II. Central and Local Draft Budgets for 2015

The year 2015 will be crucial to the comprehensive deepening of reform; it is the first year for comprehensively advancing the law-based governance of China and the final year for completing the Twelfth Five-Year Plan. When it comes to carrying out the policies and plans of the CPC Central Committee and the State Council, and modernizing our nation’s governance system and capacity for governance, it is of great significance that the budgets for 2015 are well formulated, and that we go further in giving proper expression to the role of public finance.

In 2015, the domestic and international economic situation will remain complicated. With the impact of growing downward pressure on the economy, further structural adjustments, all-round reform, and the slowdown in the growth of government revenue, the imbalance in government revenue and expenditure this year will be more notable. In light of the fiscal and economic situation that we face, in carrying out public finance work and preparing the budgets for 2015, we need to fully put into practice the guiding principles of the 18th National Congress of the CPC, the third and fourth plenary sessions of its 18th Central Committee, and the Central Economic Work Conference; act in the spirit of General Secretary Xi Jinping’s major speeches and, on the basis of the decisions and plans of the CPC Central Committee and the State Council, persevere with seeking progress while keeping performance stable and with carrying out reforms and innovations. We need to continue to implement proactive fiscal policy and, to an appropriate extent, step up the intensity, giving full scope to the important role of fiscal and tax policies in stabilizing growth, advancing structural adjustment, and promoting reform. We need to deepen reform of the fiscal and tax systems, thoroughly put into effect the new Budget Law and the decision of the State Council on deepening reform of the budget management system, improve regulations on budgetary management, and make our budgets more open and transparent. We need to improve the government budgeting system and increase the coordination between budgets. We need to make good use of both available and additional funds, and optimize the structure of budgetary expenditures, ensuring spending in some areas while cutting it in others so that spending in key areas, especially areas relating to the people’s quality of life, is guaranteed while general expenditures are brought under tight control. We must enforce strict financial discipline. We must strengthen management of local government debt, be on our guard against fiscal risks, and give impetus to steady, sound economic development and social harmony and stability.

The new Budget Law comes into effect in 2015, thus the requirements of that law must be strictly complied with in preparing the central and local government budgets for this year.

First, key items in the budgets that, according to the stipulations of the new Budget Law, are subject to examination and approval by people’s congresses, need to be reported in detail, including the implementation of the previous year’s budgets, arrangements for this year’s budgets, government debt, and transfer payments.

Second, the emphasis must be on reporting on budgeted expenditure and fiscal policies so as to actively invite oversight.

Third, available funds need to be put to good use. The central and local governments will go further to sort out carryover and surplus funds, keep newly added carryover and surplus funds under strict control, and make use of recovered funds in key areas of economic and social development.

Fourth, efforts to carry out overall planning for budgets need to be intensified. Revenue and expenditure from local educational surcharge and ten other funds will be transferred from government-managed funds budgets to general public budgets. And the proportion of funds to be transferred from the budgets for state capital operations to the general public budgets will be further increased.

Fifth, budgets need to be made more detailed. Budgets for basic expenditures at the central level and for central government departments in the draft budgets need to be detailed down to the specific economic category. On the basis of having itemized budgets for transfer payments by project, such budgets also need to be detailed to specific regions. The overall size of budgets compiled by finance departments for other departments and projects will be further cut back, and we will make more funds for budgetary items available at the start of the year.

Sixth, we need to make progress across the board in releasing budgets. With the exception of cases in which classified information is involved, any department that receives government appropriations must make its budgets open to the public.

|  |

Day|Week

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts Graduation photos of students from Zhongnan University

Graduation photos of students from Zhongnan University A school with only one teacher in deep mountains

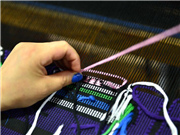

A school with only one teacher in deep mountains Glimpse of cultural heritage "Xilankapu"

Glimpse of cultural heritage "Xilankapu" Homemade cured hams in SW China

Homemade cured hams in SW China Breathtaking buildings of W. Sichuan Plateau

Breathtaking buildings of W. Sichuan Plateau Graduation photos of "legal beauties"

Graduation photos of "legal beauties" Top 10 most expensive restaurants in Beijing in 2015

Top 10 most expensive restaurants in Beijing in 2015