3) Central government tax rebates and transfer payments to local governments

Central government tax rebates and transfer payments to local governments totaled 5.160445 trillion yuan, 99.5% of the budgeted figure and an increase of 7.5%. This figure includes 2.756739 trillion yuan in general transfer payments and 1.894072 trillion yuan in special transfer payments. General transfer payments accounted for 59.3% of total transfer payments, an increase of 2.2 percentage points over 2013.

(1) Budgets for government-managed funds

In 2014, revenue from government-managed funds nationwide came to 5.409338 trillion yuan, and expenditure from these funds amounted to 5.138775 trillion yuan.

Revenue from central government-managed funds totaled 409.751 billion yuan, 98.3% of the budgeted figure and a decrease of 3.3%. Adding the 90.713 billion yuan carried forward from 2013, revenue from central government-managed funds totaled 500.464 billion yuan in 2014. Expenditure from central government-managed funds totaled 431.954 billion yuan, 86.8% of the budgeted figure and an increase of 3.4%. Of this, central government spending was 296.392 billion yuan and transfer payments to local governments amounted to 135.562 billion yuan. A total of 68.51 billion yuan has been carried forward to 2015 from central government-managed funds.

Revenue from funds managed by local governments reached 4.999587 trillion yuan, an increase of 4.1%. This figure includes 4.26059 trillion yuan from the sale of state-owned land-use rights. Adding the 135.562 billion yuan in transfer payments from central government-managed funds, total revenue from local government- managed funds was 5.135149 trillion yuan. Expenditure from local government- managed funds totaled 4.842383 trillion yuan, an increase of 1.4%. This includes 4.120245 trillion yuan of spending from the proceeds of selling state-owned land-use rights.

(2) Budgets for state capital operations

In 2014, budgetary revenue from state capital operations nationwide totaled 202.344 billion yuan, and budgetary expenditure on state capital operations totaled 199.995 billion yuan.

Budgetary revenue from the central government’s state capital operations totaled 141.091 billion yuan, 98.9% of the budgeted figure and an increase of 33.3%. Adding the 15.219 billion yuan carried forward from 2013, total revenue stood at 156.31 billion yuan. Budgetary spending on the central government’s state capital operations came to 141.912 billion yuan, 89.9% of the budgeted figure and an increase of 45.1%. Of this, 18.4 billion yuan, an increase of 183.1%, was brought into the general public budget and spent on social security and other areas related to the people’s quality of life. Surplus budgetary revenue from the central government’s state capital operations, totaling 14.398 billion yuan, was carried over to 2015.

Budgetary revenue from state capital operations of local governments totaled 61.253 billion yuan, and total budgetary spending amounted to 58.083 billion yuan. Surplus budgetary revenue from state capital operations of local governments was carried forward to 2015.

(3) Budgets for social security funds

In 2014, revenue from social security funds nationwide totaled 3.918646 trillion yuan, 104% of the budgeted figure. This includes 2.91041 trillion yuan of insurance premiums and 844.635 billion yuan of government subsidies. Social security fund expenditure totaled 3.366912 trillion yuan nationwide, 103.3% of the budgeted figure. Revenue exceeded expenditure in 2014, leaving a surplus of 551.734 billion yuan, and the year-end balance reached 5.040876 trillion yuan after the surplus in 2014 was rolled over.

In general, fiscal operations were basically steady in 2014 and fresh progress has been made in fiscal reform and development. We owe this to the sound policymaking and firm leadership of the CPC Central Committee and the State Council; to the oversight, guidance, and strong support from the deputies of the NPC and the members of the CPPCC National Committee; and to the joint efforts and hard work of all regions, government departments, and all our people.

At the same time, we are soberly aware of the following difficulties and problems in fiscal operations: Under the current tax system, as our country’s economic growth is slowing down and the PPI is continuously falling, the rate of growth in government revenue has also been falling significantly, indicating a clear trend towards moderate to slow growth, and non-tax revenue has been accounting for too big a share of the total revenue. Government expenditure continues to rise, and the structure of expenditure is becoming increasingly rigid. Some spending policies are fragmentary; and the design of our institutions still leaves room for improvement. Without deeper reform, spending would be impossible to sustain, thus placing enormous pressure on public finance in the medium to long term. All kinds of risks that were previously hidden are beginning to show. Although the risks of local government debt can, on the whole, be controlled, the task of defusing them is a formidable one. As a stream of measures to reform the fiscal and tax systems are being introduced, traditional thinking and routine practices are coming to clash with the new demands of reform, which makes it difficult to implement reform measures. As well as this, people’s awareness of the importance of financial discipline is somewhat faint, and economic and financial laws and regulations are not strictly observed. During the implementation of budgets, problems such as the erosion, leakage, and fraudulent use of funds are not uncommon, meaning there is still a need to improve the standardization, security, and effectiveness of the use of funds. We view these problems as extremely important and will take effective measures to resolve them.

|  |

Day|Week

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts Graduation photos of students from Zhongnan University

Graduation photos of students from Zhongnan University A school with only one teacher in deep mountains

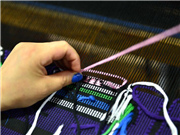

A school with only one teacher in deep mountains Glimpse of cultural heritage "Xilankapu"

Glimpse of cultural heritage "Xilankapu" Homemade cured hams in SW China

Homemade cured hams in SW China Breathtaking buildings of W. Sichuan Plateau

Breathtaking buildings of W. Sichuan Plateau Graduation photos of "legal beauties"

Graduation photos of "legal beauties" Top 10 most expensive restaurants in Beijing in 2015

Top 10 most expensive restaurants in Beijing in 2015