BEIJING, July 10 -- Chinese shares staged a strong two-day rebound after moves by the government to bolster the market.

The benchmark Shanghai Composite Index leaped 4.54 percent to finish at 3,877.8 points on Friday. The Shenzhen Component Index surged 4.59 percent to close at 12,038.15 points.

The ChiNext Index, tracking China's Nasdaq-style board of growth enterprises, climbed 4.11 percent to end at 2,535.89 points.

Combined turnover of the two bourses shrank to 927.76 billion yuan (152.09 billion U.S. dollars) from 950.8 billion yuan the previous trading day.

Only six stocks lost in Shanghai and Shenzhen at the closing. More than 1,300 shares on the two bourses jumped by the daily limit of 10 percent.

On Thursday, the Shanghai index soared 5.76 percent, the biggest daily rise in six years, the Shenzhen index soared 4.25 percent and the ChiNext Index went up 3.03 percent.

The Shanghai index has lost about 28 percent of its value since a spectacular bull run ended with a peak of 5.178.19 points on June12.

Since last weekend, the government has rolled out a batch of supportive measures to halt the further slump of the market, including moves to pour funds and restrictions on futures trading on a major small-cap index.

But the measures did not result in any immediate rally, until intensive measures taken on Thursday.

On Thursday, Chinese police joined the securities regulator to probe clues related to "malicious short selling" amid recent chaos in the stock market.

The securities watchdog announced that China Securities Finance Corporation Limited (CSF), the national margin trading service provider, will provide liquidity to apply for the purchase of a public offering funds.

The banking watchdog announced it would allow banks to extend mortgage loans that use share funds as collateral to prop up the market.

The central bank reiterated it would continue to support the liquidity needs of the CSF and has made sufficient re-lending to the CSF. The central bank also approved CSF issuing short-term financial bonds in the interbank market to replenish liquidity.

On Friday, four state-owned assets management companies vowed not to sell stocks during the abnormal changes of the market.

Sun Xiwei, an analyst with CITIC Securities, said the two-day rally responded to the government moves to bail out the market and the market is expected to stabilize in about two months.

Campus belle in HK goes viral online

Campus belle in HK goes viral online Lugou Bridge in 78 years: July 7 incident

Lugou Bridge in 78 years: July 7 incident Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

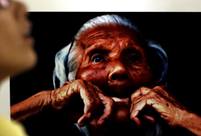

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Xi talks peace at war memorial

Xi talks peace at war memorial Vietnam-US bond less rosy than it appears

Vietnam-US bond less rosy than it appears Furry funeral

Furry funeral Infrastructure investment boosted to stabilize growth

Infrastructure investment boosted to stabilize growth Day|Week