Overseas-listed firms face tougher domestic market upon return

A total of 28 companies which had already received approval from the China Securities Regulatory Commission (CSRC) for IPO decided to postpone their listings on the Shanghai and Shenzhen bourses, citing recent market fluctuations, according to separate filings to the exchanges over the weekend.

Experts said on Monday that the market situation also makes it more difficult for overseas-listed Chinese firms to turn back to the A-share market, making them more worried about future valuations in the A-share market.

It is estimated that the 28 planned IPOs could have raised about 13.4 billion yuan ($2.16 billion), according to media reports.

Analysts say the suspension of the IPOs shows Chinese authorities are determined to stabilize the market.

However, a securities affairs representative at Zhengzhou-based Henan Thinker Automatic Equipment Co, who only gave his surname as Wang, differed.

"The impact is not as big as the public has imagined, since the amount of money absorbed by new shares is tiny compared with the combined A-share market capitalization," he said. Wang's employer is among the 28 companies which postponed their IPOs and had originally planned to raise 1.34 billion yuan, according to its prospectus.

Wang said the suspension of the IPOs upset his company's financing plan, adversely affecting its business expansion plans.

But he also admitted that the good thing is that his company can avoid an obviously low valuation by postponing the IPO.

Wang noted that future valuation in the A-share market is the biggest concern of his company, as "the market has been weakening recently."

Future valuation is also a concern of some overseas-listed Chinese firms which have plans for floating on the A-share market after going private.

"Quite a number of overseas-listed Chinese firms are considering to return to China's A-share market due to high valuations here," Tony Hung, senior investor relations director at E-Commerce China Dangdang Inc, a Chinese company listed on New York Stock Exchange, told the Global Times on Monday.

Hung noted that the suspension of IPOs will affect such firms, but companies that have began the privatization will still go ahead.

"Listing on the A-share market is going to take overseas-listed Chinese firms at least three years even if there is no suspension of IPOs, due to the lengthy procedures of delisting overseas and the long waiting time for approval from China's securities regulator, " he said. "IPOs will have restarted three years later."

"Future valuations in the A-share market is the biggest concern of these companies," Hung said.

The Shanghai Composite Index has dropped by nearly 30 percent since June 12. More than 1,000 stocks on the A-share market has dropped by over 50 percent from their peak before the current slump began, the Beijing News reported on Saturday.

Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Hong Kong college students feel the charm of Hanfu

Hong Kong college students feel the charm of Hanfu Japan’s crimes committed against "comfort women"

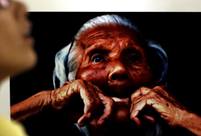

Japan’s crimes committed against "comfort women" Odd news:“carrying a rod and asking to be spanked”

Odd news:“carrying a rod and asking to be spanked” Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Hong Kong in lens

Hong Kong in lens Editorial: An uncertain road ahead for Greece and EU

Editorial: An uncertain road ahead for Greece and EU China’s class of 2015 gets creative with graduation photos

China’s class of 2015 gets creative with graduation photos Girl power on the pitch

Girl power on the pitch Giant panda Yuanzai turns two at Taipei Zoo

Giant panda Yuanzai turns two at Taipei ZooDay|Week