The United Kingdom, for example, has not built a new town or city since Milton Keynes in 1967 and is suffering a major housing shortage. Many other European countries have similar problems.

"No other country can just clear 65 square kilometers of land, move everybody out and build a new city," added Shepard.

"The UK has an inadequate supply of affordable housing so it needs to change. That is not to say that China does not have issues. Through urbanization it has created this mass human migration, and to some extent it has to build these additional cities to cope with demand."

China's urban population exceeded its rural population for the first time in 2011 and at the end of last year stood at 54.7 percent, according to China's National Bureau of Statistics.

It is expected to reach between 70 and 75 percent by 2030, according to a recent report by the Chinese Academy of Social Sciences.

This would put it on the current level of many European countries such as Germany (73.9 percent) and Switzerland (73.7 percent), but behind the UK (79.6 percent), France (85.8 percent) and the United States (82.4 percent).

There has been a recent debate, however, as to whether China is beginning to reach the so-called Lewis Turning Point, named after the Nobel Prize-winning economist Sir Arthur Lewis, when the supply of cheap rural labor available to move to cities dries up.

Athar Hussain, director of the Asia Research Centre at the London School of Economics, doubts whether this is a major issue in the China context.

"The theory is that sooner or later there comes a point where there is no more labor to be transferred from rural to urban areas, but I am not sure of that," he said.

"The agricultural sector in China employs about 35 percent of the labor force but accounts for less than 10 percent of GDP.

"The whole point of Lewis is that development is driven by the difference in productivity between the modern and traditional sectors of the economy.

"In China, there is still a huge difference so there is still huge potential for the transfer of people to the cities."

Rachel Murphy, a lecturer in the sociology of China at the University of Oxford, said migration is an increasingly complex process in China, and it is difficult to reduce it just to something that occurs between rural and urban areas.

"So much of migration in China now is between cities. I have done a lot of research on return migration. Migrants who have gone to the big cities don't generally return to their villages but to small cities or towns, particularly if they want to create some form of business," she said.

Although it might have been described as a ghost city, Zhengdong New District-the central business district of which was one of the last great projects of the late Japanese architect Kisho Kurokawa-is actually now of strategic importance to the country as the financial services hub of Central China.

It facilitates Zhengzhou's position as a vital logistics center for the government's Belt and Road Initiative.

It is home to HSBC, Bank of East Asia and Standard Chartered as well as insurance, leasing and futures trading companies-the last building on Zhengzhou's reputation as an agricultural futures trading center in commodities such as wheat, which dates back to the 1990s.

Wei Zhigang, chief of the financial services bureau of the Zhengdong New District Administrative Committee, said the plan is for Zhengdong to be not only a regional financial services hub but also an international one.

"Henan is already on the map because of the Belt and Road Initiative, but we are going to be increasingly a center for international trade. In addition to international cargo flights, it is also possible to transport goods by rail to Hamburg in 15 days," he said.

One domestic bank that has its regional headquarters in Zhengdong is Zhongyuan Bank, the largest provincial-level commercial bank in China.

Hao Jingtao, the bank's regional executive vice-president, said he believed creating a new district with a financial center was exactly what the region needed.

He pointed out the district's financial institutions have already pledged 300 billion yuan ($48.9 billion) to companies across the province over the next five years.

"It is developing to serve the needs of the whole region. With its green areas, its lakes, arts center, hospitals and schools, it is a great place to work," he said.

New districts such as Zhengdong, far from being vanity projects, as some have suggested, are a continuation of an urban development model that began in the 1990s.

The most high-profile example is the development of Pudong on the west bank of the Huangpu River in Shanghai in 1993.

What was then farmland is now home to China's main financial center with iconic skyscrapers such as the Shanghai World Financial Center and the Oriental Pearl Tower.

|

Top 10 summer resorts across China

Top 10 summer resorts across China Campus belle in HK goes viral online

Campus belle in HK goes viral online Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

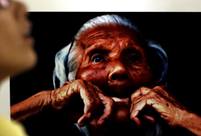

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Promote reform as stock market stabilizes

Promote reform as stock market stabilizes Taking stock: the ups and downs of Chinese shareholders

Taking stock: the ups and downs of Chinese shareholders Small rise in CPI shows growth still slack: experts

Small rise in CPI shows growth still slack: experts Donations struggle to grow after China stops getting organs from executed prisoners

Donations struggle to grow after China stops getting organs from executed prisonersDay|Week