World's "most resilient" economy leverages financial tools for better development

-- China's super-large economy boasts strong resilience and the country can achieve its full-year economic target with this resilience underpinning its development.

-- In tackling COVID-19, China has prioritized the task of maintaining the vitality of the real economy.

-- To meet the country's carbon peaking and neutrality goals, China's financial policymakers have placed the transition to a low-carbon economy high on the agenda, despite COVID-induced growth challenges.

-- While steering more funds to the real economy and green development, China has also kept a cautious eye on lurking financing risks at home and abroad, stepping up supervision and striving to stabilize development.

BEIJING, Oct. 21 (Xinhua) -- While major economies are pondering when to withdraw their ultra-loose monetary policies, China's policymakers have a different issue in mind: how to better leverage financial tools to restructure the economy and secure high-quality development.

At the ongoing 2021 Annual Conference of Financial Street Forum, China's policymakers have shrugged off concern over the country's slower economic growth in the third quarter, with full confidence about where the Chinese economy is heading.

China's super-large economy boasts strong resilience and the country can achieve its full-year economic target with this resilience underpinning its development, said Chinese Vice Premier Liu He when addressing the opening ceremony of the forum Wednesday.

In the opinion of Central Bank Governor Yi Gang, China's economic system is "the most resilient one in the world," as the country has successfully coped with the ravage of COVID-19, becoming the first economy to grow last year and logging 9.8 percent growth in the first three quarters compared with the year's target of over six percent.

Combing through speeches delivered by policymakers at the forum, one might find that the real economy, green transition, and risk control are among China's financial policy priorities to boost economic recovery and secure more sustainability.

Delegates attend the opening ceremony and plenary session of the 2021 Annual Conference of Financial Street Forum in Beijing, capital of China, Oct. 20, 2021. (Xinhua/Ju Huanzong)

FUELING THE REAL ECONOMY

When the economy is battered by external shocks, market entities often face severe competition or even live-or-die tests. That's when the financial sector helps secure financing for those in need, Yi said.

In tackling COVID-19, China has prioritized the task of maintaining the vitality of the real economy. Last year, China's central bank rolled out three monetary and credit policy packages totaling 1.8 trillion yuan (about 281.7 billion U.S. dollars) targeting micro, small, and medium-sized enterprises, followed by another 300-billion-yuan re-lending fund this year.

These monetary and credit measures, along with fiscal policies, have directly supported millions of market entities. So far, over 40 million entities have benefitted from inclusive small and micro-loans, said the governor.

Vice Premier Liu He stressed that China has adopted a prudent monetary policy that is flexible, precise, and appropriate, with a focus on key areas in its economic structure. Meanwhile, the multi-level capital market system has further improved with the establishment of the Beijing Stock Exchange to increase financing support for innovative small and medium-sized enterprises.

He encouraged the financial sector to take a more proactive approach to better serving the real economy, channeling more funds to small firms, and scaling up science and technological innovation support.

Deeming the manufacturing industry key to deepening supply-side structural reform, China's lenders have been funneling more funds to the sector. For instance, outstanding loans granted by the Industrial and Commercial Bank of China to the manufacturing sector exceeded 2 trillion yuan in the first half of the year, said Liao Lin, head of the bank.

Visitors view electric cars during China (Tianjin) Auto Show 2021 in north China's Tianjin, Sept. 29, 2021. (Xinhua/Li Ran)

FINANCING A GREEN FUTURE

To meet the country's carbon peaking and neutrality goals, China's financial policymakers have placed the transition to a low-carbon economy high on the agenda, despite COVID-induced growth challenges.

As one of the first countries to develop green finance, China has, over the past five years, picked up pace in establishing a green finance framework.

Shifting focus from anti-pollution to climate change mitigation, the country's financial authorities revised the country's green bond project catalog, raising green-bond project standards and clarifying environment-related information disclosure specifics for financial institutions.

To date, China's outstanding green loans and stock of green bonds are near 14 trillion yuan and 1 trillion yuan, respectively, both ranking among the top globally. With zero green bond defaults reported, the country's green financial assets remain generally solid.

In 2020, the country's energy consumption per unit of GDP continued to drop, while the share of clean energy in the total energy consumption mix rose 1 percent compared with 2019, showing the country's resolve to reboot the economy without sacrificing the environment and ecology.

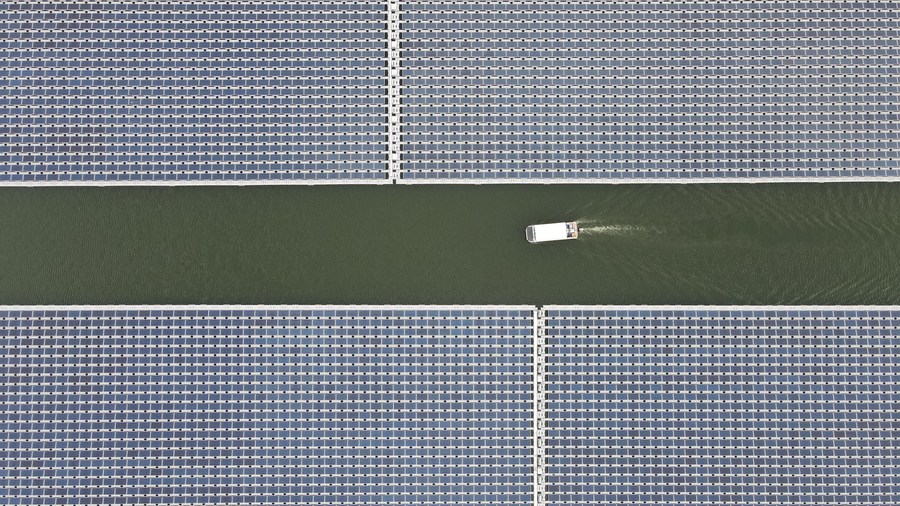

Aerial photo taken on July 20, 2021 shows a floating solar farm in Panji District of Huainan City, east China's Anhui Province.(Xinhua/Huang Bohan)

China, together with the European Union and other economies, launched the International Platform on Sustainable Finance to push global cooperation. The platform is expected to release unified green finance standards for China and Europe soon, a move expected to effectively promote green and low-carbon development among more countries and regions.

China's central bank has also jointly initiated the Network of Central Banks and Supervisors for Greening the Financial System. With over 90 members on board, this network aims to analyze climate change-triggered risks and accelerate the scaling up of green finance, representing part of China's efforts in the sector.

WARDING OFF RISKS

While steering more funds to the real economy and green development, China has also kept a cautious eye on lurking financing risks at home and abroad, stepping up supervision and striving to stabilize development.

Vice Premier Liu He urged efforts to defuse risks of small and medium-sized financial institutions through reforms and appropriately handle default risks of a few large enterprises.

Noting that there are individual problems in the real estate market, Liu said the risks are generally controllable.

"Reasonable financing demand of the sector is being met, and the overall trend of a healthy property market will remain unchanged," Liu said.

Pan Gongsheng, deputy governor of the central bank, said financing behavior and market prices of the real estate and relevant financial markets have gradually returned to normal, with excessive financialization of the housing market under control.

Dismissing concerns over external financial risks, Pan said that the impact of the U.S. Federal Reserve policy shift on China's foreign exchange market is controllable.

"Cross-border capital flows will continue, and the exchange rate of Chinese currency renminbi will remain stable at a reasonable and balanced level," Pan said.

The country's solid economic fundamentals will guarantee that China's foreign exchange market can cope with external shocks, Pan said.

Photos

Related Stories

- Chengdu-Chongqing economic circle, China's new economic engine

- Coordinated regional growth set to boost nation's common prosperity

- IMF: China's 2021 growth moderates to 8% as pandemic weakens global recovery momentum

- Nation's foreign trade expected to hit new high

- Holiday spending further vitalizes China's consumer market

Copyright © 2021 People's Daily Online. All Rights Reserved.