2. Revenue projections and expenditure appropriations for 2015

(1) General public budgets

Revenue in the central government’s general public budget is projected to reach 6.923 trillion yuan, up 7% over the actual figure for 2014. Adding the 100 billion yuan from the Central Budget Stabilization Fund, revenue in 2015 should amount to 7.023 trillion yuan. Expenditure from the central government’s general public budget is projected to reach 8.143 trillion yuan, an increase of 9.5% (up 8.8% after deducting the reserve funds). This consists of 2.5012 trillion yuan spent at the central level, 5.5918 trillion yuan paid out as tax rebates and transfer payments to local governments, and 50 billion yuan of reserve funds for the central budget. Total expenditure is projected to exceed total revenue, leaving a deficit of 1.12 trillion yuan, an increase of 170 billion yuan on 2014. The ceiling for the outstanding balance of government bonds in the central budget will be 11.190835 trillion yuan. The Central Budget Stabilization Fund will have a balance of 34.115 billion yuan.

The revenue in local governments’ general public budgets is projected to total 8.507 trillion yuan, up 7.5%. Adding the 5.5918 trillion yuan in tax rebates and transfer payments from the central government, the revenue of local governments is expected to reach 14.0988 trillion yuan. Local government expenditure from their general public budgets is projected to total 14.5988 trillion yuan, up 10.2%. The projected local government deficit thus stands at 500 billion yuan, an increase of 100 billion yuan over last year’s budgeted figure. The State Council has given its approval for this deficit to be made up by the issuance of general bonds by local governments. It should be noted that as the budgets of local governments are prepared by local people’s governments and submitted for approval to the people’s congresses at their respective levels, related data is, at this time, still being collected. The revenue and expenditure figures for local budgets that appear above have been compiled by the central finance authorities.

The above figures on budgeted revenue and expenditure for 2015 already take into account the figures from government-managed fund budgets that are incorporated into general public budgets. This refers to the following: in accordance with the plan on improving the government budgeting system, which was approved by the State Council, as of January 1, 2015, the revenue and expenditures of eleven government-managed funds, such as local education surcharge, are to be transferred into general public budgets. While this means reductions to the budgetary revenue and expenditure for government-managed funds, the estimated figures on revenue and expenditure for the general public government budgets in 2015 and the base figures for revenue and expenditure in 2014 have been increased accordingly so that there will be little impact on the increase for projected revenue and expenditure in general government budgets for 2015.

Combining the central and local general public budgets, it is projected that national revenue will amount to 15.43 trillion yuan, up 7.3%. Including the 100 billion yuan from the Central Budget Stabilization Fund, total revenue available is expected to reach 15.53 trillion yuan. National expenditure is budgeted at 17.15 trillion yuan, up 10.6%. This will produce a national deficit of 1.62 trillion yuan, an increase of 270 billion yuan over 2014.

The projected figure for total expenditure in the central budget for 2015 is 8.143 trillion yuan, up 9.5% (an increase of 8.8% after deducting the reserve funds), to which a further 112.4 billion yuan is to be added in funds carried forward from previous years. The total expenditure in the central budget is divided into spending by the central government, spending on tax rebates, and transfer payments made to local governments.

Central government spending in 2015 is projected to total 2.5012 trillion yuan, up 10.4%, to which a further 27.9 billion yuan is to be added in funds carried over from previous years. The main expenditure items are arranged as follows:

-The appropriation for agriculture, forestry, and water conservancy is 66.062 billion yuan, up 18.6%.

-The appropriation for social security and employment is 72.93 billion yuan, up 4.2%.

-The appropriation for education is 135.151 billion yuan (including 6 billion yuan carried forward from previous years), up 8.8%.

-The appropriation for science and technology is 275.725 billion yuan (including 17 billion yuan carried forward from previous years), up 12.3%.

-The appropriation for culture, sports, and the media is 24.921 billion yuan, up 6.4%.

-The appropriation for medical and health care and family planning is 11.019 billion yuan, up 22.1%.

-The appropriation for energy conservation and environmental protection is 29.125 billion yuan.

-The appropriation for transport is 80.689 billion yuan.

-The appropriation for stockpiling grain, edible oils, and other materials is 154.638 billion yuan, up 33.2%. This is mainly due to the increases in the subsidies to help pay expenses and interest on loans used for stockpiling grain and edible oils, subsidies for price differences in stockpiling grain and edible oils, and subsidies for making up losses in auctioning stockpiled cotton.

-The appropriation for national defense is 886.898 billion yuan, up 10.1%.

-The appropriation for public security is 154.192 billion yuan, up 4.3%.

-The appropriation for general public services is 100.491 billion yuan.

-The appropriation for natural resource exploration and information technology is 29.684 billion yuan.

-A total of 4.9 billion yuan which has been carried forward from previous years is to be used for standardizing allowances and subsidies for public servants and implementing performance-based pay for the employees of public institutions.

Central government tax rebates and transfer payments made to local governments will amount to 5.5918 trillion yuan in 2015, up 8.1%, to which a further 84.5 billion yuan is to be added in funds carried over from previous years.

|  |

Day|Week

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts Graduation photos of students from Zhongnan University

Graduation photos of students from Zhongnan University A school with only one teacher in deep mountains

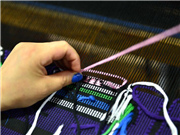

A school with only one teacher in deep mountains Glimpse of cultural heritage "Xilankapu"

Glimpse of cultural heritage "Xilankapu" Homemade cured hams in SW China

Homemade cured hams in SW China Breathtaking buildings of W. Sichuan Plateau

Breathtaking buildings of W. Sichuan Plateau Graduation photos of "legal beauties"

Graduation photos of "legal beauties" Top 10 most expensive restaurants in Beijing in 2015

Top 10 most expensive restaurants in Beijing in 2015