Of the 74 surveyed Chinese enterprises that have invested in the EU, 97 percent indicated that they would make future and additional investments in the EU, with the vast majority of them planning higher outlays, the study says.

Lending further credence to the survey findings were figures published by the National Development and Reform Commission in December, indicating that 11 of the newly approved outbound investment projects were in Europe.

Zoje Europe GmbH, the fully owned unit of Zoje Sewing Machine Co, a sewing machine company in East China's Zhejiang province, has recently completed two major acquisitions in Germany and is considering another.

The company plans to buy the German industrial sewing machine maker Pfaff Industrial to hone its technological strengths, says Chen Yongwu, general manager of Zoje Europe GmbH. If the purchase is successful, Zoje will hold more than 15 percent of the global sewing machine market, and become the world's second largest sewing machine company.

"We expect the Chinese investment wave in Germany to continue for the next five to 10 years," Chen says.

According to Germany Trade and Invest, the official investment promotion agency of Germany, investments from China accounted for 18 percent of the total investments last year. It is estimated that Chinese companies invested $1.47 billion in Germany last year, almost equal to Germany's investments in China.

"Germany is located in the center of Europe. Chinese companies can enter the European market easily by using the 'Made in Germany' tag. We expect to attract more Chinese investment this year," says Benno Bunse, chairman of Germany Trade and Invest.

Investment rationale

However, Cucino of the EU chamber says that revenue is not the only factor that is propelling Chinese companies to Europe.

"The foremost reason why Chinese companies want to invest in the EU is of course the European entry point for their products. However, they are not in Europe just for the European market, but also to bring back products to China and even export products to other countries."

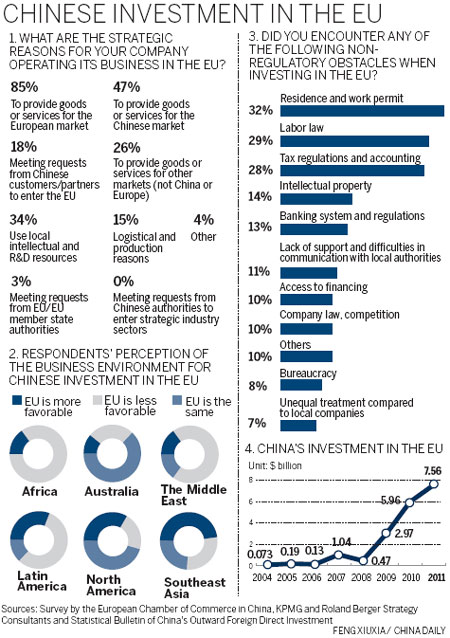

In the EU chamber study, 85 percent of the respondents said their main reason for investing in the EU was to gain market access for their products in Europe and to provide goods and services within the EU market.

But "in Europe, for Europe" is not the only purpose, experts say.

Coco Ke Liu, head of business channel development at HLB International, a global network of independent professional accounting firms, says that while some Chinese businesses are investing in Europe to serve the European market, some are also investing here to acquire technologies and brands, which are important resources for success both in the Chinese market and abroad.

![]()