Economy likely to recover after April doldrums

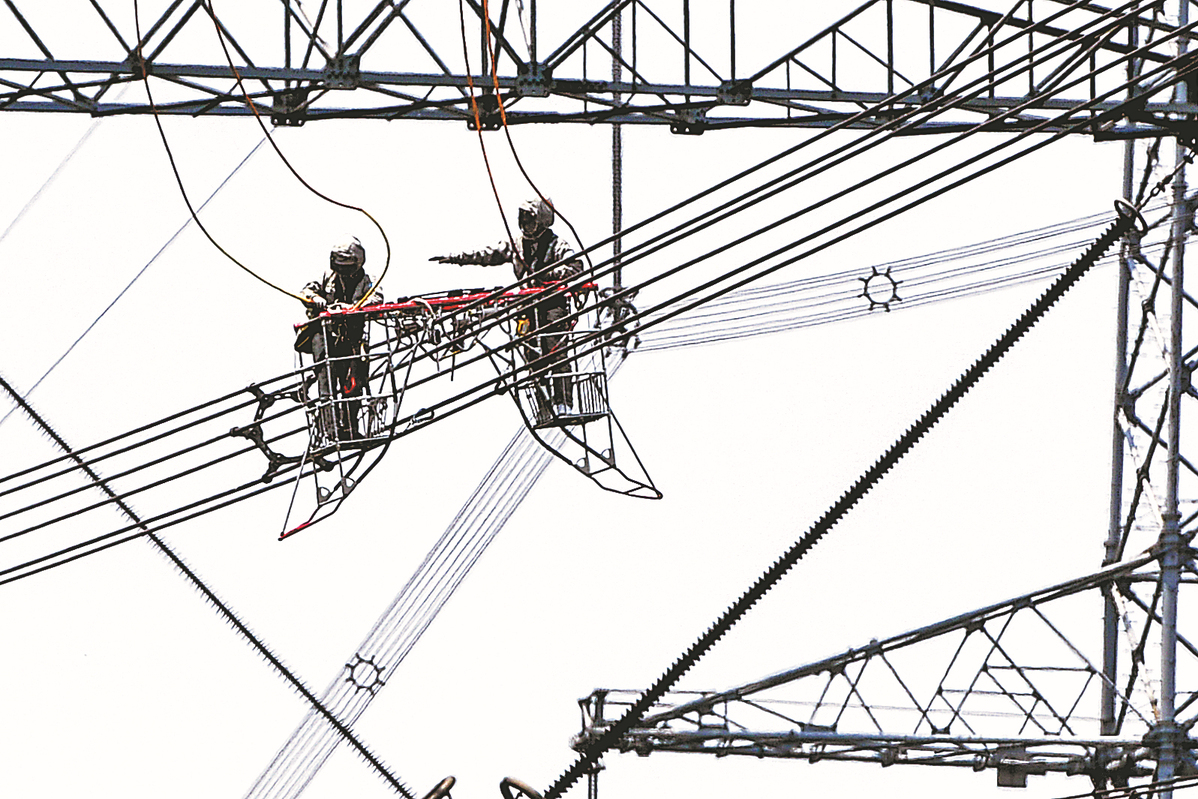

State grid employees repair an ultra-high voltage power transmission system in Huzhou, Zhejiang province, on Monday, as part of efforts to help businesses restart production. TAN YUNFENG/FOR CHINA DAILY

Fundamentals on firm footing as long-term growth prospects remain unchanged, NBS says

China's economy is supposed to see improvement this month despite weak business data in April, and economic activities may rebound with a gradual recovery in household spending and strong fixed-investment support in the following months, officials and experts said on Monday.

They said China's economy should gradually stabilize and recover, with improvement in some key economic indicators, better containment of COVID-19 outbreaks and stronger policy support.

Fu Linghui, a spokesman for the National Bureau of Statistics, said at a news conference on Monday in Beijing that while China's economic activity in April was severely affected by the pandemic, the impact would be temporary.

"The COVID-19 outbreaks in regions including Jilin province and Shanghai has been effectively controlled, and work and production have resumed in an orderly manner," Fu said.

"With the government's effective measures to expand domestic demand, ease the pressures for enterprises, ensure supplies and stable prices, and safeguard people's livelihoods, the economy is expected to improve in May."

Fu said the fundamentals sustaining China's steady and long-term economic growth remain unchanged, and the country has many favorable conditions to stabilize the overall economy and meet growth targets.

China's economy cooled in April with a drop in both industrial production and consumption, as a resurgence in domestic COVID-19 cases severely disrupted industrial, supply and logistics chains. NBS data showed that the country's value-added industrial output and retail sales fell by 2.9 percent and 11.1 percent year-on-year in April.

Tommy Wu, lead economist at the Oxford Economics think tank, said the COVID-19 cases in Shanghai and its ripple effect through China, as well as logistic delays resulting from highway controls in parts of the country, severely affected domestic supply chains. Household consumption was hit even harder due to the pandemic and weak sentiment.

"The disruption to economic activity could well extend into June," Wu said. "Even though Shanghai will gradually resume shop operations, starting from today, as new COVID cases have fallen significantly in recent days, the resumption of normalcy will likely be very gradual at the beginning."

While the government has prioritized COVID containment, it is also determined to support the economy through more forceful infrastructure spending and targeted monetary easing to support small and medium-sized enterprises, the manufacturing and real estate sectors, and infrastructure financing, Wu added.

Looking ahead, he estimated China's economy could see a more meaningful recovery in the second half, with a quarterly contraction in the second quarter before a return to growth.

Citing the official data, Wen Bin, chief researcher at China Minsheng Bank, said the latest economic indicators signal the impact of the pandemic and increasing downward pressures on the economy.

The NBS data showed that despite the drop in industrial production and consumption in April, fixed-asset investment rose by 6.8 percent year-on-year in the January-April period.

Wen said the steady growth in fixed-asset investment shows that investment has gradually become a key driving force to support economic stability.

The NBS said investment in manufacturing and infrastructure construction jumped 12.2 percent and 6.5 percent, respectively, in the first four months. Investment in high-tech manufacturing, in particular, surged 25.9 percent during the January-April period.

Wen attributed the relatively faster growth of investment in infrastructure construction to the government's front-loaded fiscal and monetary policy support.

Zhou Maohua, an analyst at China Everbright Bank, said the steady growth of manufacturing investment, especially high-tech manufacturing investment, showcased the strong resilience of manufacturing investment and China's accelerated economic and industrial transformation.

Zhou said that once the pandemic is contained, he expects to see a recovery in economic activity in May with improvement in key economic indicators like industrial production, consumption and investment.

Those views were echoed by Yue Xiangyu, an analyst at Shanghai University of Finance and Economics' Institute for the Development of Chinese Economic Thought, who estimated the economy may recover in the third quarter with the government's stronger fiscal and monetary policy support.

Considering China's solid steps to resume work and production in regions like Shanghai, Chen Jia, a researcher at the International Monetary Institute of Renmin University of China, said China's economy is close to rebounding and the country will likely hit its annual GDP growth target of around 5.5 percent.

To stabilize the overall economy, Wen from China Minsheng Bank said the government needs to ramp up efforts to exert better control over the pandemic, step up economic adjustments, ease pressures on hard-hit sectors and enterprises, and boost domestic demand.

Photos

Related Stories

- China's economy expected to recover gradually from Omicron impacts: spokesperson

- Nation to prioritize economic stability

- Foreign firms refute ‘investor flight’ hype; temporary disruptions do not represent long-term outlook

- China likely to meet annual growth target

- Interview: China to ratchet up support for market entities: official

Copyright © 2022 People's Daily Online. All Rights Reserved.