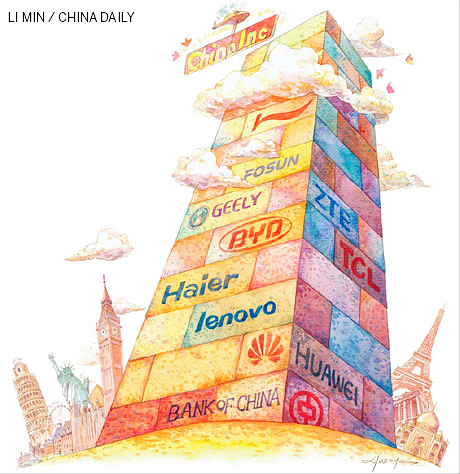

Private Chinese companies are an emerging force in the global investment market.

The Makings of a Global Phenomenon

China's overseas investment has become a global phenomenon. It can be classified into three categories: financial investment by the state, private investment by wealthy individuals and private-equity firms and the advance of SOEs.

Although SOEs' share in China's overseas investment has fallen in recent years, they remain the major force of China's ODI.

China's central SOEs currently account for more than two-thirds of China's total ODI, said Wang Tianlong, a researcher at China Center for International Economic Exchanges.

16 out of the top 18 Chinese multinationals with the biggest holdings of foreign assets were large SOEs, according to a survey conducted in 2010 by the Vale Columbia Center, part of Columbia University in the United States.

"Central SOEs have sufficient capital and are most capable of carrying out overseas investment," said Ms. Shi.

"There is a misconception about China's SOEs that should be corrected, which is this: SOE is not the embodiment of the Chinese government. Most SOEs in China have adopted a complete modern corporate system. These enterprises operate on their own, and are fully responsible for their own profits and losses."

Although China's ODI is, to some extent, still a SOEs phenomenon, investment by China's private companies has been on the rise in recent years, especially in mergers and acquisitions (M&A).

The number of M&A deals by private companies has overtaken those by the SOEs for the first time. Official statistics showed that private Chinese enterprises took part in more overseas M&As than their State-owned counterparts did in the past three quarters of this year.

According to a report released in November by the global accounting firm KPMG LLP, in the third quarter, private companies took part in 62.2 percent of the M&A deals that involved Chinese companies, up 50 percent from the first half of the year.

Chinese private investors have been making far more overseas M&A deals in the past four years, with their proportion of the total going from 44 percent to more than 62 percent. At the same time, that of SOEs went from 56 percent to 38 percent, the report said.

By the end of 2011, ODI by private companies accounted for 44 percent of China's total ODI, said Liang Yutang, deputy head of China Minsheng Banking Corp Ltd.

"Private Chinese companies are an emerging force in the overseas investment market," concluded the KPMG report.♦

Read on: Part II: A Source of Warmth amid Economic Chill

Li Zhenyu authors the "Golden Decade" column for People's Daily Online.

Black-headed gulls come to Kunming for winter

Black-headed gulls come to Kunming for winter

![]()