Bank of China has joined seven other financial institutions to become a direct participant on the electronic platform that sets the gold price in London. [Photo: cngold.com.cn]

Bank of China has become the first Chinese bank to participate in the electronic auctions that set London's Gold Price benchmark.

Bank of China has joined seven other financial institutions to become a direct participant on the electronic platform that sets the gold price in London.

Being the world's largest bullion consumer, China has never directly played a role in global gold pricing before now.

Sun Yu, general manager of Bank of China's London branch says participating in the gold auctions will increase the link between China and international markets.

"Participating directly in the electronic auctions means we will be able to reflect the supply and demand in the Chinese market on a global platform, which can also help the global pricing of gold to be more accurate and comprehensive."

Sun adds that it will also help reduce the trading cost of Chinese clients and enable the bank to introduce services based on the global gold price benchmark.

The benchmark is widely recognized by producers, consumers and investors in gold trade across the world. It was administered by the Inter Continental Exchange through a twice daily electronic auction platform which replaced the London Gold Fix in March this year.

Finbarr Hutcheson, President of ICE Benchmark Administration welcomes the new Chinese participant, believing it to be a demonstration of market support for the digital gold auction system.

"China is both a huge producer and consumer of gold and so it is a more global process to bringing China to join in the participation here in London. We do expect more interest and more participation from around the globe and from China. Bank of China is the first Chinese participant and it is also a great breakthrough for us."

Chinese students learn Duanwu customs in Hefei, Anhui

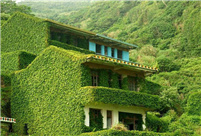

Chinese students learn Duanwu customs in Hefei, Anhui Abandoned village swallowed by nature

Abandoned village swallowed by nature Graduation: the time to show beauty in strength

Graduation: the time to show beauty in strength School life of students in a military college

School life of students in a military college Top 16 Chinese cities with the best air quality in 2014

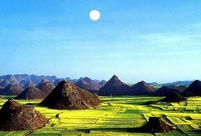

Top 16 Chinese cities with the best air quality in 2014 Mysterious “sky road” in Mount Dawagengzha

Mysterious “sky road” in Mount Dawagengzha Students with Weifang Medical University take graduation photos

Students with Weifang Medical University take graduation photos PLA soldiers conduct 10-kilometer long range raid

PLA soldiers conduct 10-kilometer long range raid Stars who aced national exams

Stars who aced national exams

Can heavy arms make US allies feel safer?

Can heavy arms make US allies feel safer? 14 cartoon cats Chinese love

14 cartoon cats Chinese love Selfies from Syria: Chinese-born militia member sends social media missives from the frontlines

Selfies from Syria: Chinese-born militia member sends social media missives from the frontlines China resumes nuclear power plant construction after a four-year freeze

China resumes nuclear power plant construction after a four-year freezeDay|Week