BEIJING, July 7 -- Foreign businesses in China should put their victim mentality to rest for good and embrace new rules set to protect their own interests in order not to miss the boat as the Chinese economy matures.

Multinational companies were reportedly given the "jitters" after Chinese lawmakers adopted a new national security law which expands China's legal reach to almost every aspect of public life.

In particular, the new law stipulated a review system to reinforce the country's ability to examine incoming foreign investments for national security threats.

The law is again seen by some as a sign of a worsening business climate in China, with fears that such a move could bring uncertainty to future investments in the world's second-largest economy.

But multinational firms in China should realize that the new law is not intended to target overseas investors' legitimate operations nor to block much-needed inbound foreign investment, but to safeguard national security.

After all, security is the cornerstone for countries' development. An insecure China -- a country with 1.3 billion people and the top trading partner for more than 130 countries -- is bad news for all.

Foreign businesses need to stop seeing themselves as victims of a rule that sets out to protect their interests in the first place by trying to create a more law-based business environment.

National security reviews are a long-standing practice both in China and worldwide.

China's Foreign Trade Law, which came into force in 1994, stipulated that the country could restrict or prohibit imports and exports of goods and technology for the sake of safeguarding national security.

A Foreign Investment and National Security Act, effective in the United Statessince 2007, also provided for intensified security checks over foreign investment in key infrastructure projects and the high-tech industry.

Singling out China's national security review rules while turning a blind eye to similar practices overseas is simply off the mark.

Nevertheless, multinational companies have been increasingly grumpy about a perceived deterioration of China's business environment, especially in the wake of rising operating costs in the country.

For decades, foreign investors have reaped handsome profits from one of the world's fastest-growing economies while sitting on cheap labor, generous consumers and a "super national treatment" that includes hefty and exclusive tax breaks.

These have prompted many to feel entitled to favorable policies while on Chinese soil, and to play the victim card in order to continue to press for advantageous accommodations in the face of rising labor costs and when authorities try to treat them as the equals of domestic firms.

But it is only logical that when the economy grows, so do labor costs. In addition, as China continues to adjust its market economy, equal treatment for domestic and foreign firms has become an irreversible trend. The lenient policies of yesterday have worn out their usefulness, and foreign companies should keep that in mind.

Foreign investment is still much needed in today's China as its economy enters a "new normal" of plateauing growth. The Chinese economy in 2014 grew 7.4 percent, the weakest annual expansion in 24 years. The government has further lowered this year's growth target to approximately 7 percent.

Authorities have long vowed to change the country's economic structure, led by exports and massive state-directed investments, into one more responsive to the growing needs of a consumer-driven society.

Financial input from overseas and expertise in the process will be welcome, and the restructuring also means new business opportunities for foreign firms.

But they should first abandon their victim complex and learn to adapt to the new norms in order to continue to thrive.

Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Hong Kong college students feel the charm of Hanfu

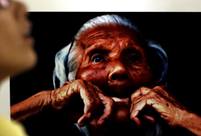

Hong Kong college students feel the charm of Hanfu Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Odd news:“carrying a rod and asking to be spanked”

Odd news:“carrying a rod and asking to be spanked” Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Hong Kong in lens

Hong Kong in lens Can China play a role in Greek debt crisis?

Can China play a role in Greek debt crisis?  Dogs in uniform: China’s combat canines

Dogs in uniform: China’s combat canines Cut for China

Cut for China Market reacts to govt support

Market reacts to govt support Day|Week