Tightened regulation, slowing user growth play a role

Photo: Global Times

On the surface, China's video game obsession appears as feverish as ever as mobile gamers remain glued to their phones, virtual reality (VR) technology grabs headlines, and game-themed movies like last year's Ready Player One harvest handsome box office earnings. However, a closer look reveals China's gaming industry is feeling the pinch as it can no longer rely on an exploding domestic user base to bring growth.

To the delight of domestic game publishers, the Publicity Department of the Communist Party of China (CPC) Central Committee, which regulates the licenses for video games, ended a freeze on new video game releases last December. The freeze began in March 2018 amid growing criticism that video games were too addictive and violent for young players.

Domestic news site thepaper.cn reported on Wednesday that a relevant official confirmed the regulator had asked local authorities to stop submitting applications as it was "making adjustments."

In China, game companies must file applications to local authorities for approval from the Publicity Department of the CPC Central Committee. The completion of this process means the companies can monetize their new titles through means such as in-game purchases.

A high-level executive from a gaming firm, which has gained approval of new titles since the issuance resumed, said a backlog of at least 4,000 to 5,000 games are awaiting approval now. "It won't be until August or September at the soonest that the backlog is issued," the anonymous executive was quoted as saying in a report by Caixin Weekly on February 18.

The executive said new applicants at the beginning of this year are likely to have to wait until 2020.

Chinese regulator approved 1,982 domestic and overseas online games during the January-March period last year before the freeze, official data from the website of the State Administration of Press, Publication, Radio, Film and Television showed. That came after approving a total of 9,651 domestic and overseas online games in 2017.

Under a cloud

The freeze on new title approvals has brought huge pressure to industry leaders like Tencent Holdings and NetEase Inc as well as the future development of the entire industry.

Two Tencent games - Folding Fan and Wooden Connection, both of which fall into the category of "functional games of an educational nature" - were green lit last December as part of the first group of titles approved.

In addition to Chinese game companies like Tencent and Perfect World, South Korean companies including Nexon and Netmarble and Japanese companies like Capcom and Square Enix all saw their shares surge following the December announcement.

However, the Shenzhen-based internet giant is still waiting for licenses for some of its most popular games, such as PlayerUnknown's Battlegrounds (PUBG), a survival shooter game developed by South Korean firm Bluehole.

Tencent claimed the rights to distribute the game in China in 2017, putting it on par with rival NetEase. But the game has not been granted a license so far, which means the company can publish a trial version of the game but cannot make money from it.

NetEase's Knives Out gained 100 million users within one month after its launch in November 2017, the same month it obtained its license.

Data from third-party platform Quest Mobile showed that the daily active user (DAU) of its two trial versions of PUBG - PUBG Exhilarating Battlefield and PUBG Army Attack have soared to 43.09 million and 5.84 million, respectively, as of September 2018.

According to the Caixin Weekly report, two industry insiders said the suspended approval for PUBG is likely due to relations between China and South Korea, which have soured since the South Korean government allowed the US to install the Terminal High Altitude Area Defense anti-missile system on South Korean soil, despite a warming trend between the two countries in the second half of last year.

Problems within the domestic online gaming industry include a lack of originality, culture, and social responsibility, as well as a misdirection of values, said Feng Shixin, vice director of the Publicity Department of the CPC Central Committee's copyright bureau, in a meeting last December.

Also in December, China established an assessment committee to ensure online games will meet a certain code of ethics to provide the public with healthy entertainment products and protect adolescents from the negative impact of online gaming.

A veteran industry watcher surnamed Jia told the Global Times on Friday that the business value of video games should not be neglected amid the restrictions on the sector.

"A balance should be struck here," Jia said.

"Some advanced technologies and facilities can be born out of the gaming sector, which will become a new driver of economic and technological development," he noted.

For Tencent, the company's determination to bet on PUBG has not been shaken. Ma Xiaoyi, senior vice president of Tencent, who is also responsible for international publishing of Tencent Games, told Caixin Weekly that the company has no idea of giving up on PUBG's approval.

Based on statistics provided by app market data provider App Annie, survival shooter games like PUBG often rank in the top three in terms of game app downloads in big gaming markets such as China, the US, Japan and South Korea.

Seeking survival

China surpassed the US and Japan in terms of gaming revenues in 2016, becoming the world's largest gaming market, according to Dutch industry tracker Newzoo.

China is estimated to remain as the largest gaming market in 2018 with 620 million gamers, who could contribute a total of $37.9 billion in revenue with more than 60 percent coming from mobile games, according to a Newzoo survey released in mid-2018.

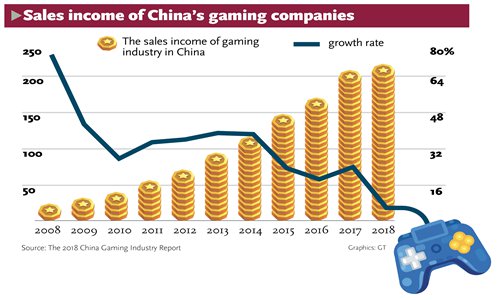

The booming industry, however, was met with slowing growth last year, according to the 2018 China Gaming Industry Report jointly launched by Beijing-based research firm CNG and the Game Publishers Association Publications Committee (GPC) of China Audio-video and Digital Publishing Association.

The dividends from a growing user base are clearly decreasing. Chinese mobile users maintained single-digit growth in 2017 and 2018, while the year-on-year growth rate had recorded nearly 250 percent back in 2013. Meanwhile, the average revenue per paying user was 221.4 yuan ($32.99) in 2018, merely 6 percent increase on a yearly basis, the lowest since 2014, said the industry report.

Amid a 24-percent yearly increase in revenue to 80.6 billion yuan and a 30-percent year-on-year raise in profits to 23.3 billion yuan, Tencent, China's biggest gaming and social media group, still cannot hide the decline in its gaming business.

Revenue generated by Tencent's smartphone games grew 7 percent year-on-year to 19.5 billion yuan, mainly due to contributions from its new games, yet it was the first time the growth figure dropped below 10 percent.

Revenue from Tencent's games, including smartphone and PC ends, accounted for less than 33 percent in the third quarter, compared with 64 percent in the first quarter.

Domestic industry players have to adjust to the "new normal" of growth for market size and user scale.

Beijing-based investment banking firm CICC lowered its expectations for the domestic mobile game market in 2019 and 2020 with estimated revenues of 153.7 billion yuan and 174.9 billion yuan, respectively, and a growth rate of 15 percent and 14 percent.

The tightening of regulation and ebbing of a profit-making period that has relied on dramatic user growth have both impacted the domestic gaming sector, leaving only the industry's leaders to make money.

According to recent research released by CICC, of 25 games that generated more than 500 million yuan per month between 2014 and 2018, only six belonged to non-leading game firms, while 12 games were from Tencent and seven games came from NetEase.

Wang Xu, co-founder and chief analyst of the CNG, said it is difficult for small game firms to compete with leading companies in terms of R&D talent, funding and other factors. However, the industry has not entered a monopoly phase, he stressed.

The previously quoted high-level executive noted that small players struggling at the bottom of the industry find it hard to survive, since previously they could earn money based on various approved titles, but now, with the slower approval process, the financial pressure will be hard for them to sustain.

Fire brigade in Shanghai holds group wedding

Fire brigade in Shanghai holds group wedding Tourists enjoy ice sculptures in Datan Town, north China

Tourists enjoy ice sculptures in Datan Town, north China Sunset scenery of Dayan Pagoda in Xi'an

Sunset scenery of Dayan Pagoda in Xi'an Tourists have fun at scenic spot in Nanlong Town, NW China

Tourists have fun at scenic spot in Nanlong Town, NW China Harbin attracts tourists by making best use of ice in winter

Harbin attracts tourists by making best use of ice in winter In pics: FIS Alpine Ski Women's World Cup Slalom

In pics: FIS Alpine Ski Women's World Cup Slalom Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa

Black-necked cranes rest at reservoir in Lhunzhub County, Lhasa China's FAST telescope will be available to foreign scientists in April

China's FAST telescope will be available to foreign scientists in April "She power" plays indispensable role in poverty alleviation

"She power" plays indispensable role in poverty alleviation Top 10 world news events of People's Daily in 2020

Top 10 world news events of People's Daily in 2020 Top 10 China news events of People's Daily in 2020

Top 10 China news events of People's Daily in 2020 Top 10 media buzzwords of 2020

Top 10 media buzzwords of 2020 Year-ender:10 major tourism stories of 2020

Year-ender:10 major tourism stories of 2020 No interference in Venezuelan issues

No interference in Venezuelan issues

Biz prepares for trade spat

Biz prepares for trade spat

Broadcasting Continent

Broadcasting Continent Australia wins Chinese CEOs as US loses

Australia wins Chinese CEOs as US loses