5. Strengthening management of local government debt

We will fully implement the guidelines for strengthening the management of local government debt, and strictly forestall and control fiscal risks.

First, we will establish a standardized mechanism for debt financing by local governments, which combines both general debt and special debt. The central government will allocate quotas for general and special debt to local governments principally on the basis of calculation of objective factors, such as their financial resources. We will improve the market-based pricing mechanism for local government bonds, have the market play a more significant role in regulating local government debt, protect the rights and interests of investors, and stabilize market confidence.

Second, we will establish sound mechanisms for debt management. We will impose ceilings for local government debt, which must not be exceeded. We will place local government debt under budgetary management for general public finance and government-managed funds, based on the type of debt. We will establish mechanisms for risk assessment and early warning about risks related to local government debt, and give early warning to regions where high risk is detected. We will provide guidance for and urge local governments to set up mechanisms for dealing with urgent matters concerning debt risks, and formulate contingency plans for the handling of such matters. We will introduce a system for releasing information on local government debt, and make regular public disclosures. We will move quickly to develop a system for comprehensive government financial reporting based on accrual accounting, formulate the rules for preparing the government’s comprehensive financial reports and the guidelines for their operation, and lay down the basic principles of government accounting.

Third, we will make appropriate arrangements for handling outstanding debts and follow-up financing for on-going projects. Outstanding debts which have been reviewed and approved through statutory procedures will be placed under budgetary management, based on the type of debt. Local governments need to raise funds through multiple channels, and repay maturing debts on time. At the same time, a reasonable grace period will be set, during which part of the follow-up financing may be settled through bank loans within the limit set for on-going projects to avoid any break in the chain of funding and prevent fiscal and financial risks. Replacement is allowed as appropriate for those outstanding local government debts which have been brought under budgetary management after having been screened to lower the burden on local governments of paying more interest, improve the mix of debt maturities, and make more funds available for key projects.

6. Tightening up financial discipline

Building on past achievements in tightening up financial discipline and eliminating unauthorized departmental coffers, we will continue to take a strong stance in fields where violations of financial discipline and law are prone to occur or occur frequently, or where there are sensitive issues involved; regularly carry out inspections to check for strict compliance with financial discipline; and firmly prevent violations of financial discipline and law from re-emerging once dealt with.

We will increase transparency of information on policies. We will ensure that operation guidelines are issued for every special-purpose fund and that these guidelines are released to the public, so that the operation of government funds is transparent. We will intensify oversight over government funds, especially funds that are of particular significance to people’s wellbeing, and tighten oversight through auditing.

We will move more quickly to set up systems and mechanisms for internal control of finance departments. We will ensure that, in important fields and key positions within which power over the allocation or use of government funds, or powers related to government procurement are concentrated, the way power is exercised is determined on the basis of the matter in question, the way power is arranged is determined on the basis of the position in question, and the way power is delegated is determined on the basis of the level of government in question. We will use the redesigning of procedures and information technology to strengthen the prevention of risk in fiscal activities and management, the control of such risks when they do arise, and oversight and remedies after risks have been brought under control. We will effectively prevent risk in every type of fiscal activity as well as any risk that might pose a threat to keeping government clean.

Fellow Deputies,

The successful implementation of the 2015 budgets is of vital importance. Under the leadership of the CPC Central Committee with Comrade Xi Jinping as General Secretary, we will follow the guidance of Deng Xiaoping Theory, the important thought of Three Represents, and the Scientific Outlook on Development, willingly accept the oversight of the NPC, and seek comments and suggestions from the CPPCC National Committee with an open mind. We will devote ourselves to reform, work with diligence, strive to successfully implement this year’s budgets and complete our work on fiscal reform and development, and contribute to promoting steady, healthy economic development and social harmony and stability.

|

Day|Week

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts Graduation photos of students from Zhongnan University

Graduation photos of students from Zhongnan University A school with only one teacher in deep mountains

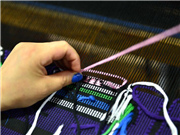

A school with only one teacher in deep mountains Glimpse of cultural heritage "Xilankapu"

Glimpse of cultural heritage "Xilankapu" Homemade cured hams in SW China

Homemade cured hams in SW China Breathtaking buildings of W. Sichuan Plateau

Breathtaking buildings of W. Sichuan Plateau Graduation photos of "legal beauties"

Graduation photos of "legal beauties" Top 10 most expensive restaurants in Beijing in 2015

Top 10 most expensive restaurants in Beijing in 2015