Most blue-chip firms not benefiting from support measures

About 1,000 Chinese mainland-listed companies, or over a third of firms on the Shanghai and Shenzhen stock exchanges, suspended trading on Tuesday precipitated mainly by the continuous drop in share prices.

The number of firms that halted trading is believed to be the largest in Chinese mainland stock market history.

The benchmark Shanghai Composite Index lost 1.29 percent to close at 3,727.12 points Tuesday, while the Shenzhen Component Index tumbled by 5.80 percent, with ChiNext, the country's NASDAQ-style board for high-tech and start-ups, shedding 5.69 percent.

A total of 203 listed companies, including Beijing Enlight Media Co Ltd and Shenzhen Zhongqingbao Interaction Network Co Ltd, announced the suspension of trading in their shares Tuesday morning, which was quickly followed by another 23 companies during the lunch break.

While the 200 companies that announced a suspension in trading on Tuesday failed to disclose the reason to the public, analysts generally believe that they wanted to sit out the market turbulence because the wave of listed companies seeking a suspension in trading comes at a time when mainland stock markets have been suffering considerable losses over the past several weeks.

On Monday, Chinese Premier Li Keqiangsaid in a speech that China is confident and able to deal with the risks and challenges faced by its economy.

A series of unprecedented emergency rescue measures were implemented over the weekend, such as the suspension of the IPOs of 28 companies, allowing 21 Chinese brokerages to invest 120 billion yuan ($19.3 billion) in blue-chip exchange-traded funds (ETFs) and Central Huijin, a unit of China's sovereign wealth fund, vowing to buy A-shares.

However only a limited number of blue-chip companies were able to directly benefit from the funds.

Heavily weighted banks and other financial stocks performed best on Tuesday, with banking shares soaring by 7.07 percent, as brokerages, insurance companies and mutual funds all pledged to buy stocks or ETFs.

"Given most stocks in Shenzhen still remain significantly overvalued, it is impossible to expect brokerages, insurance firms, mutual funds and even State-backed Central Huijin to buy small caps, which are still very expensive," Li Daxiao, director of research at Yingda Securities, told the Global Times Tuesday.

"This is why most of the companies seeking a suspension in trading are from the small and medium-sized enterprise (SME) board and ChiNext, because they need to find a way to escape the market turmoil."

According to a report from Securities Journal, 243 SME companies announced they would suspend trading or extend it, accounting for 31 percent of all SME companies. Meanwhile, 147 ChiNext companies announced a trading suspension during the same period, or 30 percent of all ChiNext companies.

While investors may avoid further losses during the market slump due to the trading suspension, it doesn't mean those shares will stop plummeting once trading resumes, Li said.

"Standing outside until the market stabilizes won't help. If share prices are overvalued, then they need to go down to ease the risks," he further noted.

"In fact, today's overall market has already showed signs of stability," Yu Haihua, chief analyst at Bohai Securities, told the Global Times Tuesday. "Blue-chip companies have clearly been supported by a string of recent support measures, but small caps may still need some time [to stabilize]."

However, Yu also said that market confidence is relatively weak after the recent plunge, but investors should avoid deciding on impulse.

Agencies contributed to this story

Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Hong Kong college students feel the charm of Hanfu

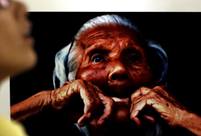

Hong Kong college students feel the charm of Hanfu Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Odd news:“carrying a rod and asking to be spanked”

Odd news:“carrying a rod and asking to be spanked” Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Hong Kong in lens

Hong Kong in lens Can China play a role in Greek debt crisis?

Can China play a role in Greek debt crisis?  Dogs in uniform: China’s combat canines

Dogs in uniform: China’s combat canines Cut for China

Cut for China Market reacts to govt support

Market reacts to govt support Day|Week