BEIJING, July 13 -- China's Internet regulator has ordered local authorities and website operators to pull illegal online ads touting "margin investing" - using borrowed money to buy stocks - as part of government support measures for the stock market.

The Cyberspace Administration of China (CAC) said in a statement late Sunday that it has found a large number of "margin investing" ads on the Internet, including social media platforms and messaging services, which claim they can lend money to investors or let investors use multiple security accounts to buy shares.

"Such acts have violated the securities law and relevant regulations, which forbid unauthorized security trading services," said the CAC, adding some of the ads exaggerated their service and misled investors, thus damaging legitimate interests and disrupting stock market order.

Margin financing helped China's stock market rise quickly, but also intensified the sell-off when investors began to pull out.

The CAC order came after the Ministry of Public Security announced they have found clues that certain trading firms have suspectedly manipulated futures trading in the stock market.

After the key stock index plunged by more than 30 percent from its June 12 peak, the government has stepped in with various measures to save the market, including pouring in funds and restricting futures trading on a major small-cap index.

Top 10 summer resorts across China

Top 10 summer resorts across China Campus belle in HK goes viral online

Campus belle in HK goes viral online Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

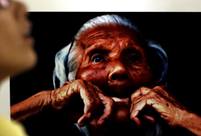

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Promote reform as stock market stabilizes

Promote reform as stock market stabilizes Taking stock: the ups and downs of Chinese shareholders

Taking stock: the ups and downs of Chinese shareholders Small rise in CPI shows growth still slack: experts

Small rise in CPI shows growth still slack: experts Donations struggle to grow after China stops getting organs from executed prisoners

Donations struggle to grow after China stops getting organs from executed prisonersDay|Week