Vintage cars show kicks off in London

Vintage cars show kicks off in London

Gorgeous scenery in NE China

Gorgeous scenery in NE China

Picturesque Barkol grassland in Xinjiang

Picturesque Barkol grassland in Xinjiang

Small Wild Goose Pagoda - A World Cultural Heritage Site along the Silk Road

Small Wild Goose Pagoda - A World Cultural Heritage Site along the Silk Road

Maritime Silk Road Luxuries of the Han Dynasty

Maritime Silk Road Luxuries of the Han Dynasty

Ciao! Chinese beauties!

Ciao! Chinese beauties!

An eye feast: BFA freshmen registration

An eye feast: BFA freshmen registration

Top 10 most lavish weddings

Top 10 most lavish weddings

Most amazing chi-pao beauties

Most amazing chi-pao beauties

Chinese lingerie brand arrives in Las Vegas

Chinese lingerie brand arrives in Las Vegas

|

| (Graphics:GT) |

There is no statistical support for the notion that foreign capital is withdrawing from the world's second-largest economy, said a Ministry of Commerce (MOFCOM) spokesperson Tuesday, although August data shows foreign investment in China continues to drop.

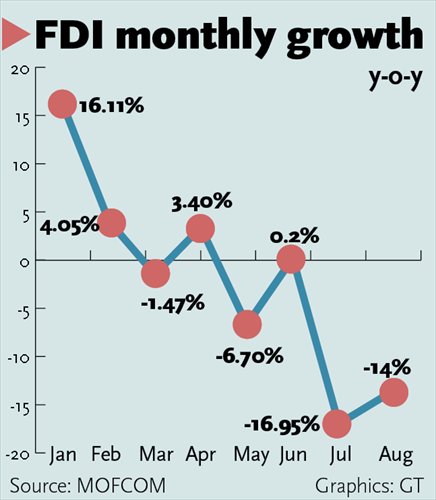

Figures released by MOFCOM Tuesday show that foreign direct investment (FDI) into non-financial sectors in August was $7.2 billion, down 14 percent over the same period last year.

The margin of the drop in August is narrowed by 2.95 percentage points from that of July, when the FDI inflow saw a 16.95 percent year-on-year drop.

Addressing a question on whether foreign capital is leaving China, Shen Danyang, MOFCOM spokesperson, said there is no data supporting such a theory.

"We've noticed that some researchers and some financial new media have made relevant conclusions. We are still analyzing related investment and trade flows. Currently, there are no abnormal changes," Shen told a press conference in Beijing.

International capital is still recovering from the global finanical crisis, and developed countries are often chosen as the destination for this capital, Shen told reporters attending a press briefing later on Tuesday, explaining the weak growth in FDI inflow.

Other reasons listed by Shen include the fluctuation of the yuan exchange rate, regulatory changes in company registration and the diminishing advantage of China as a manufacturing base.

Experts say the FDI data is a sign of underlying economic factors, but it is too early to call it a trend, as figures over two months are too small compared to the annual total.

For the first eight months, FDI, which excludes investment in the financial sector, stood at $78.34 billion, edged down 1.8 percent from the same period in 2013, the ministry said.

"Short-term data mirrors a number of underlying factors. It reflects foreign investors' short-term outlook. The data shows they might be slowing the pace of China investment, switching to a wait-and-see stance," said Lian Ping, chief economist at the Bank of Communications Tuesday.

He cautioned the data should not be considered a trend characterized by an exodus of foreign capital from China.

"Further research is needed to see whether this short-term fluctuation could grow into a trend," Lian noted.

Zhao Bo, assistant professor with the National School of Development at Peking University, also believes the notion of "foreign capital flight" is not well-grounded.

"The economy is at a cyclical low, so some media, especially foreign media, have taken a pessimistic stance on the Chinese economy. Extreme forecasts even put China's GDP growth rate at 6.9 percent," Zhao said.

China's official 2014 GDP figure is close to 7.5 percent.

"Foreign companies may sense rising short-term risk, resulting in scaled-down investment plans. We need more data over a longer period of time to see how the trend goes," Zhao noted.

Lian said the FDI figure also reflects China's ongoing industrial upgrade and restructuring, particularly singling out the service sector which is intertwined with the high-tech industry.

Bucking the trend, FDI in the country's service sector grew by 8.9 percent year-on-year to reach $43.27 billion in the first eight months of the year, with distribution and transportation attracting a sizeable portion of foreign capital.

FDI to the manufacturing sector slipped 15.7 percent to $27.5 billion. Service and manufacturing respectively took 55 percent and 35 percent of the national total.

Zhao said this is because the service sector is unaffected by economic cycles.

"The housing market is at a cyclical low, so upstream industries like manufacturing are affected. This also means investment demand shrank. Industry is also subject to these cycles," Zhao said.

In the first eight months, FDI inflow from major economies slumped. FDI from the US dropped 16.9 percent year-on-year, while FDI from the EU and Japan declined 17.9 percent and 43.3 percent annually.

"The still-chilly investment environment is contributing to an increasing sense of pessimism among foreign multinational companies in China," the American Chamber of Commerce said in a September 2 report, citing a survey on investment sentiment.

The results show that 60 percent of those surveyed feel foreign business is less welcome in China than before, and 49 percent believe foreign firms are being singled out in recent pricing or anti-corruption campaigns.

The European Union Chamber of Commerce in China said on September 9 that the golden age of development for foreign firms, during which they could enjoy rapid growth and fat margins, has ended.

Amid "difficult business headwinds and continued unfavorable treatment," European companies have set more modest expectations and downsized plans for China, chamber President Jörg Wuttke said on September 9.

At the Summer Davos opening ceremony in North China's Tianjin on September 10, Premier Li Keqiang told business leaders from home and abroad that China will standardize its business environment and continue opening the economy to foreign capital.

China's August outbound direct investment by non-financial firms surged to $12.62 billion, with a year-on-year increase of 112.1 percent.

Shen of MOFCOM said 2015 will be a turning point in which China's outbound direct investment will probably surpass FDI inflow to China.

Mixed reaction to smartphone sidewalk

Mixed reaction to smartphone sidewalk 'Rainbow running' race in Jiangxi

'Rainbow running' race in Jiangxi Tourists float with lotus in park in Taipei

Tourists float with lotus in park in Taipei Amazing aerial photos of China's Xisha Islands

Amazing aerial photos of China's Xisha Islands Chinese Buddhist Canon blesses Hong Kong

Chinese Buddhist Canon blesses Hong Kong Beautiful postgraduate teaches in remote area

Beautiful postgraduate teaches in remote area Amazing Guinness World Records

Amazing Guinness World Records Freshmen of Beijing Dance Academy take military training

Freshmen of Beijing Dance Academy take military training Top 10 world's highest-paid models 2014

Top 10 world's highest-paid models 2014 Lingerie show at 2014 Miss China

Lingerie show at 2014 Miss China Songstress Li Xianglan dies at 94

Songstress Li Xianglan dies at 94 Police recruiting posters

Police recruiting posters Anshun Daxi- Living fossil of Chinese drama

Anshun Daxi- Living fossil of Chinese drama Urban farmers in China

Urban farmers in China 'Firepower-2014 Weibei'military exercise

'Firepower-2014 Weibei'military exerciseDay|Week|Month