Third Session of the Twelfth National People’s Congress

March 5, 2015

Ministry of Finance

Fellow Deputies,

The Ministry of Finance has been entrusted by the State Council to submit this report on the implementation of the central and local budgets for 2014 and on the drafts of the central and local budgets for 2015 to the Third Session of the Twelfth National People’s Congress (NPC) for your deliberation and for comments from the members of the National Committee of the Chinese People’s Political Consultative Conference (CPPCC).

I. Implementation of the Central and Local Budgets for 2014

Faced with a complex and changing international environment and formidable tasks of domestic reform, development, and stability in 2014, the Central Committee of the Communist Party of China (CPC) and the State Council have grasped the overarching trend of development, adhered to the general principle of seeking progress while keeping performance stable, deepened reform in all respects, continued to develop new ideas and methods for exercising regulation at the macro level, and effectively implemented proactive fiscal policy and prudent monetary policy. As a result, the economy has performed within an appropriate range, and development has become more balanced and sustainable. Both the central and local government budgets were well implemented.

1. Implementation of the NPC’s budget resolution

In accordance with the resolution of the Second Session of the Twelfth NPC on the report on both the implementation of the central and local budgets for 2013 and the central and local draft budgets for 2014 and the review of that report by the NPC’s Financial and Economic Affairs Commission, we have deepened reform of the fiscal and tax systems, strengthened budgetary management, and made full use of the role of public finance.

Major progress has been made in reforming the fiscal and tax systems.

The overall plan for deepening reform of the fiscal and tax systems was deliberated over and passed at a meeting of the Political Bureau of the CPC Central Committee.

First, substantive progress has been made in reforming the budget management system. We cooperated with the NPC on revising the Budget Law and saw the completion of its revision, and moved faster to revise the regulations on its enforcement. We issued the decision on deepening reform of the budget management system. We formulated the guidelines on carrying out medium-term fiscal planning, and began work on developing a national fiscal plan on a rolling three-year basis. We drew up the proposal on reforming and improving the system of transfer payments from the central to local governments and optimized the structure of payments, cutting the number of items receiving special transfer payments by over one third compared with the previous year and increasing transfer payments to old revolutionary base areas, areas with concentrations of ethnic minorities, and border areas by 12.1%.

Second, systematic steps have been taken to reform the tax system. We further extended the trials to replace business tax with value added tax (VAT) to include, on a national scale, the railway transport, postal, and telecommunications industries. We drew up a plan for the reform of consumption tax and improved related policies. We implemented nationwide reform to levy a price-based resource tax on coal, adjusted the rates of resource tax on crude oil and natural gas, and cleared up and standardized administrative charges and government funds related to coal, crude oil, and natural gas. We cooperated with the work of the NPC on tax-related legislation, including preparatory work on legislation on environmental protection tax, and submitted to the NPC a suggested timetable for work on the implementation of the law-based taxation principle.

Third, with a view to creating a better fit between government powers and spending responsibilities, we made a systematic review of how powers and expenditure responsibilities are allocated in mature market economies, researched into the current allocation of powers and spending responsibilities in sectors including national defense, public security, and food and drug regulation, and achieved initial results in our research on fiscal structural reform.

|

Day|Week

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts Graduation photos of students from Zhongnan University

Graduation photos of students from Zhongnan University A school with only one teacher in deep mountains

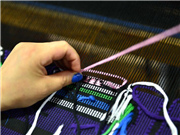

A school with only one teacher in deep mountains Glimpse of cultural heritage "Xilankapu"

Glimpse of cultural heritage "Xilankapu" Homemade cured hams in SW China

Homemade cured hams in SW China Breathtaking buildings of W. Sichuan Plateau

Breathtaking buildings of W. Sichuan Plateau Graduation photos of "legal beauties"

Graduation photos of "legal beauties" Top 10 most expensive restaurants in Beijing in 2015

Top 10 most expensive restaurants in Beijing in 2015