BEIJING, July 10 -- By any standard, China's stock market rout in the past few weeks is an event that will leave its mark in history.

After plunging by over 30 percent from its June 12 peak, China's key stock index staged a strong rebound for a second consecutive day on Friday on the back of a raft of government support measures.

The benchmark Shanghai Composite Index surged 4.54 percent to end at 3,877.8 points on Friday, while the Shenzhen Component Index closed 4.59 percent higher at 12,038.15. The ChiNext, tracking China's Nasdaq-style board of growth enterprises, jumped 4.11 percent to end at 2,535.89.

The rally to some extent helped restore shattered confidence among the country's 90 million stock investors, most of whom are retail traders with little financial expertise.

"I will hold on and weigh my options until the index reaches 4,500 points again," said retail investor Tian Xiaoqiang. When he opened the stock account in May, the Shanghai index was at 4,800 and he hoped it could smash through its 6,124-point record from 2007.

The recent plunge has wiped 40 percent off his 500,000-yuan (81,967 U.S. dollars) investment, nearly two years of his household income.

"The stock market disaster was a cruel lesson for us new entrants," he said, cautiously optimistic about the outlook in the long run.

Before the market took a downturn on June 12, the Shanghai composite had risen by 152 percent since July 2014 and nearly 60 percent since the beginning of the year.

The frenzy ran far ahead of economic fundamentals during the period. Growth in the first quarter fell to 7 percent, its lowest level in six years.

The frothy market conditions might have been one factor that triggered the massive sell-off in late June. The authorities have launched investigation into "malicious short selling", suspected to be also behind the plunge.

The trend seemed out of control this time as unlike previous stock market boom-busts, the latest bull run was fueled by widespread use of leverage as many investors used borrowed money to buy shares, a practice which can magnify both gains and losses.

For fear of the market rout threatening overall financial stability, the government has stepped in with various measures to save the market, including pouring in funds and restricting futures trading on a major small-cap index.

On Thursday, Chinese police joined the securities regulator to investigate "malicious short selling" to stem the bloodshed.

The China Banking Regulatory Commission announced on Thursday morning that it will allow banks to extend mortgage loans that use share funds as collateral to prop up the stock market.

China's central bank also reiterated that it will continue to support the liquidity needs of the China Securities Finance Corporation Limited (CSF), the national margin trading service provider. It said it has made sufficient re-lending to the CSF and approved the latter to issue short-term financial bonds in the interbank market to replenish liquidity.

Hence the strong rebound on Thursday and Friday. While some economists hailed the government's move to stem risks to the broader economy, some others suggest more market-oriented measures be taken.

"The current correction is a result of a previous frenzy... the intervention will give some investors a false impression that the government will always back them up," said Liu Shengjun, deputy director of the Shanghai-based Lujiazui International Finance Research Center.

Despite the eye-catching rebound on Thursday and Friday, Minsheng Securities reckons the market will fluctuate and struggle in the near future as it takes time to disperse market panic and rebuild confidence.

In the longer term, however, China's economic restructuring, accelerating reforms and monetary easing cycles, are likely to continue to underpin the market.

"The foundation for prosperity in the capital market remains intact," according to Minsheng Securities' report, which forecast a long and slow bull run.

But bull or bear, the Chinese stock market has a long way to go in learning to keep its raging temper.

Yang Tao, a researcher with the Institute of Finance and Banking under the Chinese Academy of Social Sciences, said the drastic ups and downs in the stock market were partly due to the herd mentality of China's retail investors, which constitute over 80 percent of turnover, whereas in more mature markets, institutional investors dominate.

While pushing ahead with internationalization of the capital market, China needs to cool down the national mania for the stock market, Yang believes.

"Any financial market that is filled with get-rich-quick stories and excessive profits is not a sustainable and healthy one," he said, calling for more focus on the fundamentals of listed enterprises.

"The long-term value and improving productivity of traded firms should be the major benchmark and foundation for the stock market."

Campus belle in HK goes viral online

Campus belle in HK goes viral online Lugou Bridge in 78 years: July 7 incident

Lugou Bridge in 78 years: July 7 incident Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

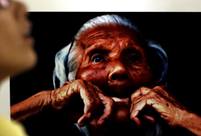

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Xi talks peace at war memorial

Xi talks peace at war memorial Vietnam-US bond less rosy than it appears

Vietnam-US bond less rosy than it appears Furry funeral

Furry funeral Infrastructure investment boosted to stabilize growth

Infrastructure investment boosted to stabilize growth Day|Week