U.S. Fed hikes interest rates by 25 basis points

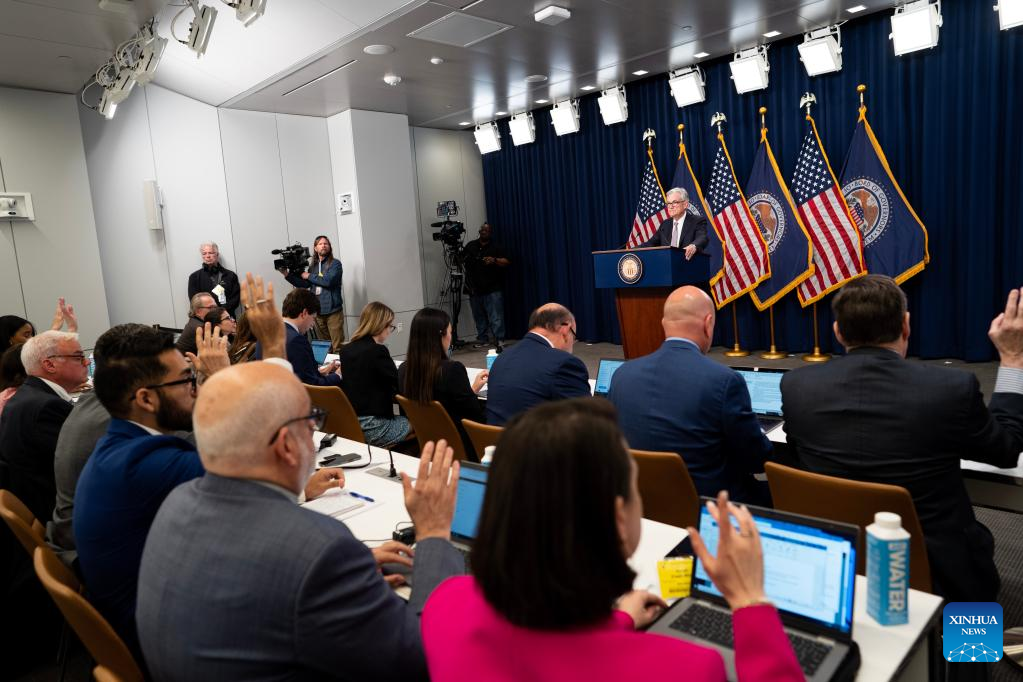

U.S. Federal Reserve Chair Jerome Powell attends a press conference in Washington, D.C., the United States, on May 3, 2023. The U.S. Federal Reserve on Wednesday raised the target range for the federal funds rate by 25 basis points to 5-5.25 percent, saying that the Fed "remains highly attentive to inflation risks." (Xinhua/Liu Jie)

NEW YORK, May 3 (Xinhua) -- The U.S. Federal Reserve on Wednesday raised the target range for the federal funds rate by 25 basis points to 5-5.25 percent, saying that the Fed "remains highly attentive to inflation risks."

As the tenth hike since March 2022, the continuous tightening of monetary policy is in line with market expectations.

Still, there is growing calls for pause of rate hikes as U.S. inflation eased recently and recession risks heightened.

A group of 10 U.S. senators and Congress members sent a letter to Fed Chair Jerome Powell early this week, calling for a pause in interest rate hikes at the Fed's monetary policy meeting ending Wednesday.

U.S. Federal Reserve Chair Jerome Powell attends a press conference in Washington, D.C., the United States, on May 3, 2023. The U.S. Federal Reserve on Wednesday raised the target range for the federal funds rate by 25 basis points to 5-5.25 percent, saying that the Fed "remains highly attentive to inflation risks." (Xinhua/Liu Jie)

U.S. Federal Reserve Chair Jerome Powell attends a press conference in Washington, D.C., the United States, on May 3, 2023. The U.S. Federal Reserve on Wednesday raised the target range for the federal funds rate by 25 basis points to 5-5.25 percent, saying that the Fed "remains highly attentive to inflation risks." (Xinhua/Liu Jie)

U.S. Federal Reserve Chair Jerome Powell attends a press conference in Washington, D.C., the United States, on May 3, 2023. The U.S. Federal Reserve on Wednesday raised the target range for the federal funds rate by 25 basis points to 5-5.25 percent, saying that the Fed "remains highly attentive to inflation risks." (Xinhua/Liu Jie)

U.S. Federal Reserve Chair Jerome Powell attends a press conference in Washington, D.C., the United States, on May 3, 2023. The U.S. Federal Reserve on Wednesday raised the target range for the federal funds rate by 25 basis points to 5-5.25 percent, saying that the Fed "remains highly attentive to inflation risks." (Xinhua/Liu Jie)

U.S. Federal Reserve Chair Jerome Powell attends a press conference in Washington, D.C., the United States, on May 3, 2023. The U.S. Federal Reserve on Wednesday raised the target range for the federal funds rate by 25 basis points to 5-5.25 percent, saying that the Fed "remains highly attentive to inflation risks." (Xinhua/Liu Jie)

U.S. Federal Reserve Chair Jerome Powell (1st R, Rear) attends a press conference in Washington, D.C., the United States, on May 3, 2023. The U.S. Federal Reserve on Wednesday raised the target range for the federal funds rate by 25 basis points to 5-5.25 percent, saying that the Fed "remains highly attentive to inflation risks." (Xinhua/Liu Jie)

U.S. Federal Reserve Chair Jerome Powell (Rear) attends a press conference in Washington, D.C., the United States, on May 3, 2023. The U.S. Federal Reserve on Wednesday raised the target range for the federal funds rate by 25 basis points to 5-5.25 percent, saying that the Fed "remains highly attentive to inflation risks." (Xinhua/Liu Jie)

U.S. Federal Reserve Chair Jerome Powell attends a press conference in Washington, D.C., the United States, on May 3, 2023. The U.S. Federal Reserve on Wednesday raised the target range for the federal funds rate by 25 basis points to 5-5.25 percent, saying that the Fed "remains highly attentive to inflation risks." (Xinhua/Liu Jie)

Photos

Related Stories

- U.S. Fed decision triggers mixed comments from major news outlets

- Economic Watch: U.S. debt ceiling crisis worsens economic plight, threatens global financial stability

- U.S. to open embassies in Tonga, other Pacific island countries: senior diplomat

- U.S. stocks sank on concerns over debt ceiling, weak data

- U.S. House Democrats move to force debt-limit increase as default date looms: New York Times

Copyright © 2023 People's Daily Online. All Rights Reserved.