BEIJING, July 9 -- With the launch of the BRICS New Development Bank (NDB), the BRICS mechanism has achieved substantial progress in pragmatic cooperation.

In the past, the BRICS -- Brazil, Russia, India, China and South Africa -- has not only boosted economic growth in its member states, and together generated about one fifth of the world GDP, but also contributed new ideas and strategies to global governance.

It is therefore expected that the bloc's emerging economies and developing countries will play a bigger role in global governance in the future. The NDB is a case in point.

The NDB, to begin operating later this year or early next year in Shanghai, held its first meeting in Moscow to appoint members of the board of directors and the management on Tuesday. Meanwhile, the Contingent Reserve Arrangement (CRA) is set to start lending in 2016.

The establishment of the NDB and CRA testify to the BRICS countries' endeavors, influence and vitality, and more importantly -- their coordinated attitude towards the reform of global economic governance.

Different from other development banks, the NDB's initial capital of 50 billion U.S. dollars was supplied equally by each of the five founding members, which also have equal voting power.

This egalitarian practice serves to strengthen the cohesion among all member states. Moreover, it could serve as an example of an innovative idea and a creative mechanism model which can boost the reform of global economic governance.

Since the 2008 financial crisis, the world economic landscape has changed dramatically with emerging economies springing up rapidly, which entails that developing countries play their due parts on the world stage and developed countries coordinate and cooperate with emerging economies.

In line with this trend, the representation of emerging economies on the Financial Stability Board (FSB) has increased and new institutions such as the Asian Infrastructure Investment Bank (AIIB) and the NDB have come into being.

The NDB represents a concrete contribution by the BRICS to the systemic challenges related to international development, especially with respect to better integration between emerging and developing economies.

Yet as funding in infrastructure is inadequate worldwide, more sources are needed to fill the funding gap, including establishing a new financial platform, public-private partnerships and other approaches.

In sum, it is notable that new institutions such as the NDB can supplement the current international economic order, but not challenge or replace the old one.

Campus belle in HK goes viral online

Campus belle in HK goes viral online Lugou Bridge in 78 years: July 7 incident

Lugou Bridge in 78 years: July 7 incident Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

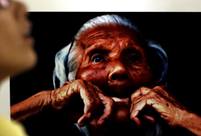

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Xi talks peace at war memorial

Xi talks peace at war memorial Vietnam-US bond less rosy than it appears

Vietnam-US bond less rosy than it appears Furry funeral

Furry funeral Infrastructure investment boosted to stabilize growth

Infrastructure investment boosted to stabilize growth Day|Week