Nearly 40% of top economic cities eye 6% GDP growth for 2024, to play 'dragon head role' in bolstering economy

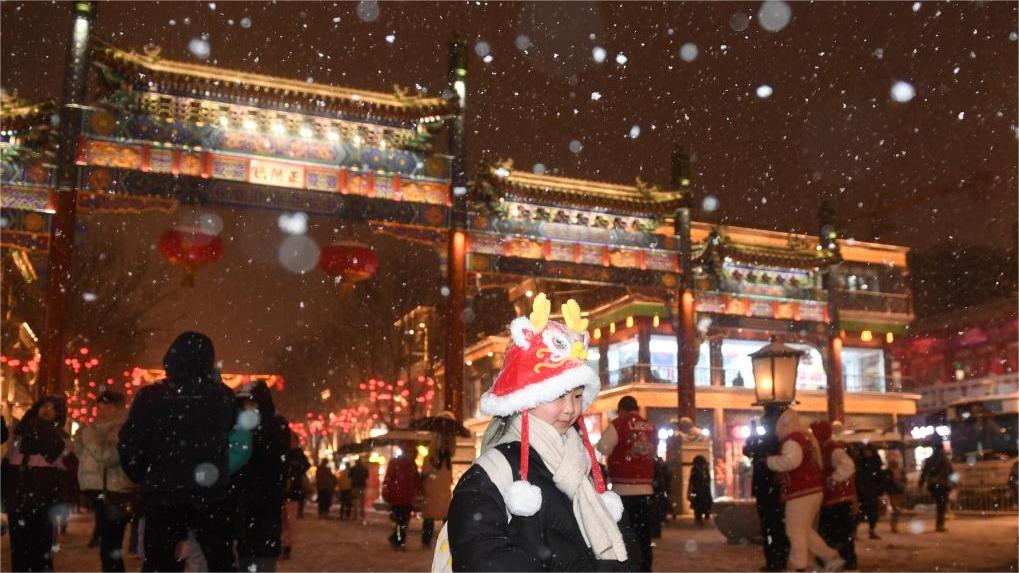

This photo taken on Feb 9, 2024 shows a light show on the eve of Chinese Lunar New Year in southwest China's Chongqing Municipality. Photo: Xinhua

China's first-tier economic heavyweight cities - 26 cities each with a GDP of more than 1 trillion yuan ($139.1 billion) in 2023 - have set their annual GDP targets a notch higher this year as localities conclude their local two sessions.

Analysts said the proactive moves by these cities, which often play a vital driving role in their respective provinces, will encourage other cities within their provinces to strive harder in the pursuit of economic development this year.

These comments follow proactive goal-setting by provinces, with most localities setting GDP targets at about and above 5 percent for 2024.

China should be able to achieve a growth rate of about 5 percent for the year, with the country being one of the fastest-growing major economies in the world, despite hype by Western media outlets that the Chinese economy is in trouble, they noted.

An analysis of the 26 cities, which accounted for 40 percent of China's GDP in 2023, has revealed that they are proactively leaning toward driving up growth in 2024, news outlet yicai.com reported.

A total of 10 cities including Southwest China's Chongqing Municipality and Wuhan, capital of Central China's Hubei Province, have set targets at 6 percent or higher, with Zhengzhou, capital of Central China's Henan Province, announcing a 7-percent-growth target - the fastest growth targets among the 26 cities, according to the analysis of the yicai.com report.

Thirteen cities put their annual targets at rates faster than what they actually achieved in 2023, and all but one set a growth target of above 5 percent.

Dongguan, an export and manufacturing powerhouse in South China's Guangdong Province, whose economy grew 2.6 percent last year in recovering from the pandemic's impact and global supply chain readjustment, aims to nearly double its growth this year with a stated target of 5 percent.

The fact that some key cities are setting higher targets shows that they believe they have the economic potential to grow at a faster rate, given the right policy incentives, and assuming they can fully tap the vigor of market entities, Li Chang'an, a professor at the Academy of China Open Economy Studies of the University of International Business and Economics, told the Global Times on Wednesday.

These higher targets will have a positive spillover effect on other cities, encouraging them to strive further in terms of production, investment and consumption, laying a foundation for the national economy to leap forward, Li noted.

Cao Heping, an economist at Peking University, told the Global Times on Wednesday that with their ability to exert a pull factor on regional and downstream growth, these cities are 26 economic locomotives scattered across China.

"From my field visits to a lot of these places, I could see that some are a bit conservative in their stated goals, given the global economic outlook and geopolitical risks," Cao said. "Seen from this regard, the Chinese economy is poised to achieve stable growth and foster the recovery momentum that was in place in 2023."

Some companies in the information technology sector told me they expect 500 percent annual growth, Cao said.

Analysts noted that localities with abundant new productive forces, with sectors such as new-energy vehicles, are moving faster.

The ambitious growth goals came as more support policies are being implemented to give the economy a needed push.

On Tuesday, the People's Bank of China, the central bank, cut its benchmark mortgage reference rate by 25 basis points(bps), the largest one-time rate reduction in years, in a renewed effort to stimulate credit demand and revive the property market.

The move followed a cut in the reserve requirement ratio, the amount of cash that banks must hold as reserves, of 50 bps from February 5, with approximately 1 trillion yuan of long-term liquidity injected into the market.

Following solid growth of 5.2 percent in the fourth quarter of 2023, the Chinese economy is expected to register slightly better results due to higher vehicle sales, a surge in tourism that started last winter, and stellar consumption during the Spring Festival holidays.

"The better-than-expected situation should underpin a first-quarter year-on-year GDP growth rate of 5.4 percent or higher," Cao predicted.

As the internal impetus of economic development continues to be bolstered, and transformation and upgrades are advanced solidly, the aggregate force of positivity in the economy stands to offset areas that are negatively affected in 2024, and this means the country's annual growth is well on track to meet its target, if it is set at about 5 percent, Cao said.

The two experts predicted that the central government will set this year's growth target at above 5 percent.

John Ross, a senior fellow at Chongyang Institute for Financial Studies, Renmin University of China, noted in an opinion piece published on news portal guancha.cn on Wednesday that China's economy is growing much faster than Western major economies, and attempts to suggest otherwise are falsehoods and politically motivated.

Ross, however, noted the issue of weak industrial profitability needs to be addressed.

A target for overall GDP growth in 2024 is expected to be released at the annual two sessions in March.

Photos

Related Stories

- Commentary: Spring Festival spending highlights momentum of China's economy

- China ready to unleash growth potential

- Chinese Numbers: China kicks off Year of the Loong with robust Spring Festival holiday statistics

- China implements biggest LPR cut on record

- Explainer: What do "new productive forces" mean?

- China's economy booming during Spring Festival holiday

Copyright © 2024 People's Daily Online. All Rights Reserved.