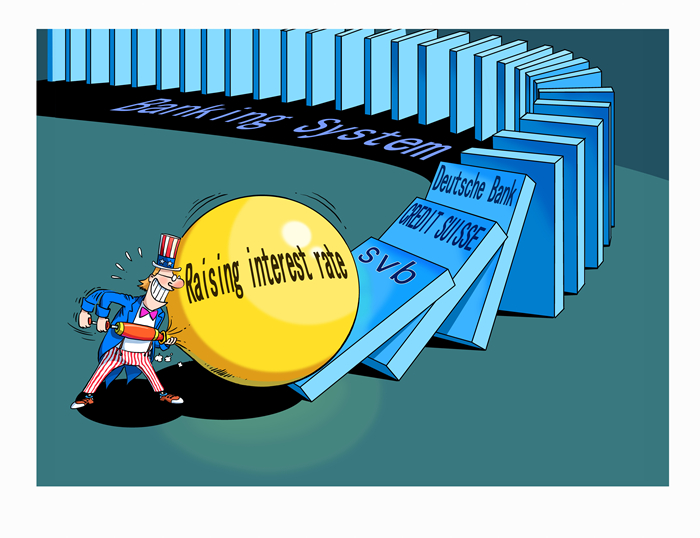

U.S. Fed rate hikes create a domino effect

Cartoon by Ma Hongliang

The recent collapse of the Silicon Valley Bank in the U.S. triggered turmoil in financial markets and led to spillover effects in the European banking system. The share prices of several banks including Credit Suisse and Deutsche Bank slumped.

The negative impact of the U.S. Federal Reserve’s aggressive monetary policy is generating a domino effect.

The Fed has aggressively raised rates in the past year, in a bid to curb rampant inflation. Since March 2022, it has hiked up rates by 450 basis points and increased the upper limit of the target range for the Fed funds rate from 0.25 percent to 4.75 percent.

A few days ago, U.S. Treasury Secretary Janet Yellen described rising interest rates, which have been increased by the Fed, as the core problem behind the collapse of SVB. Many of the bank’s financial assets, such as bonds, lost market value as rates climbed. According to her, the problems of the tech sector are not at the heart of the bank’s problems.

Photos

Related Stories

- U.S. Fed says higher interest rates will remain

- U.S. Fed hikes interest rates to 15-year high

- U.S. recession looms as Fed continues to raise rates

- Fed's six consecutive rate hikes could further drag on U.S., world economy

- Economists voice concerns over U.S. Fed's aggressive rate hikes

- Experts downplay impact of Fed hike

- U.S. Fed implements fourth consecutive 0.75-point hike

- Questions raised about Fed's interest rate hikes to tackle inflation: report

- With Fed's policy spillovers raising concern, global economy may slip into recession

- U.S. stocks rise as investors assess Fed decision

Copyright © 2023 People's Daily Online. All Rights Reserved.