China's latest moves to rescue the ailing stock market failed to bolster a large number of small-cap companies yesterday as investors were divided on market prospects even after the government urged various efforts to arrest the downturn.

The Shanghai Composite Index rose 2.41 percent to close at 3,775.91 but small firms declined as funds mainly flew into heavy-weighted chips. The ChiNext index, which tracks the Nasdaq-like board in Shenzhen, sank 4.28 percent, while the Shenzhen Component Index retreated 1.39 percent.

The Shanghai Composite Index was boosted by PetroChina Co, which rose by the 10 percent daily cap. The Industrial and Commercial Bank of China rose 9.04 percent while Bank of China was up 9.87 percent. The large-cap CSI 300 Index gained 2.90 percent.

"The market has yet to reverse its pessimistic mood," said Liu Yu, a trader with Orient Securities Co. "Apparently, state funds went into large caps. But investors continued to dump smaller firms, showing a lack of confidence."

China's top regulators have taken a number of steps, such as halting initial public offerings and pleading more liquidity support from the government, after an interest rate cut, relaxed rules on margin trading and a reduction in trading fees failed to prevent the slump. The Shanghai Composite has dropped nearly 30 percent from this year's high on June 12.

Last week, 28 companies announced a suspension of their IPOs, with the China Securities Regulatory Commission saying there would be no new IPOs in the near term.

Twenty-one brokers said they will invest at least 120 billion yuan (US$19.3 billion) in a stock-market fund to stabilize the market and pledged not to sell holdings if the Shanghai benchmark remains lower than 4,500.

On Sunday, the commission announced that it would join forces with the People's Bank of China to provide an unspecified amount of liquidity to the China Securities Finance Corp, which is tasked with buying into A shares to keep the market stable.

Financial magazine Caijing reported yesterday that China's social security fund had ordered its fund mangers to not sell any stocks, without identifying the sources. By the end of 2014, the state fund had US$159 billion of assets investing in bonds and equities.

A number of major mutual fund houses, including China AMC, China Southern Asset Management and Tianhong Asset Management, have announced plans to subscribe to their companies' equity-focused funds in an effort to prop up the stock market. Meanwhile, the chairmen of 42 Hunan-based listed companies said in a joint statement that they would not sell shares in their companies this year.

According to Bloomberg data, the Shanghai Composite's 50-day volatility jumped to its highest level in seven years as the gauge surged as much as 7.8 percent at opening yesterday, marking the biggest intraday gain since 2008, before paring.

"The fact is people were selling when the index hiked instead of holding the belief that the market will rebound to the 4,500-point level," said Chris Wu, a trader with Changjiang Securities Co. "Authorities need to do more to win the trust of investors."

Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Hong Kong college students feel the charm of Hanfu

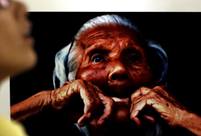

Hong Kong college students feel the charm of Hanfu Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Odd news:“carrying a rod and asking to be spanked”

Odd news:“carrying a rod and asking to be spanked” Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Hong Kong in lens

Hong Kong in lens Editorial: An uncertain road ahead for Greece and EU

Editorial: An uncertain road ahead for Greece and EU China’s class of 2015 gets creative with graduation photos

China’s class of 2015 gets creative with graduation photos Girl power on the pitch

Girl power on the pitch Giant panda Yuanzai turns two at Taipei Zoo

Giant panda Yuanzai turns two at Taipei ZooDay|Week