Tax, fee cuts to better shore up biz recovery

Revenue reports reflect confidence in achieving growth target of this year

China's tax and fee cuts and related preferential policies have grown more targeted and tailor-made this year to better boost the economy with a steady and strong recovery by unleashing business vitality, officials and experts said.

Their comments came as Wang Daoshu, deputy head of the State Taxation Administration, said at a news conference on Thursday that China is expected to reduce tax and fee charges for businesses by 1.8 trillion yuan ($261.62 billion) this year via preferential tax policies and tax credit refunds.

Wang said tax and fee cuts are a key part of a proactive fiscal policy. Since the beginning of this year, the Ministry of Finance and the STA announced the extension and improvisation for existing preferential tax and fee policies, which are expected to reduce business tax and fee payments by another 1.2 trillion yuan.

China has recently extended some preferential tax breaks for low-profit small enterprises and self-employed individuals and continued pretax deductions for research and development expenses of enterprises.

"The policies are conducive to further stabilizing businesses' expectations and bolstering their confidence," said Li Xuhong, a professor at the Beijing National Accounting Institute.

Li said this year's preferential tax and fee policies reflect macro policy continuity, as they are well adapted to the country's counter-cyclical economic policy adjustment and help the sustainable development of market players, precisely focusing on high-quality growth, energizing innovation and modernization.

"With steady continuity, these policies will fully stimulate the market's vitality, promote economic and social development, stabilize employment and protect people's livelihoods," she said.

Wang Jun, Party secretary and commissioner of the STA, said at the news conference that a raft of tax revenue figures across the first quarter indicates that the economy has widely bounced back.

Noting that tax revenue is the barometer for economic recovery and business performance, Wang said that tax revenue figures have shown that the growth pace for businesses' sales revenue has been gradually picking up and the market is regaining confidence toward production and business operations.

According to the STA, sales revenue from enterprises increased 4.7 percent year-on-year in the first quarter. Consumption registered a remarkable growth rate, with retail sales revenue up 11.6 percent annually.

Specifically, in March, the sales revenue of industrial enterprises grew 7 percent year-on-year. Property sector is seen recovering steadily, with consumption of real estate up 17.9 percent year-on-year.

Tax revenues are expected to show faster growth in the second quarter thanks to a low base last year and the concentration of significant tax credit rebates in the second quarter, said Cai Zili, chief auditor of the STA, during the news conference.

Noting that the economy still faces many uncertainties at home and abroad, Wang, the commissioner, said he is confident that this year's growth target of around 5 percent will be achieved, but with arduous efforts.

Photos

Related Stories

- China extends, improves tax relief policies for businesses

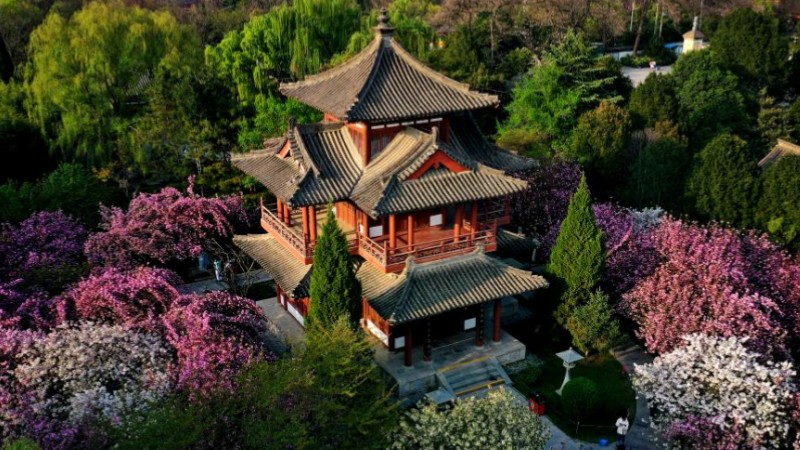

- Tax departments boost recovery of flower-themed tourism in C China's Hunan

- China's tax and fee cuts, refunds, deferrals exceed 4 trillion yuan in 2022

- China's tax and fee cuts, refunds, deferrals top 13 tln yuan from 2013-2022: official

- Preferential tax policies give boost to innovative development of enterprises

- China's stamp tax revenue up in first 11 months

- U.S. House panel votes to release report on Trump's tax returns

- China's policy toolkit saves home purchase costs, spurs demand

- China further eases corporate burden with tax, fee support

- China to levy consumption tax on e-cigarettes

Copyright © 2023 People's Daily Online. All Rights Reserved.