into account weaker-than-expected growth in the People’s Republic of China (PRC), and four key external factors: the situation in Greece, the pace of recovery in the US and Japan, food and fuel prices, and the prospect of a US interest rate hike.

China is projected to slow down to 7.0%, partly due to a shrinking labor force and a rising wage rate. This is offset in part by India’s higher growth rate at 7.8%. Both countries can realize even higher productivity growth through structural reforms including making labor markets more flexible.

Looking at factors outside Asia, the big news of the last few weeks has been Greece. The Greek debt crisis has played out as classic Greek drama, with plenty of twists and turns. Despite the announcement of the €86 billion deal between Greece and its eurozone creditors, uncertainty will continue in both Greece and the eurozone until details of the bailout conditions are confirmed and reform measures are undertaken.

If one is to look for a worst-case scenario, one might see a messy Greek default and recession dragging down the German banking sector and the European economy as a whole. Thus the indirect impact of a new European recession triggered by a Greek implosion could be quite sizable as Europe collectively is often a top export destination and a major source of capital for many countries in Asia. However, this is not a high-probability scenario. More likely, the crisis will be contained and the indirect impact on Asia will remain small.

A second factor is the pace of recovery in the U.S. and Japan. Earlier this year, we had high hopes for a robust recovery in the US. However, US economic performance in the first quarter registered a contraction due to production disruptions from the harsh winter weather and trade disruptions from the West Coast ports dispute. Moreover, the strengthening US dollar has hurt US export performance. Meanwhile in Japan, exports remain sluggish despite the weaker yen.

These developments prompted us to scale back our forecasts for the three major industrial economies collectively (US, Europe and Japan) to 1.6% in 2015 – from 2.2% earlier this year. This is likely to be a temporary development. We project that both the US and the Japanese economies will strengthen in the second half of 2015 and in 2016. As a result, we expect the effect of the external demand channel will become more positive for developing Asia. Nevertheless, if slow growth in advanced economies continues, developing Asia’s exports to these markets will be hurt, putting pressure on exporters to reach out to new markets and reduce their reliance on external demand to propel growth.

In contrast, the 40% drop in oil prices compared to a year earlier has provided a boost to Asia as most in the region are net importers. As a core input into the production of most products, low oil prices have helped drive down costs to firms and increase household consumption. Of course, the same low oil price represents a fiscal challenge for oil exporting countries. Since these countries found it difficult to diversify their economies when the oil price was high, they should use this time to expand the capacity of other sectors.

Food prices are also relatively low now partly due to favorable weather conditions in many economies. In the first half of 2015, food prices fell by 16% compared to the same period last year. Low food prices translate into higher real incomes for poor households, for whom food accounts for a large share of expenditure.

The fourth external factor, and perhaps the most anticipated, is the prospect of the first rise in US interest rates in 10 years. The baseline scenario in our projection is that when it happens, it will turn out to be a non-event, precisely because it has been talked about for so long, taking neither central banks nor financial markets by surprise.

Despite downside risks, external factors are unlikely to produce a major economic disaster for most Asian economies in the near future. Domestic factors, on the other hand, will be a key determinant of medium-term growth. Will Asian economies in the Northeast be able to increase productivity to compensate for declining working age populations? Will rising wages shift production from Asia’s traditional growth leaders to new up-and-comers? Can meaningful labor market reforms increase flexibility and competitiveness? And can the most productive firms get the capital they need to grow? How these questions are answered will determine whether Asia remains the engine of global growth.

The author is Chief Economist of Asian Development Bank

Day|Week

Top 10 international destinations for Chinese millionaires

Top 10 international destinations for Chinese millionaires New-type self-propelled gun fires in drill

New-type self-propelled gun fires in drill Chinese artists create 'fall of an angel'

Chinese artists create 'fall of an angel' PLA's only woman CBRN emergence rescue team

PLA's only woman CBRN emergence rescue team Stunning! Gorgeous girls practice yoga on 2,000-meter-high cliff

Stunning! Gorgeous girls practice yoga on 2,000-meter-high cliff A glimpse of China's Zijinshan gold & copper mine

A glimpse of China's Zijinshan gold & copper mine Hot figure show in SW China

Hot figure show in SW China Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century