BEIJING, July 3 -- The service sector continued to expand in June, but at its slowest rate since January, according to an industry index released by HSBC on Friday.

The HSBC/Markit China's services purchasing managers' index (PMI) was posted at 51.8 in June, down from 53.5 in May.

The index samples more than 400 private service-sector companies in China. A reading above 50 indicates expansion, while a reading below 50 represents contraction.

HSBC said the slowdown in service activity growth reflected softer new business gains in June, with service providers signalling the slowest increase in new orders in 11 months.

On Wednesday, the National Bureau of Statistics (NBS) and the China Federation of Logistics and Purchasing jointly announced that the PMI for China's service sector increased to 53.8 in June from 53.2 in May and 53.4 for April.

The official PMI for the manufacturing sector was unchanged at 50.2 in June.

On the same day, HSBC released its version of China's June manufacturing PMI, which was 49.4, up from 49.2 in May. It was the fourth successive month that the figure was in contractionary territory.

Official PMI covers large enterprises as well as small- and medium-sized enterprises (SMEs), while the HSBC poll was more focused on SMEs.

"The latest PMI data signalled a further loss of growth momentum in China's economy at the end of the second quarter," said Annabel Fiddes, an economist at Markit.

She added that tentative signs of improvement were evident at manufacturers, however, new orders and purchasing activity only rose slightly in June.

"The business activity, new orders and employment in the service sector all expanded at slower rates, while optimism toward the business outlook also moderated." said Fiddes.

She added that more stimulus measures are required to ensure growth momentum improved in the second half of the year, and the GDP growth target of around 7 percent could be hit.

China's economy expanded 7 percent in Q1, down from a 7.3 percent increase in the last quarter of 2014.

The government has responded with a steady drumroll of policy easing. The People's Bank of China, the central bank, cut interest rates for the fourth time since November and trimmed the amount of cash banks are required to hold as reserves on Saturday.

Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Hong Kong in lens

Hong Kong in lens Typhoon class strategic Submarine in photos

Typhoon class strategic Submarine in photos Hong Kong college students feel the charm of Hanfu

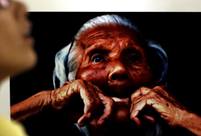

Hong Kong college students feel the charm of Hanfu Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Odd news:“carrying a rod and asking to be spanked”

Odd news:“carrying a rod and asking to be spanked” Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple College graduates shining on the red carpet in Nanjing

College graduates shining on the red carpet in Nanjing Pledging allegiance reinforces Constitution

Pledging allegiance reinforces Constitution  Market falls amid fears about unregulated margin lending

Market falls amid fears about unregulated margin lending  Mass wedding for North Korean defectors held in Seoul

Mass wedding for North Korean defectors held in Seoul  Orthodox Church sees opportunities in China following enhanced Sino-Russian ties

Orthodox Church sees opportunities in China following enhanced Sino-Russian tiesDay|Week